J.P. Morgan’s Q1 2025 US Biopharma and Medtech Reports Signal a Strategic Start

Never miss a thing.

Sign up to receive our insights newsletter.

The first quarter of 2025 brought both medtech and biopharma sectors a blend of resilience and strategic recalibration, according to J.P. Morgan’s Q1 2025 biopharma therapeutics and medtech licensing reports. Highlights from the reports indicate that investors and industry leaders continued to maneuver a landscape marked by cautious optimism, larger deals and evolving global participation.

Biopharma: Fewer, Bigger Bets and a Focus on Innovation

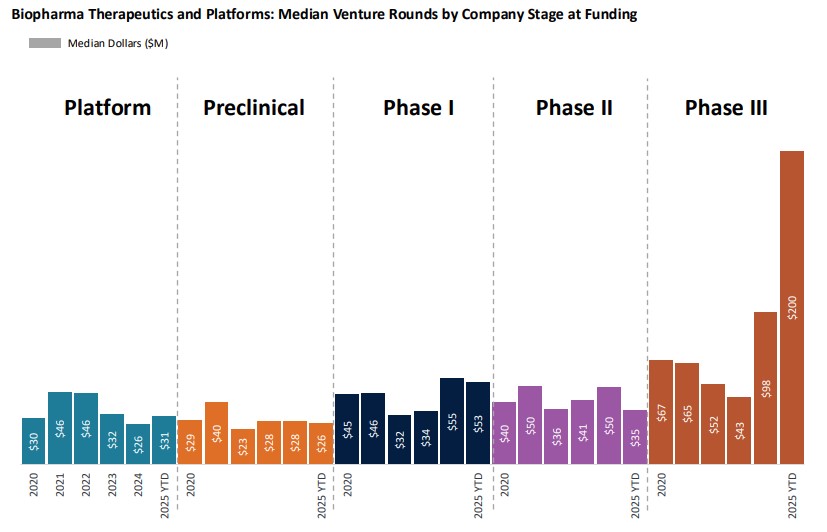

Biopharma continued to favor larger private rounds, with $6.7 billion raised across 109 deals, matching the pace set in Q1 2024. However, the number of deals shrank as investors concentrated capital into fewer, more mature companies while still supporting discovery platforms. Platform-stage rounds saw a median value of $31 million, underscoring investor confidence in early-stage innovators.

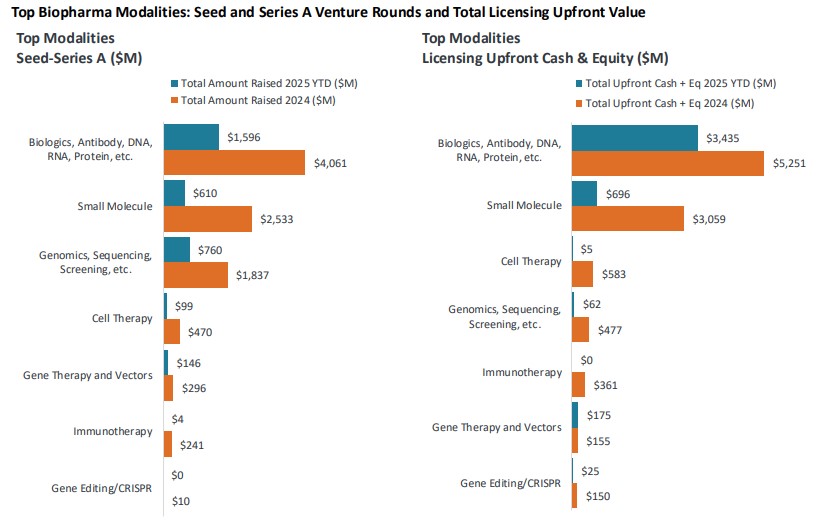

Licensing activity posted $56.8 billion in total announced value, with upfront payments accounting for 8%, noting a modest increase over last year. Large cap pharma favored Phase II assets, and biologics remained the most active mode in terms of investment and deal volume. Merger and acquisition (M&A) activity reflected the “fewer but larger” trend with 27 transactions totaling $25.2 billion featuring headline deals like Johnson & Johnson’s $14.6 billion acquisition of Intra-Cellular Therapies.

