Will Private Equity Drive Energy Transition?

Never miss a thing.

Sign up to receive our insights newsletter.

For some time, energy companies and private equity firms have considered their place in the great energy transition. Amidst the uncertainties, one thing is perfectly clear and unlikely to change: trillions of dollars will be spent on energy transition. Society demands it. It’s going to happen. It’s now just a matter of figuring out the who, what, where and when.

Industry veterans have seen a lot of changes over the years, but we’re in the midst of change like we’ve never seen before. If we’re going to keep up with energy demand, and at the same time manage our atmosphere’s chemistry, we have an enormous challenge ahead of us.

Change is Coming, But Who Will Take the Lead?

Over the last several years there has been “white board” talk around energy transition, but key questions remain unanswered. How will the transition be financed? Will corporate energy giants, with their capital and technical expertise, lead the way? Will governments get more deeply involved? Will private equity teams, with their fund-raising prowess and deal execution skills, play a meaningful role?

These are intriguing questions and vital ones as we continue the conversation.

Market-driven solutions are the best means of allocating capital resources on a massive scale. And it’s for this reason private equity’s response to energy transition is informative. Private equity teams are experts at spotting and executing winning investments. When private equity deploys capital in a big way in energy transition, it will be a clear sign that market forces are driving investment.

Tracking the Data

What does the data tell us? Is there any data that indicates whether private equity firms are making significant moves in energy transition?

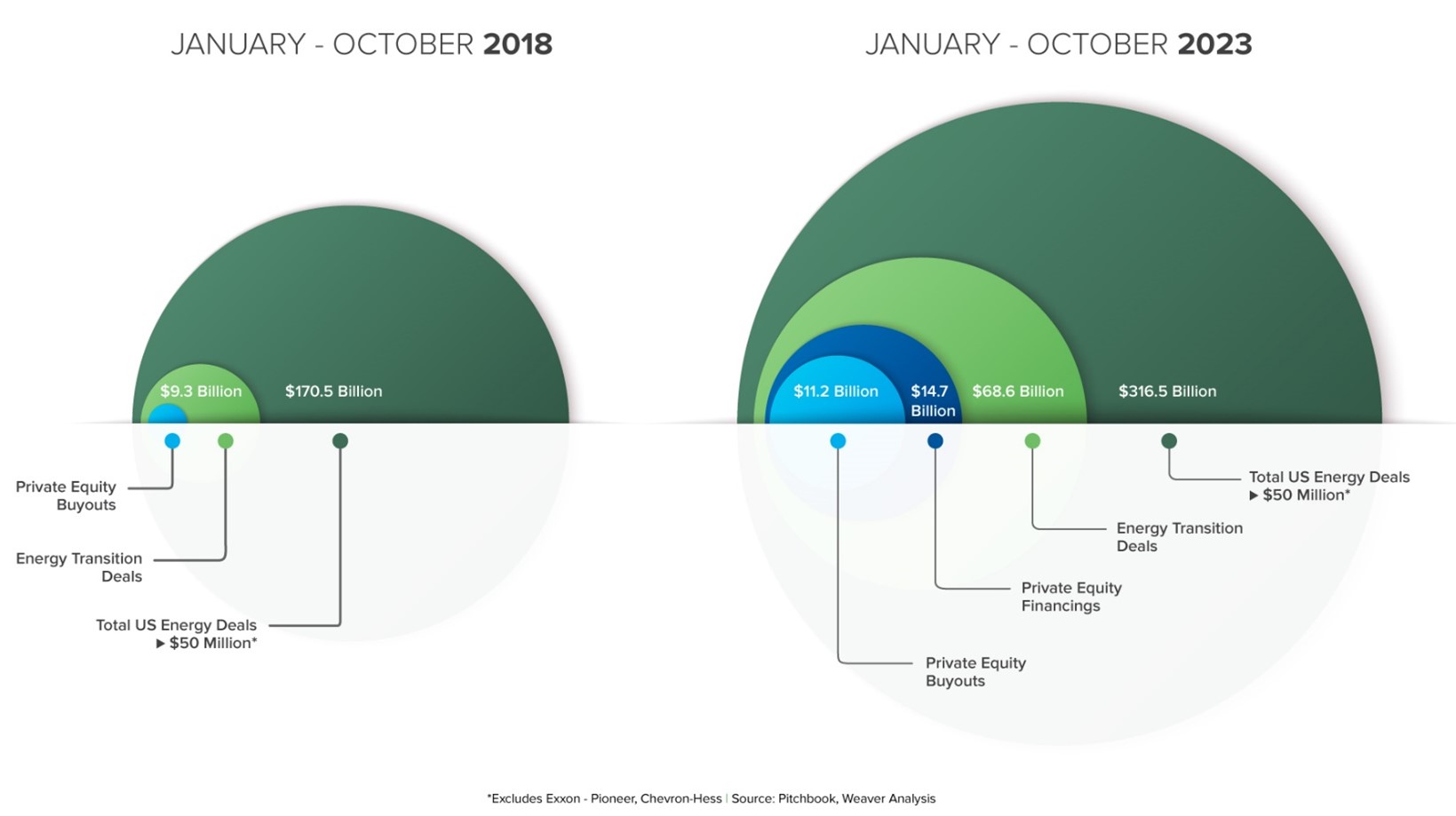

One way to follow the data is to look at recent energy deals in the U.S. to see whether private equity is moving into energy transition, and if so, at what scale and in which sectors. The comparisons that follow are based on U.S. energy deals over $50 million between January and October 2023, with corresponding data for 2022 and 2018.

