The Economist’s Role in Forecasting Medical Costs in Personal Injury Disputes

Forensics & Litigation Services

Forensics & Litigation Services

Forensics & Litigation Services

Never miss a thing.

Sign up to receive our insights newsletter.

The cost of future medical care is often one of the largest components of economic losses in personal injury disputes. Life care planners or other medical experts (“medical professionals”) are typically engaged as experts to opine on a plaintiff’s medical conditions following an injury to determine their expected future medical needs.

These medical professionals generally present their opinions of the plaintiff’s future medical care needs in a life care plan. This plan assesses the plaintiff’s medical needs following an injury and the projected costs for future medical care. Medical professionals project the future medical costs of a personal injury plaintiff in today’s dollars even though their projections may span years or even decades into the future.

Making the Plaintiff Whole

In personal injury disputes, the objective of calculating economic damages is to make the plaintiff whole, including ensuring they receive sufficient compensation to cover all medical expenses related to the injury. The objective is to put the plaintiff in the financial position they would have been in without the injury. Economic experts are often engaged to assist the trier of fact in determining a fair compensation amount that covers the plaintiff’s economic losses due to the injury. Economic damages do not include hedonic damages such as pain and suffering, which are generally not based on a specific methodology or calculation and are decided by the trier of fact.

Although a life care plan uses current market prices to help outline the future medical costs, it doesn’t account for changes in prices over time. This is why it is recommended to retain an economist to project future medical costs, which considers expected increases in the cost of medical care. An economist can also adjust the future medical costs to account for the time value of money. The “time value of money” is a financial concept that means a sum of money is worth more today than the same amount in the future due to its potential to earn interest and accrue value over time.

Calculations

Economic experts are often engaged to calculate the future and/or present value of life care plans. Most economic experts use similar methodologies, yet they can arrive at different results due to two main variables: the applied growth rate(s) and the applied discount rate(s) used in their calculations.

Most economic experts calculate the present value of medical costs using a risk-free discount rate, typically based on tax-free municipal bond rates, or the U.S. Treasury yield curve, adjusted for the plaintiff’s expected tax rate.

A primary difference between economists is how they determine the projected growth of future medical costs over the duration of care presented in the life care plan.

Growth Rates

Determining an appropriate basis for the applied growth rates is crucial in calculating future medical costs. Because there are no official forecasts of medical costs growth available or that are widely accepted, most economic experts base their forecasts on historical medical cost growth rates.

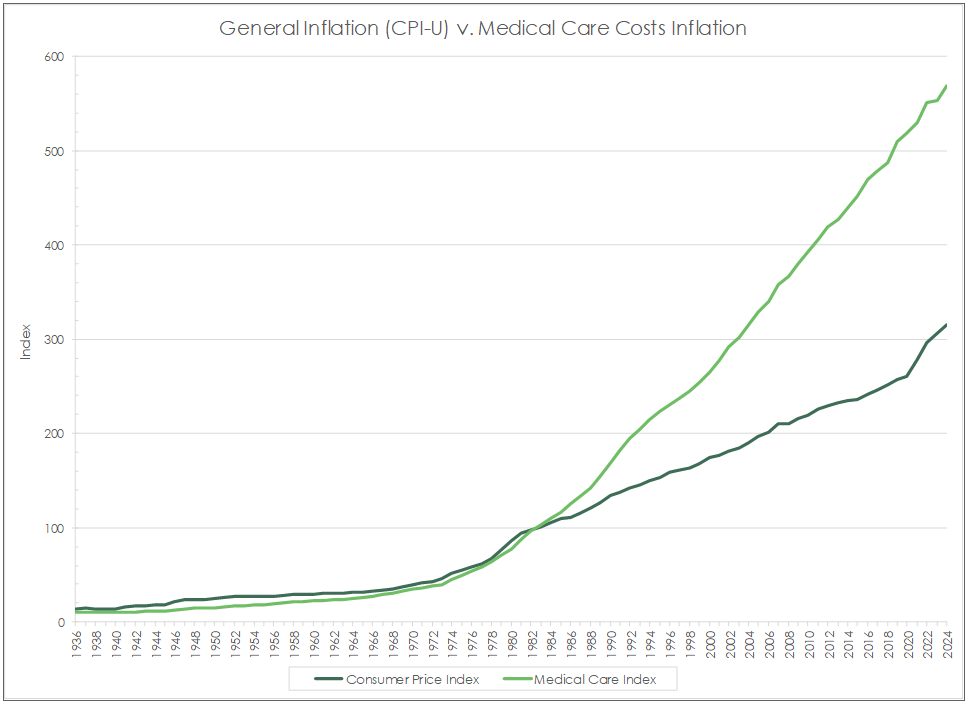

Since the cost of all goods and services does not change at the same rate, it is important to use category-specific growth rates rather than a general inflation rate for all items. As shown in the chart below, medical care costs have increased at a faster rate than general inflation (Consumer Price Index for All Urban Consumers (CPI-U)) since the early 1980s.

