Weaving Through Uncertainty: Valuing Amidst Volatility

Never miss a thing.

Sign up to receive our insights newsletter.

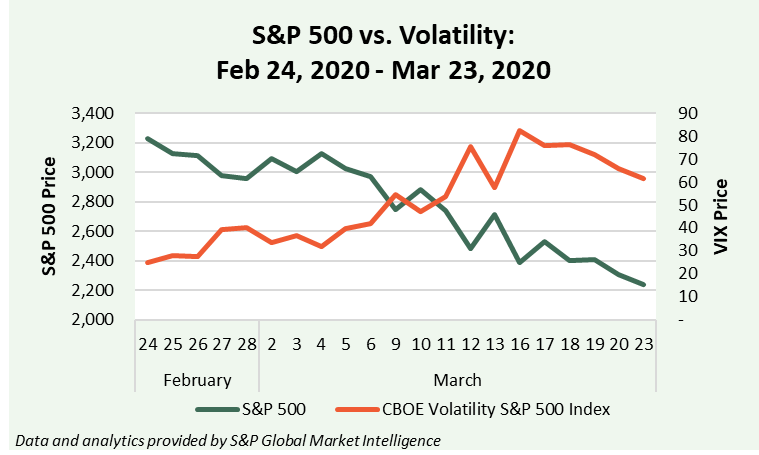

COVID-19’s impact on public health and the prescribed solution, social distancing, is wreaking havoc on small businesses and capital markets alike. While the path forward is genuinely uncertain, a reflection on prior periods of elevated volatility reveals a host of trends, all of which prove to increase the complexity of valuation approaches and assumptions. During these tumultuous times, asset managers ought to pay special attention to protecting investors’ trust and dispelling concerns, which is why firms are considering an independent check on mark-to-market to offer assurance over values, now more-so than ever.

Through the lens of your home office window, the world looks like a totally different place from a month ago, thanks to COVID-19. While parents balance the novel demands of working from home and entertaining their quarantined kids, economists attempt to grasp the rapidly morphing, macroeconomic environment.

Estimates of gross domestic product continue to be revised downward with the latest Q2 2020 estimates, by Goldman Sachs and J.P. Morgan, amounting to -24% and -14%, respectively. Forecasts for the remainder of 2020 hang in the balance, awaiting the impact of impending monetary and fiscal policy measures. While the yield curve’s change from inverted to steepening can be viewed as a harbinger of a looming recession, the only curve that truly matters right now is COVID-19’s transmission curve.

Social distancing appears to be the only prescription available in the short-term to mitigate the public health risks. However, social distancing is having a significantly disruptive effect on the economy, with some industries reeling more so than others, leading many investors to ask: has the mergers and acquisitions (“M&A”) environment systematically changed? The short answer is it’s too early to tell, but we can reflect on prior trends to help set expectations.

Although the principal causes of the 2007-2009 economic slowdown (“the Great Recession”) differ from those of today, the resulting behaviors and environment may not be dissimilar. During the Great Recession and the spell of elevated volatility, deal characteristics shifted in several notable ways, besides the obvious drop in M&A activity.

First, the average deal size reduced with fewer closings of mega-deals, likely due to the difficulty of building a consortia of deal participants. Additionally, the time between announcement and closing reduced significantly. Furthermore, a greater proportion of deals were characterized as restructuring endeavors as companies looked to efficiently align their capital structures with the market conditions. If the potential credit crisis also comes to fruition in 2020, M&A buyers may be forced to reduce leverage and settle for more minority stakes, as they did during the Great Recession. Finally, term sheets may not only see expanding representations and warranties coverage, but the composition of deal consideration may shift systematically, whereby cash, as opposed to stock, will represent a greater proportion of the consideration mix. The reason being that sellers may be reluctant to hold highly volatile stock as consideration, while buyers may view their own stock as unduly oversold. Divergences in valuations will likely lead to greater proliferation of contingent consideration as a mechanism to bridge the gap between the differing views, as well as protect buyers from worsening conditions. In short, valuations will become increasingly complex in these tumultuous times.

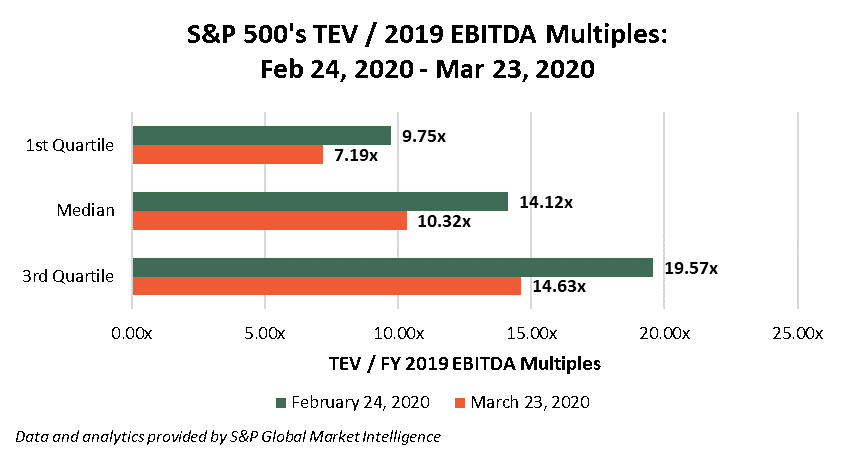

Valuing contingent consideration certainly increases the level of complexity, but the complications don’t stop there. Valuations will demand increased levels of scrutiny to properly match timing and risk to the rapidly evolving market conditions; for instance:

- Forecasts of future operations used in the income approach may need to be a composite of the probability weighted scenarios in order to most accurately capture the uncertain future.

- Discount rates will require more attention, especially using the Capital Asset Pricing Model, whereby certain components, such as the equity risk premium, beta and company specific risk premium, may warrant uncommon adjustments.

- The market approach will present its own unique concerns related to appropriately matching the subject company’s financials to market multiples, both in terms of timeframe and risk-adjusted cash flows. While greater emphasis will need to be paid to net working capital, as well as a host of other factors, from geographic concentration to supply chain exposure, there may be a shift in marketability and control premiums/discounts caused by modifications in M&A behavior. In these circumstances, it will be especially critical to not only capture the additional risk components, but also avoid double-counting those risk measures.

- There may be grave, irreversible consequences for valuation mistakes, whereby goodwill and other long-lived assets may incur unwarranted impairment charges, if the situation is improperly assessed as permanently altered, rather than temporarily disrupted.

Stoicism is often revered in these times of hardship, and Seneca, the Stoic philosopher, once observed that “we suffer more from imagination than reality.” Market downturns coax the worst fears out of investors while they pause and triage their financial health to discern sturdy positions from shaky ones.

If you are looking for ways to protect investors’ trust and dispel concerns surrounding transparency, incorporating independence into your valuation procedures builds investor confidence in your pricing and reporting. This might be a good time for you to evaluate how your valuation advisors can help you offer more assurance around your internal valuation protocols, the valuations derived in-house or the quarterly/annual valuation process. The merit of consulting with valuation specialists is no greater than during times of uncertainty.

If you have further questions about valuing amidst volatility, please reach out to Weaver’s Financial Advisory Services team for more information. Stay safe and socially distanced!

Authored by Tyler Ridley, CPA.

© 2020