Profit Tunneling in Nursing Home Facilities: Key Takeaways and Guidance

Health Care Valuation Services

Never miss a thing.

Sign up to receive our insights newsletter.

As nursing home facilities face increased regulatory oversight, the practice of “tunneling,” or hiding profits by inflating related-party transactions, has become a critical concern across the health care industry. Recently, guidance from the U.S. Department of Health and Human Services (HHS) Office of Inspector General (OIG) flags tunneling among the top risks for these facilities. With the heightened focus on transparency and accountability in the industry, it’s important to understand and address profit tunneling in nursing homes, so these facilities can maintain compliance, avoid penalties and ensure fair market practices.

What Is Profit Tunneling?

Profit tunneling happens when nursing homeowners or investors overstate expenses paid to related companies, hiding the facility’s real profits. This takes many forms, such as:

- Real estate leases or transactions: Selling a facility’s property to a related real estate firm, then leasing it back at above-market rates

- Management fees: Outsourcing management to a sister company at inflated costs

A recent study suggests that 68% of nursing home profits were concealed through related-party markups. Some specific areas include:

- Real estate: 31% of expenses, with a 36% markup

- Management: 25% of expenses, with a 42% markup

The Numbers Tell the Story

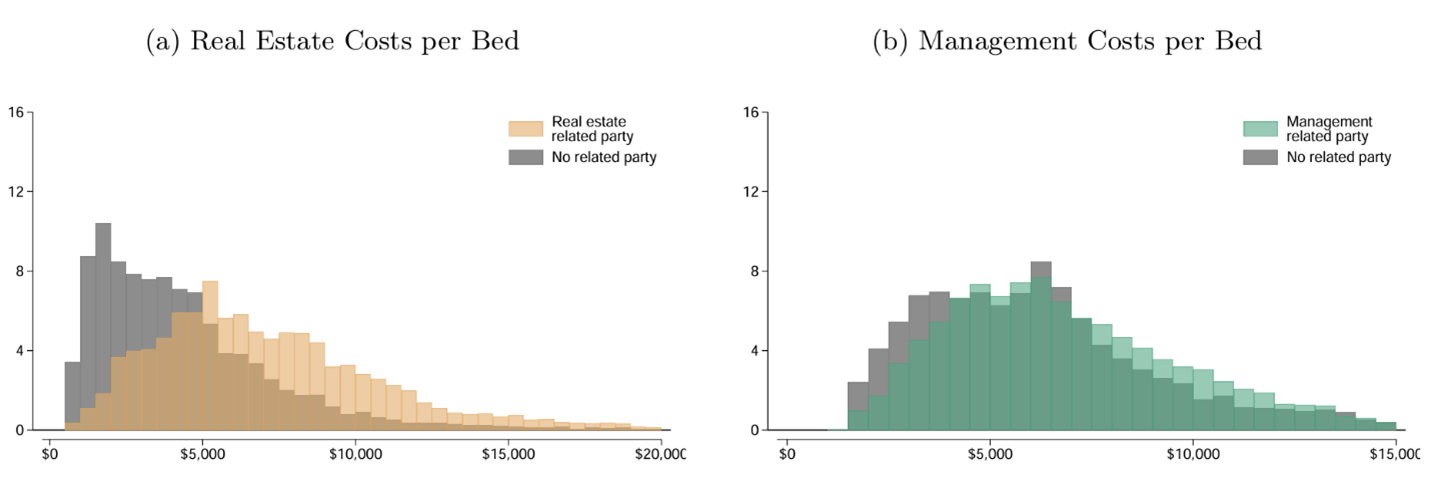

To better understand the financial consequences of profit tunneling, the below histograms taken from a report published in the “National Bureau of Economic Research” illustrate costs per bed and compare related and nonrelated party transactions. The data reveals that costs per bed for nursing homes paying related-party fees significantly outpace facilities with no related-party transactions. Specifically, costs exceeded a $5,000 per bed benchmark.

Health Care Valuation Key Takeaways

In connection with the OIG’s guidance, nursing home facilities must maintain transparency and consider:

- Fair market value (FMV) compliance: Nursing home facilities need to ensure that transactions involving related-party transactions must reflect true market value conditions.

- Detailed analysis: Valuators need to perform thorough reviews of management and facility spending both with and without related-party transactions and use professional judgement to adjust costs where necessary.

- Regular updates: Maintain and update FMV opinions regularly to mitigate the risk of transactions being misunderstood as tunneling and ensure compliance.

Bottom Line

Profit tunneling is under increased scrutiny, and nursing home facilities must recognize the risks associated with related-party transactions. It’s critical to ensure alignment with FMV not only as a best practice to maintain transparency but also trust with stakeholders. We’re here to help you understand the regulatory environment and maintain compliance. Contact us today.

©2025