*Click to enlarge the image above

Underlying data from U.S. Department of Labor, Bureau of Labor Statistics; “Consumer Price Index for All Urban Consumers (CPI-U): U.S. City Average, by Expenditure Category.”

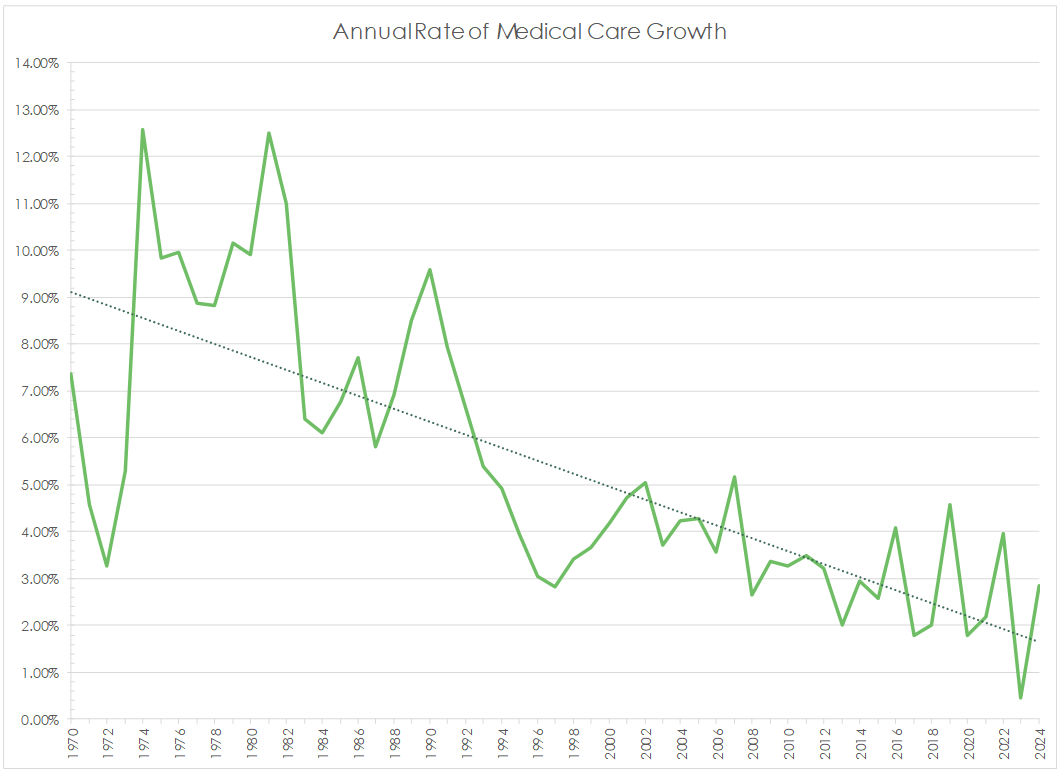

The following chart shows that while the annual rate of medical care growth has fluctuated over the last 54 years, it has followed a downward trend (indicated by the dotted line). In summary, even though medical costs continue to increase, they are increasing at a slower pace.

*Click to enlarge the image above

Variances in Growth Rates

Economic experts generally use averages of historical medical growth rates to forecast growth rates. However, different economic experts use different periods of time. The downward trend in medical care growth rates explains why different economic experts can arrive at different conclusions about the future value of a life care plan.

The table below summarizes commonly used subcategories of medical care based on Bureau of Labor Statistics CPI-U and the average growth rates for different periods of time.

| Period | Years | CPI All Items | Medical Care | Medical Care Commodities | Prescription Drugs | Nonprescription Drugs | Medical Equipment & Supplies | Physician’s Services | Services by Other Medical Professionals | Hospital Services | Nursing Homes & Adult Day Services |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 10 Years | 2015-2024 | 3.26% | 2.62% | 1.68% | 1.68% | 1.41% | 1.16% | 1.51% | 1.62% | 3.99% | 3.78% |

| 20 Years | 2005-2024 | 2.52% | 2.94% | 2.04% | 2.41% | N/A | N/A | 2.03% | 1.79% | 5.01% | 3.66% |

| 30 Years | 1995-2024 | 2.52% | 3.27% | 2.41% | 2.99% | N/A | N/A | 2.42% | 2.11% | N/A | N/A |

| 40 Years | 1985-2024 | 2.76% | 4.14% | 3.26% | 3.94% | N/A | N/A | 3.37% | N/A | N/A | N/A |

The table demonstrates that averaging growth rates for a shorter period leads to smaller projected growth rates for most medical care subcategories. When forecasting medical costs into the future, differences in the applied growth rates can result in different conclusions.

