Accounting for Divorce: Proving Separate Property in a Texas Divorce

Forensics & Litigation Services

Forensics & Litigation Services

Never miss a thing.

Sign up to receive our insights newsletter.

In a Texas divorce, community property is divided between the two spouses, but separate property is retained by the spouse who owns it. The court resolves any disagreement between the spouses about whether a particular asset is community property or separate property. Many divorcing spouses hire attorneys and tracing experts to assist them in presenting evidence on why certain property should be characterized as separate instead of community.

What is Separate Property in Texas?

Section 3.001 of the Texas Family Code provides the basic definition of separate property. “A spouse’s separate property consists of: (1) the property owned or claimed by the spouse before marriage; (2) the property acquired by the spouse during marriage by gift, devise, or descent; and (3) the recovery for personal injuries sustained by the spouse during marriage, except any recovery for loss of earning capacity during marriage.” Chapter 4 of the Texas Family Code also allows a couple to enter into what are called “premarital” (sometimes referred to a pre-nuptial) and “marital” (sometimes referred to as post-nuptial”) property agreements. In such agreements, prospective spouses or couples that are already married agree in writing on whether property is community or separate property.

Complications in determining whether property is community or separate often arise when, during the marriage, the spouses lived or worked in other states and acquired or disposed of property while they were there. Texas law provides for certain presumptions, but many times the characterization of those assets is resolved in the same manner as property acquired in Texas.

What Does it Take to Prove an Asset is Separate Property?