This dataset, from the research and insights firm Pitchbook, produced 827 energy transactions across the entire spectrum, from oil and gas to power to renewables to energy-related products and services. It was based on publicly available information, and deals were organized by type (e.g., traditional energy vs. energy transition). Deals involving private equity in some form were also identified.

Private Equity Buys In, Big Time

Based on information from this dataset, energy transition deals involving private equity exploded over the last five years, with total deal value increasing by 7,300%. This reflects astounding growth among private equity firms in this space.

The total value of all private equity-backed energy transition deals in the U.S., per the dataset, was less than $500 million in 2018. By 2023 the figure had leapt to more than $25.9 billion. In comparison, traditional private equity energy deals grew during the period by only 53%, from $20.9 billion in 2018 to $32.0 billion in 2023. Although still behind, private equity deal flow in the transition space almost caught up with private equity deal flow in the traditional energy arena over the past five years.

Energy transition deal flow is still dominated by the non-private equity players. But growth among non-private equity investors, while robust, was less impressive. The total value of energy transition deals not involving private equity increased 379%, from $8.9 billion in 2018 to $42.7 billion in 2023.

To put this in the broadest context, total energy deal value (traditional plus energy transition, with and without private equity) increased by 86% from $170 billion in 2018 to $316.6 billion in 2023 per the dataset (this excludes the Exxon-Pioneer and Chevron-Hess deals, which, at $64 billion and $60 billion respectively, distort 2023).

This increase in private equity investing in the energy transition arena is substantial and could be viewed as a driver of energy transition efforts.

But Keep the Cork in The Bottle

The world is dramatically under-investing in energy transition, according to most estimates. If we need to invest $5 trillion per year, and if we are only investing $1 trillion per year, the only conclusion we can draw from private equity investing $25.9 billion in energy transition in the U.S., as the dataset suggests, is that we have a long, long way to go. Moreover, there are three reasons the explosion in private equity investing in energy transition may not be a long-term trend.

First, the surge in private equity investing in energy transition deals between 2018 and 2023 reflects, in a significant way, the general trend in private equity transactions across all industries to invest in credit as opposed to leveraged buy-outs. Roughly two thirds of energy transition deals in 2022 and 2023 involving private equity firms were credit transactions, according to the dataset. While a credit deal requires the rigor and discipline that private equity firms are known for, a credit investment is based on stability of cash flow rather than expectation as to future value. Credit investing may be a good sign, but equity investing would have been a much better sign that energy transition businesses are expected to grow significantly in value. Value growth, more so than stable cash flows, will attract the kind of investment climate experts believe we need.

Second, many of the private equity firms backing companies in the energy transition space in 2022 and 2023 were relatively new to the energy arena. Familiar names such as EnCap, Quantum, Riverstone, ArcLight, Apollo and KKR invested in energy transition, but unfamiliar names outnumbered them by ten to one. Veteran energy firms know how to make money; that’s how they became veterans. As for the newcomers, only time will tell. When enthusiasm runs high, new entrants join the fray. With so many new private equity players drawn to the excitement of energy transition, the number of private equity firms in the space might plateau as the industry matures.

Third, when private equity moves into a new space in a big way, fund managers don’t actually know if they’ll make money. Today’s investment performance will inform fund managers’ judgment as to future investments. Simply put, it will take time before we know if private equity will be a force in energy transition over the long haul.

Enter a New Breed of Private Equity

Interestingly, there is a new breed of private equity investor joining the energy transition movement whose focus is on socially responsible investing. The dataset revealed that funds such as Energy Impact Partners, formed in 2015, Breakthrough Energy, formed by Bill Gates in 2015, Lowercarbon Capital, formed in 2018, and Ara Partners, formed in 2017 – four among many funds committed to addressing climate change – have been very active in the energy transition space. This is a shift from private equity’s traditional role of investing in familiar industries with the sole objective of earning a return. We now see private equity firms raising massive amounts of capital to transform industries to achieve a societal objective, as well as earn returns. Whether they can do both remains to be seen.