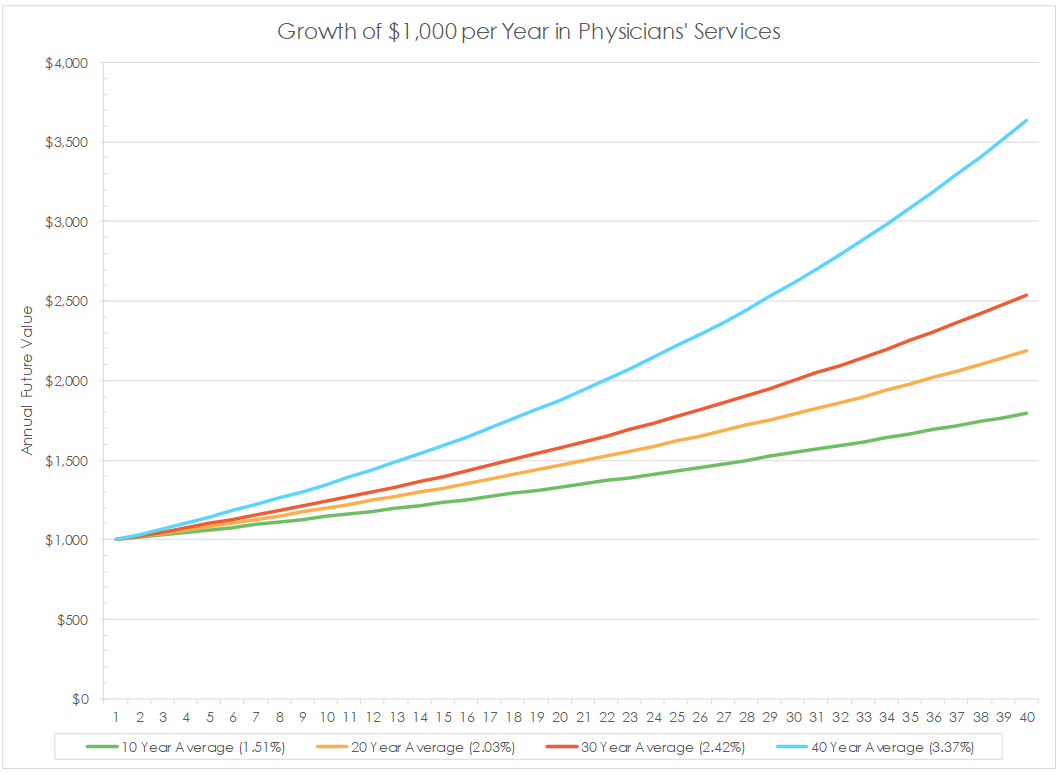

For example, consider a $1,000 annual expense in physicians’ services over 40 years. The total nominal value would be $40,000. Applying growth rates based on averaging different periods of time results in varying future values:

- 10-year average growth rate of 1.51%: future value = $54,401

- 20-year average growth rate of 2.03%: future value = $60,755

- 30-year average growth rate of 2.42%: future value = $66,162

- 40-year average growth rate of 3.37%: future value = $81,995

*Click to enlarge the image above

Factors Affecting Medical Cost Growth

One factor to consider when determining medical cost growth rates is the implementation of the Affordable Care Act (ACA). The ACA, a comprehensive health care reform law, was signed into law on March 23, 2010, and had three primary goals:

- Expand health insurance coverage

- Shift the health care delivery system from treatment to prevention

- Reduce health care costs while improving efficiency

The impact of the ACA on the growth of medical costs remains uncertain. It is unclear if the costs are following the general downward trend since the 1970s, or if the ACA has had an impact on slowing the growth of medical costs. However, it is imperative to consider any major factors that could create a shift in trends when using historical data to forecast future trends.

Another factor to consider is the impact of the COVID-19 pandemic and the resulting period of high inflation. The growth of medical costs remained relatively stable compared to general inflation (CPI-U) in 2020 and 2021 but surged in 2022. However, 2023 saw minimal growth in the Medical Care Index, and 2024 growth was representative of pre-COVID-19 levels.

Key Takeaways

Accurately projecting future medical costs in personal injury disputes requires careful consideration of growth rate(s) and discount rates. Results can vary significantly, so it is crucial to work with experienced economic experts to ensure an accurate valuation of projected medical costs. For more information about the role of economic experts in personal injury disputes, contact us. We’re here to help.

©2025