The Voluntary Carbon Offset Market

Never miss a thing.

Sign up to receive our insights newsletter.

Does Your Project Have What It Takes?

You may have seen competitors selling carbon offsets (also called “carbon credits”) and wondered, “Can we do that?”

Maybe. But those emissions reductions you achieved for regulatory compliance can’t be sold as offsets. Neither can the improvements at a new facility that you recently built. The only projects that can be certified for the voluntary carbon market are those that create new, additional emission reductions (or carbon capture) that would not have happened without the investment from selling the offsets.

New carbon offset markets and opportunities are opening up all the time. This article will introduce you to the key concepts and offer some starting points for research. If you want to pursue these opportunities, it’s best to work with an experienced consultant to help you find the right market and make sure your project will qualify.

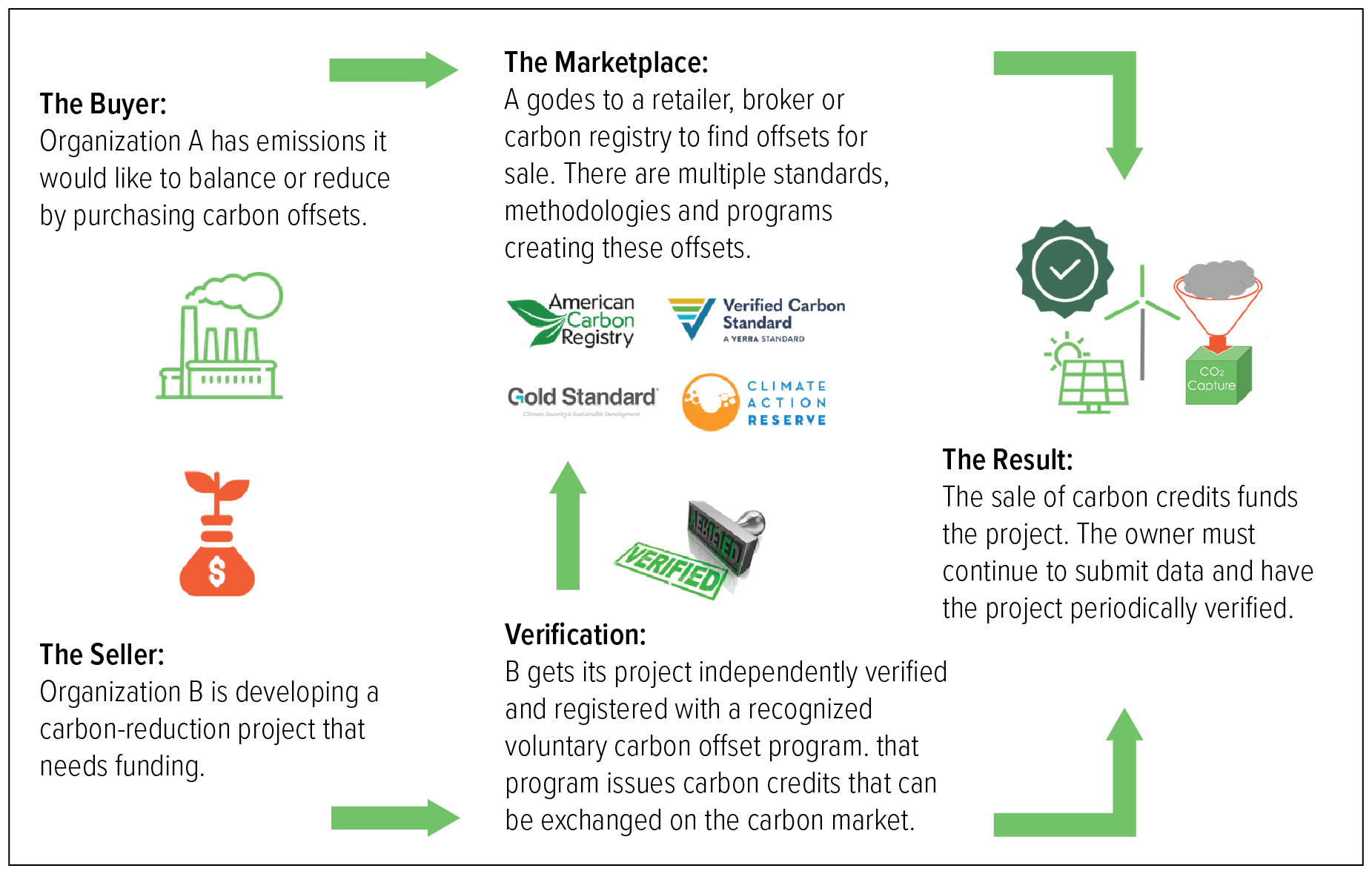

How do carbon credits work?