Source: J.P. Morgan Q1 2025 Biopharma Report

Medtech: Mega Rounds, Fewer Players and Steady M&A

Medtech mirrored biopharma’s pattern of larger investments into fewer companies. Q1 2025 saw $3.7 billion invested across 117 rounds, a year-over-year increase in total dollars despite a dip in the number of transactions. Larger rounds went to fewer companies, 13 of which exceeded $100 million. First-time financing activity was concentrated in fewer, high value deals, including Lila Sciences’ $200 million Series A.

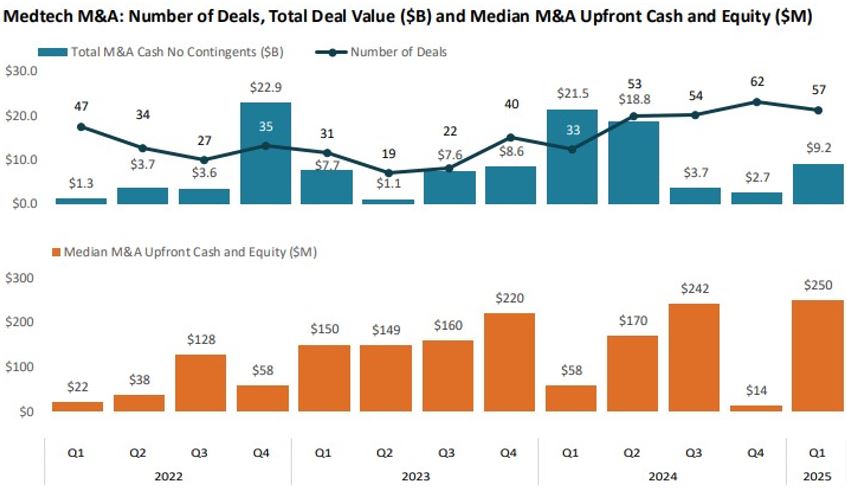

The licensing environment was notably active, with 286 medtech deals announced. Upfront commitments totaled $871 million, the highest proportion (24%) of deal value committed upfront in nearly a decade. M&A activity remained active with 57 transactions totaling $9.2 billion. Notable deals included Stryker’s $4.9 billion acquisition of Inari Medical. Licensing and research and development (R&D) partnerships also saw larger upfront commitments, reflecting confidence in advanced stage and commercial ready technologies.

Source: J.P. Morgan Q1 2025 Medtech Report

Overall Trends and Takeaways

As dealmaking in life sciences grows more complex, organizations must navigate evolving tax, accounting and compliance challenges with greater precision. Key trends point to areas where thoughtful planning and technical execution are essential.

- Higher licensing upfronts and revenue recognition under ASC 606: Upfront payments require clear documentation of performance obligations, price allocation based on standalone selling prices and revenue recognition tied to “right to use” vs. “right to access.”

- Cross-border licensing and global financings: International deals require aligning profits with development, enhancement, maintenance, protection and exploitation (DEMPE) functions, applying profit split methods for early-stage intellectual property (IP) and documenting which entities assume economic risk.

- Growth in platform and discovery stage investments: Companies should document technical uncertainty and experimentation, include algorithm development as qualifying R&D activity and maintain records to support credit claims.

- Complex deal structures and milestone payments: Deal complexity calls for cross-functional review, automated milestone tracking, enhanced Sarbanes Oxley (SOX) controls and scaled management review based on deal size.

- Valuing contingent consideration in an evolving landscape: Milestone driven deals need dynamic, probability-adjusted models, option pricing or weighted methods and regular updates based on clinical or regulatory changes.

The Q1 2025 reports show that medtech and biopharma are shifting toward fewer but larger deals, a greater emphasis on proven science and an increasingly global outlook. Aligning financial strategy with innovation is key to sustaining growth in this evolving landscape. With thoughtful planning and technical precision, Weaver works with you to turn complex challenges into confident decisions. Whether you’re raising capital, forming strategic partnerships or preparing for a major transaction, we’re ready to help you move forward. Contact us.

©2025