The “All of the Above” Salvation

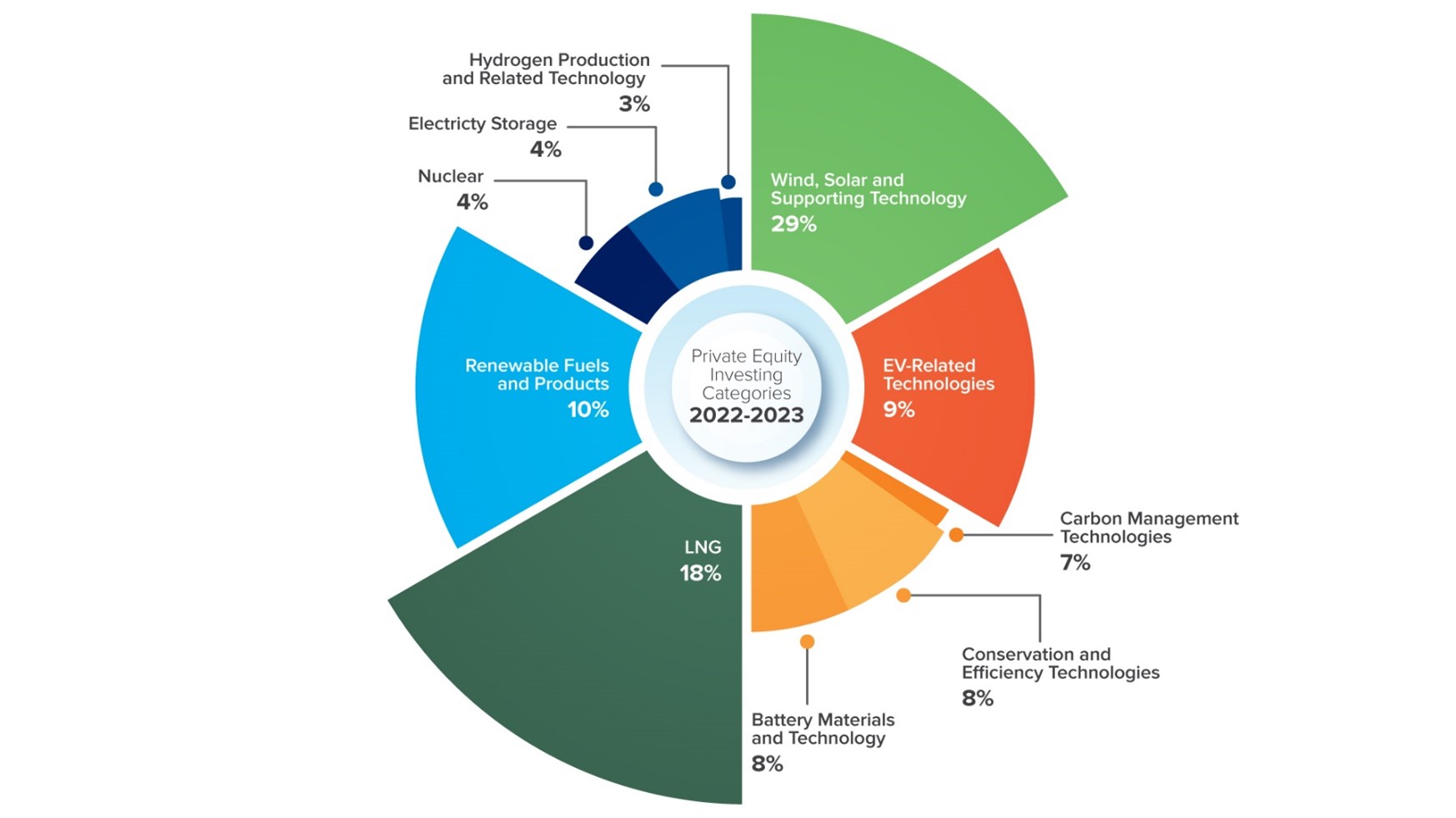

As for how capital is being deployed, the dataset suggests private equity investing in energy transition is very broad in scope. The major categories in 2022 and 2023 were wind, solar and supporting technologies ($12.8 billion); LNG ($8.0 billion); renewable fuels and other renewable products ($4.5 billion); EV-related technologies ($3.7 billion); battery materials and technology ($3.5 billion), conservation and efficiency technologies ($3.5 billion); carbon management technologies ($2.9 billion); electricity storage ($1.8 billion); nuclear ($1.7 billion); and hydrogen production and related technologies ($1.1 billion).

It’s encouraging to see private equity investing across a broad front in the energy transition space. This aligns with the “all of the above” mentality that every energy veteran knows will be required to meet the energy transition challenge.

The world needs energy from nearly every available source, including traditional oil and gas. At the same time, we must release fewer carbon molecules per person through technical innovation. And, for every carbon molecule that goes up, another must come down.

From an engineering standpoint, it’s easy. It involves an “all of the above” mindset. But from an investment and return standpoint, that’s the tricky part. Private equity is in the game, which is an encouraging sign, but it remains to be seen if this is a harbinger of ultimate energy transition success.

The Role of Policy Makers

Policy makers in the U.S. have recently made bold moves in the form of tax incentives and other means to stimulate investment in energy transition. The dataset provides no insight into whether, or to what extent, it’s working. But as regulations mature, as investors respond with appropriate management systems, and as modalities of monetizing tax credits become well established, the new policies are likely to find their way into investment models and increase private equity investments in energy transition.

There is nothing innovative about using tax policy to influence business and industry. Policy makers should, at a minimum, strive for solutions that are built on reliable returns on invested capital. One way we’ll know if policy is working is by watching private equity.

Weaver offers extensive tailored services to support businesses involved in the energy transition. Visit our Energy Transition and Inflation Reduction Act pages or contact us for assistance.

©2024