Companies (or organizations) that need investments to implement new carbon-reduction projects can sell offsets — one credit for each ton of CO2 emissions either avoided or recaptured — to fund the project. Other companies can then purchase those credits to compensate for, or offset, their emissions.

There are two markets: voluntary and regulatory. The regulatory market involves companies trading emissions credits to achieve compliance with government requirements. The voluntary market is just that: companies or individuals investing in carbon-reduction projects to balance their own emissions. Companies may do this out of an ethical stance or to improve their public image with customers and investors. We’re focused here on the voluntary market.

*Click to enlarge the image below.

How are carbon credits measured?

In the carbon offset market, one carbon credit = one metric ton of carbon dioxide (CO2) or equivalent either avoided or recaptured. Other gases, such as methane, nitrous oxide, hydrofluorocarbons (such as refrigerants) and other greenhouse gases are usually converted to CO2 equivalent or carbon equivalent to simplify transactions. Credits may be issued for either reduced emissions or for carbon sequestration, whether that’s using a recapture technology or “bio-sequestration” such as reforestation.

Q: My company is building a new plant to meet new permit requirements, and it will result in lower methane emissions. Can I sell those avoided emissions as carbon offsets?

A: No. Carbon credits will only be granted for carbon reductions or recapture that would not have happened without the offset project. This is called “additionality”: the reductions must be in addition to what your company was already doing or planning. Facility upgrades to replace aging equipment or meet regulatory requirements are things you would have to do anyway; therefore, those kinds of projects are not eligible.

Lifecycle of a carbon credit

These are the essential steps in the lifecycle of a carbon credit for the voluntary market, from concept to retirement:

- Developing a methodology. The major carbon offset programs have existing methodologies or protocols for most project types, such as reforestation, energy efficiency, renewable energy and facility improvements to reduce emissions. Each program has different requirements, so it pays to investigate multiple options and find the one that suits your organization.

- Developing, validating and registering a project. Projects must be proposed, accepted by a carbon offset program, validated by a third party, and registered with the program. Credits are not generated until the project begins operating.

- Earning carbon credits. Once the project has been implemented, it is monitored regularly and verified annually. The selected carbon program then issues credits to the developer’s registry account based on the tons of CO2-equivalent that were either removed or avoided.

- Selling carbon credits. Buyers can invest directly in a project in exchange for credits generated, or sign “Emission Reduction Purchase Agreements” committing to buy a set number of carbon credits as they are issued. Alternatively, the credits can be sold through a retailer, a broker, or a carbon exchange.

- Retiring credits. Credits that have been used to offset greenhouse gas emissions must be retired so that they cannot be sold or used again. The retirement process is different for each program.

What requirements do projects have to meet to produce carbon credits?

Each program has different requirements, but all of them address these key factors:

- Additionality – must be additional carbon reductions, or reductions that would not have happened without the project for which offsets are being sold.

- Durability/permanence – Carbon release must not merely be delayed (for example, until a property is sold), but permanently removed or prevented. What’s the timeline of the project? Ten years? Is a 100-year contract or promise enforceable?

- Buffer Pool — This pool contains extra credits purchased to account for losses over time (such as wildfires in a protected forest).

- Leakage — Think of “leakage” as similar to the way a balloon squeezed at one end bulges out at the other. A program cannot earn carbon credits by merely moving emissions from one location to another; the emissions should be prevented or sequestered (locked up) permanently and globally. Carbon emissions that are merely displaced, rather than being avoided or sequestered (e.g., the same acres of forest logged but in a different location), are considered to be leakage. Depending on the project, formulas may reduce the number of credits issued to account for leakage.

avoided or reduced

A renewable energy credit (REC) is earned based on actual renewable energy generated. It is a measure of energy, not emissions.

Choosing a carbon offset program or framework

Different standards focus on different regions and types of projects, so it’s important to choose one that’s appropriate to your project. Some standards, such as the Gold Standard, require projects to offer social benefits, such as local jobs or improvements to water quality. It’s important to look at the methodology, ongoing monitoring requirements, and costs associated with each program before choosing one.

