Home Health and Hospice Sectors are Heavily Exposed to Medicare Risk

Health Care Valuation Services

Never miss a thing.

Sign up to receive our insights newsletter.

Home health, personal care and hospice sectors are undergoing significant shifts driven by regulatory changes, reimbursement uncertainty, staffing challenges and a push toward value-based care. These trends are reshaping market dynamics and impacting valuations and the acquisition market in the home health sector. Due to divergent industry dynamics, personal care has the potential to provide a risk mitigation strategy for companies operating in home health and hospice.

By the Numbers

Addus HomeCare Corporation (ADUS), a large independent and publicly traded home care company, primarily operates in the personal care space, but its services also include hospice and home health.

On June 10, 2024, Addus announced a definitive agreement to acquire the personal care operations of Gentiva for an anticipated purchase price of $350 million. The transaction relates only to its personal care operations, which serve over 16,000 patients per day in a seven-state service area. Gentiva is the largest provider of personal care services in the state of Texas, where Addus currently has no personal care operations.

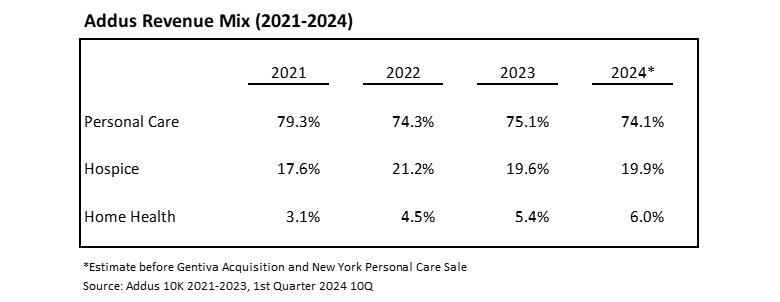

Since 2019, Addus has made 13 acquisitions, adding $350 million in revenue. These acquisitions have slightly decreased the company’s reliance on personal care services (now 74.1% of revenue) and increase the revenue share from hospice services (now 19.9%).

Why It Matters – Diversification

Hospice and home health businesses are highly exposed to Medicare reimbursement changes and annual updates. Diversification into personal care services help companies like Addus mitigate the risks associated with Medicare reimbursement and regulatory changes. They also serve the elderly, chronically ill, disabled and at risk of hospitalization or institutionalization.

Personal care is typically provided on a long-term continual basis with an average duration of 26 months per patient. Without these services, patients progress to nursing homes at more than three times the cost.

This sector has a much lower reliance on Medicare, with state programs funded by Medicaid as the largest payor source. In addition, personal care is paid at a per-hour rate, rather than per-diem payment for hospice and episodic payment in home health.

Health Care Valuation Takeaways

Revenue diversification is a positive valuation attribute, as future reimbursement risk is diversified and less exposed to Medicare reimbursement and regulatory policy. A valuator may consider personal care revenue more stable than other home health categories. State agencies may also be reluctant to cut funding for personal care because of the large cost of the alternative site of care (i.e., nursing homes or hospitals).

The shifting dynamics underscore the importance of diversification as a strategic tool for risk management and revenue stability. By expanding into the personal care sector, companies can better navigate the uncertainties of Medicare reimbursement and regulatory changes. For a deeper understanding of these trends and how they can impact your business, reach out to our team.

Authored by Sam Betsill, Lauren Tollison and Elliott Jeter

©2024