Goodwill Impairment Issues related to COVID-19

Never miss a thing.

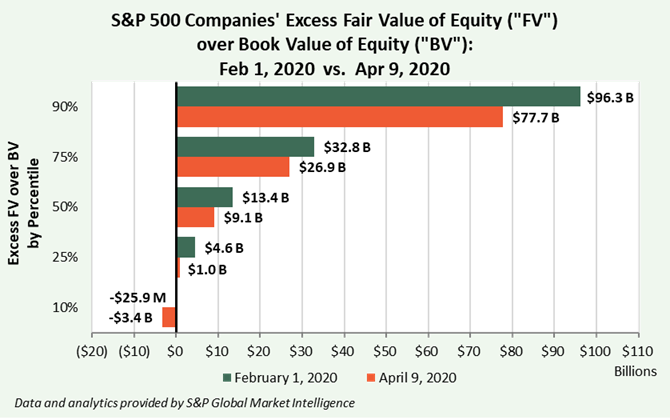

Sign up to receive our insights newsletter.

COVID-19 continues to wreak havoc on the economy, industries and businesses, wiping away trillions of dollars in equity value in a matter of weeks. This downward pressure on equity valuations naturally leads to questions surrounding goodwill impairment. Among the impairment factors on executives’ minds are triggering events and whether COVID-19 will prompt impairment testing. Even if COVID‑19’s impact triggers impairment testing, consideration needs to be paid to the nature of the impact, whether temporary or permanent, and the severity of the downturn, both in terms of direct and indirect impacts. The one potential silver lining is that all of these considerations can now take place under the simplified impairment testing framework.

1. Triggering Events

ASC 350 Intangibles – Goodwill and Other requires an entity to test for goodwill impairment when an event occurs or if circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. This applies to entities adopting the private company accounting alternative, which also allows for the amortization of goodwill. Given the broad scale impact, it is highly probable that COVID-19’s effects on businesses qualify as a triggering event, and therefore, a goodwill impairment analysis may be required.

2. Temporary vs. Permanent Impairment

An important item to consider when quantifying the amount of goodwill impairment, if any, is whether the potential COVID-19 impact will be temporary or permanent. Given that a goodwill impairment analysis is forward looking, the possibility exists that future expected earnings and recovery will outweigh current losses. Additionally, businesses must consider whether the potential decline in a reporting unit’s fair value is driven by other assets, rather than goodwill alone (e.g. fixed assets, inventory, etc.). If excess inventory exists or the use of certain equipment is no longer economical, the potential write-down of those assets could reduce or eliminate any goodwill impairment.

3. Direct and Indirect Impacts

When assessing triggering events in the context of a goodwill impairment analysis, it is imperative that executives consider both the direct impacts of COVID-19 as well as any indirect impacts. Direct impacts would be items that impact daily operations, such as increased customer attrition, insufficient working capital to meet payroll or rent expenses, and many others. However, indirect factors could also cause severe financial and operational impacts on businesses. Examples of indirect factors include supply chain issues, such as longer lead times on inventory, and distributor interruptions, which may impact businesses’ ability to fulfill demand after the pandemic wanes. Both of these indirect impacts may also affect earnings margins if business are forced to incur most costs from seeking alternatives to the standard supply chains.

4. Some Relief

While there may be an inordinate number of factors to consider in a goodwill impairment analysis, the 2017 update to the accounting standards simplified goodwill impairment testing procedures. Of these, the most significant change was also the most complex step: elimination of the hypothetical purchase price allocation to determine goodwill’s implied fair value. Instead, the amount of goodwill impairment is determined to be the reporting unit’s excess carrying value over the fair value. While this change to accounting standards isn’t compulsory for private companies until after December 15, 2021, early adoption is permitted. Although this update does not eliminate the need for determining triggering events or testing for goodwill impairment, it will save businesses time and costs associated with performing these analyses.

While COVID-19 may force businesses to quantify damages, the practice of assessing operations in a changing environment is probably one of the most useful exercises right now to gain greater clarity over the health of the business. As always, Weaver is here to help! We are happy to offer a free consultation to discuss the high-level details of your specific business situation and map out the next steps to assess goodwill impairment, if any. Please contact a Weaver professional today.

Authored by Kaci Howell, CPA, ABV, CVA, and Tyler Ridley, CPA.

© 2020