When selecting a program, one of the first considerations should be the type of credit you are seeking, as some programs limit their credits to specific types. At the highest level, there are two major categories: emissions avoidance versus direct air capture (sequestration). Emissions avoidance would include projects such as new industrial technology. Landscape protection or soil improvement are most likely to be considered sequestration.

Most projects fall into these categories:

- Bio-sequestration, such as forest protection or reforestation to lock up carbon in living plants

- Methane capture, which could involve either sequestration (capturing and storing methane) or emissions avoidance/reductions, depending on the project

- Industrial gases, involving sequestration or emissions reductions of carbon-containing gases other than methane

- Energy efficiency, which reduces energy use at industrial facilities, manufacturing sites or other buildings, thereby reducing emissions at the generation source

- Renewable energy generation such as wind, solar, wave or geothermal sources, which reduces or avoids emissions compared to traditional fossil fuel generation

Existing Programs

These are four of the most recognized programs in the voluntary market. All of them will require a detailed project plan, proof of additionality and permanence, a methodology for measuring results, establishment of a baseline, and ongoing monitoring or reporting. Keep in mind, though, that there are other carbon offset markets and opportunities, and new programs are evolving all the time. This list is intended merely to give you an idea of what’s already in place as of 2022.

| Voluntary Carbon Offset Programs | Coverage (Project Location) | Project Type | Credit Names |

|---|---|---|---|

| Verified Carbon Standard (Verra) |

Any, except countries with emission caps (unless offsets are backed by permanently retiring carbon emission credits) | Any type with VCS-approved methodology, except projects from new industrial gas facilities; accepts GHG reduction projects without additional environmental or social benefits Recognizes Climate Action Reserve projects |

Verified Carbon Unit (VCU) |

| The Gold Standard (established to support UN Sustainable Development Goals)  |

Any, except countries with emission caps (unless offsets are backed by permanently retiring carbon emission credits); most projects are in developing, low- and middle-income countries | Renewable energy and energy efficiency projects; excludes industrial gas projects; projects must meet community impact requirements | Verified Emission Reduction (VER) |

| American Carbon Registry (accepted by California Air Resource Board)  |

Any location | All types; must meet ACR Technical Standard. Industry-specific methodologies based on ISO 14064 | Emission Reduction Tonne (ERT) |

Climate Action Reserve |

U.S., Native Sovereign Nations, Canada and Mexico | Forest management, reforestation, avoided conversion, livestock and landfill methane capture | Climate Reserve Tonne (CRT) CRTs can be converted to VCUs and transferred to a VCS registry |

These are just a few examples of international programs available in 2022. If you have a specific project in mind, it’s best to get the help of an experienced consultant to explore possible markets and frameworks or registries.

Six Steps to Entering the Carbon Offset Market

If you have a carbon reduction or sequestration project in mind and would like to seek carbon offset investments, these are the major steps to follow:

- Select a program.

Each verification program/credit issuer has different requirements for eligible projects, methodology, additional social benefits, and location. For example, if you are considering an industrial gas project, rule out the Gold Standard, which specifically excludes such projects. - Understand your program’s requirements.

Each program has its own quality criteria and methodology or protocol for each type of project. - Develop your project plan.

Look for a list of approved methodologies and use the appropriate one to develop your own project plan. You can work with a specialist in carbon offset project development, if your organization doesn’t have those skills in-house. It is possible to propose your own methodology for a new project type, but that can be expensive and risky, if the proposed methodology is rejected. - Arrange for validation and registration.

Once the project has been designed, it’s ready to be submitted to an independent verifier. If approved, it can be registered with the carbon offset program. Registration means that the project is ready to start operating and generating carbon credits. - Implement the project.

The project can now begin operating. It will require monitoring and periodic (usually annual) verification to measure the emission reductions or capture. Verification reports are sent to the program, which issues carbon credits equal to the tons of CO2 reductions. - Sell the credits.

Credits in the project owner’s account can be sold, traded or transferred. Credits can continue to change hands until they are used to offset emissions, at which point they must retired.

For more information:

These are a few helpful websites with more information about carbon offset programs:

- Carbon Offset Guide

- Creating Carbon Offset Units on the Voluntary Market

- Verra Verified Carbon Standard

- Gold Standard

- American Carbon Registry

- Climate Action Reserve

Weaver can help.

If you’re interested in exploring the carbon offset market, our Energy Compliance Services team can help you evaluate potential projects and identify the most appropriate registry or framework. Contact us for a complimentary consultation or more information.

©2022