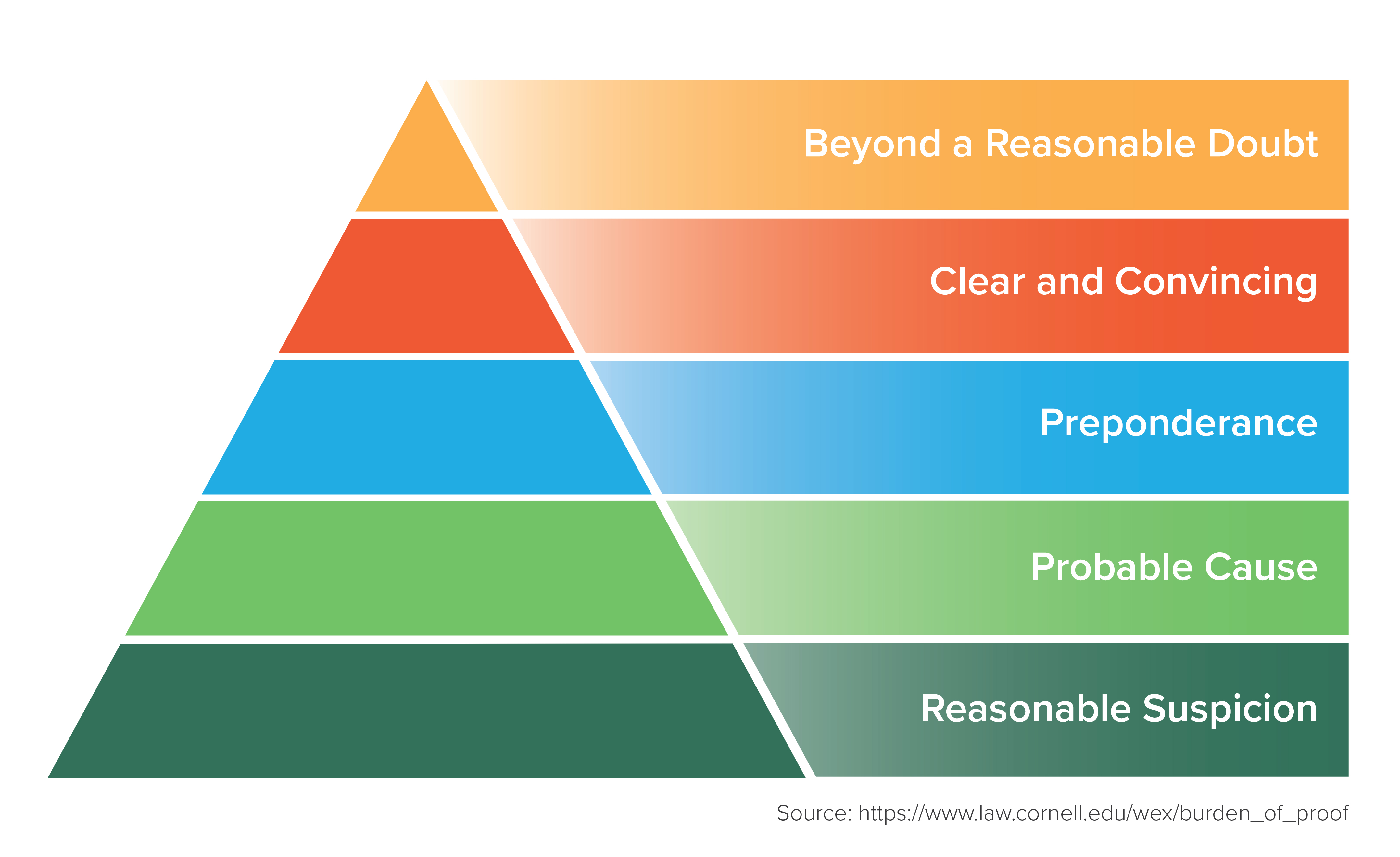

Section 3.003 of the Texas Family Code states that “property possessed by either spouse during or on dissolution of marriage is presumed to be community property” and a spouse who makes a claim of separate property must establish their position through “clear and convincing evidence.” That degree of proof is different and higher than just a “preponderance of the evidence” required in many other aspects of family law. Generally speaking, the spouse must prove it is substantially more likely that the property is separate property instead of community property.

Usually, spouses and their attorneys decide that presenting clear and convincing evidence will require documentary evidence that establishes the time and manner in which the property was acquired (termed “inception of title” by the Texas Family Code) and any later sales or exchanges (“mutations”) of the property during marriage. In most cases, unless one spouse proves by clear and convincing evidence that an asset is his or her separate property, the court just follows the presumption that the asset is community property and subject to division.

Usually, spouses and their attorneys decide that presenting clear and convincing evidence will require documentary evidence that establishes the time and manner in which the property was acquired (termed “inception of title” by the Texas Family Code) and any later sales or exchanges (“mutations”) of the property during marriage. In most cases, unless one spouse proves by clear and convincing evidence that an asset is his or her separate property, the court just follows the presumption that the asset is community property and subject to division.

How Can a Tracing Expert Help?

An expert witness on financial tracing helps a spouse and his or her attorney identify evidence to present either before trial (such as at a mediation) or later during the couple’s divorce trial. A paper trail that follows your separate property from inception of title to the time of divorce is often the key to meeting your burden of presenting clear and convincing evidence. “Tracing” is the method an expert witness can use to piece together that paper trail when your separate property has changed form, been exchanged, or sold during your marriage, resulting in you owning different property at the time of divorce.

Tracing relies on the concept that property retains its character as separate or community over time, even if you convert it to another form like cash or another type of asset. For example, if you sell a home that was your separate property, the proceeds from the sale are still considered to be your separate property. Additionally, if you reinvest the proceeds of the sale of separate property into another house titled in your name, that house would also be viewed as your separate property, even though you purchased it during your marriage.

Commingling separate property with community property can make proving your separate property claim even harder. For example, if you deposit the inheritance you received from your parents into a joint bank account with your spouse, then the inheritance may be considered community property unless you can find clear and convincing evidence to the contrary.

Tracing experts help you and your attorneys identify documentation that shows how your property changed into its various forms over time and then they present that paper trail in a way the judge or jury can understand.

Typically, longer marriages, mutations in the form of separate property since its origin, commingling of separate and community property, or crossing state lines during a marriage will all complicate the tracing of separate property with clear and convincing evidence. A financial tracing expert who is familiar with generally accepted tracing principles and methodologies and is skilled at presenting expert testimony during litigation can add value and credibility to your separate property claim.

Our family law professionals can work with you and/or your attorney to trace your separate property for presentation at mediation or at trial. We are here to help. Contact us today.

Weaver professionals assist clients and their attorneys, but Weaver professionals do not provide legal advice and are not your lawyers. Consult with your attorney before taking any action related to your divorce.