2024 Q1 Accounting and SEC Update

Never miss a thing.

Sign up to receive our insights newsletter.

Weaver’s first quarterly Accounting and SEC Update of 2024 was a busy session that hit on key segment reporting and Effective Tax Rate calculation details before providing extensive information about the SEC’s final rules for climate-related disclosures, megatrends impacting risk assessments, and implementing Artificial Intelligence (AI) in the workplace.

Accounting Standards Updates Effective in 2024

ASU 2023-07 Segment Reporting – This update to the existing Topic 280 requirements primarily enhances disclosures around significant segment expenses and extends the requirements of ASC 280 to single segment entities. Information provided or available to the chief operating decision maker (CODM) is key to defining significant segment expenses and is integral to several other disclosures required in this update.

ASU 2023-07 is now effective for public entities with fiscal years beginning after December 15, 2023, with interim period requirements becoming effective after December 15, 2024.

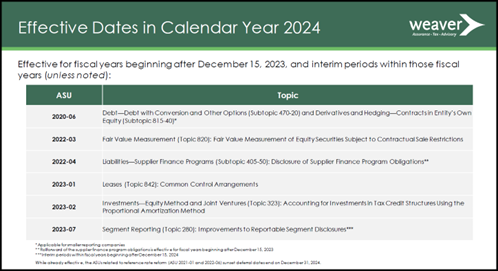

ASUs Effective in Calendar Year 2024 – Ensure that you become familiar with each of the following ASUs that affect your organization.

ASC 740

The FASB recently issued ASU 2023-09 — improvements to income tax disclosures — which requires new disclosures focused on rate reconciliations and income taxes paid. This update expands guidance and requirements for the tabular reconciliation of an entity’s reported tax expense (benefit) and effective tax rate, which must now present both percentages and reporting currency amounts.

We also discussed considerations for calculating the effective tax rate that will be used for interim periods. A FIN18-like approach is used to establish a consistent Effective Tax Rate (ETR) each quarter, preventing wild swings during interim periods which could be confusing to financial statements users.

Permanent book-to-tax adjustments such as meals and entertainment, transaction costs, fines and penalties, and Section 162(m) compensation deduction limitations are added back to pretax book income projections to arrive at an ETR for the interim fiscal periods.

Certain items impacting the ETR are accounted for discretely in the period in which the item occurs. Representative items that impact the tax rate discretely and outside of the “core” ETR include:

- Change in the Valuation Allowance

- Change in FIN48 Uncertain Tax Position Reserves

- Deferred tax balance adjustments

- Swings in equity compensation

- The impact of newly enacted tax laws or rates—when effective, not in the legislative phase.

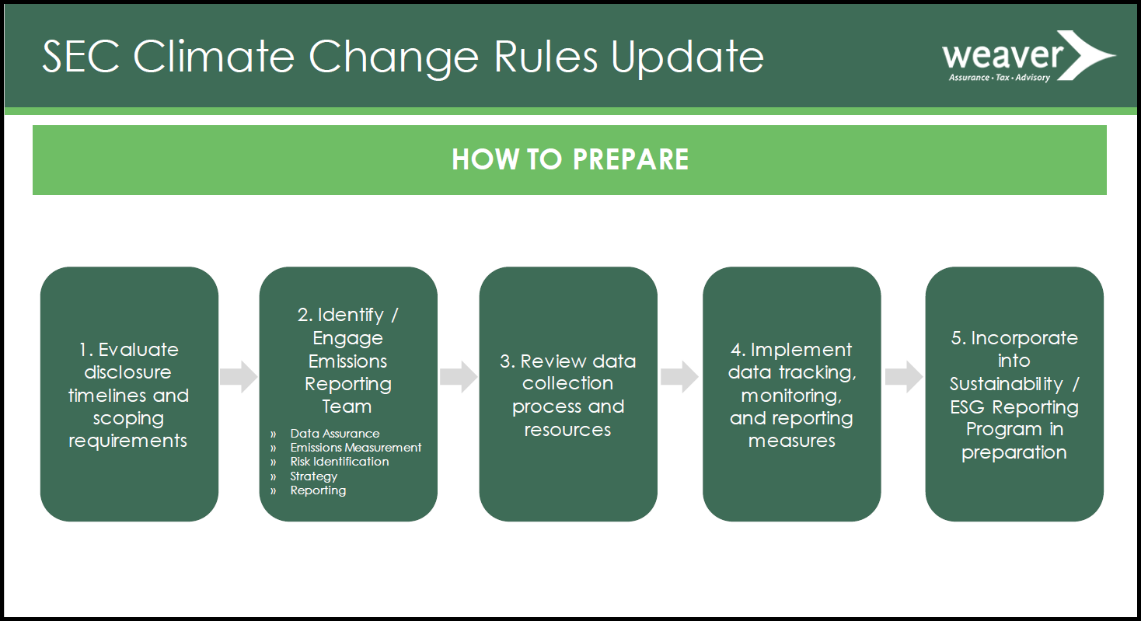

Climate Related Disclosure Final Rules

On March 6th, the Security and Exchange Commission (SEC) issued much-anticipated Final Rules on climate-related disclosures for public companies. The SEC reports that the agency received more than 24,000 comment letters since the proposed rules were introduced in March 2022. The final rules did not include the SEC’s proposed requirements for reporting supply chain greenhouse gas emissions (Scope 3), but those doing business in California and the European Union should be mindful of other legislation that contains similar requirements.

Formally titled as The Enhancement and Standardization of Climate-Related Disclosures for Investors, the final 885-page document provides more time than initially proposed to implement the disclosure and assurance requirements. However, given their extent and complexity, companies are advised to begin preparing for implementation as soon as possible.

Disclosures will be required to address:

- Climate-related risks with an actual or potential material impact to the strategy, business model, and/or outlook of the business

- Governance oversight by the board of directors and management’s role of risk assessment and risk mitigation as they pertain to climate-related risks

- The effects of weather events and natural conditions on the business and any changes in its projections

- Information about climate-related targets and goals and their effect on a registrant’s business, results of operations, and/or financial condition

- Descriptions of carbon offsets, renewable energy credits or certificates (RECs) and how the registrant plans to achieve their goals

- Any processes involved in identifying, assessing, and managing material climate-related risks and how the processes are integrated into the registrant’s overall risk management system or processes

Quantitative Reporting Requirements and Assurance

The SEC has provided a phased-approach for implementing the climate-related disclosures and their reporting requirements with varying compliance dates depending on filer status.

- Large accelerated filers (LAFs) have disclosure requirements beginning in Fiscal Year 2025.

- Accelerated filers (AFs), excluding Smaller Reporting Companies (SRCs) and Emerging Growth Companies (EGCs) have disclosure requirements beginning in Fiscal Year 2026.

- Non-accelerated filers, SRCs and EGCs have disclosure requirements beginning in Fiscal Year 2027.

LAF’s and AF’s (excluding SRCs and EGCs) will also be required to provide separate qualitative reporting on direct GHG emissions (Scope 1) and indirect GHG emissions from purchased electricity and other forms of energy (Scope 2) fin fiscal years 2026 and 2028, respectively. Materiality is considered, and qualified-provider attestation reports must accompany the disclosures.

Limited assurance reports are initially required for LAFs and Afs in fiscal years 2029 and 2031, respectively, and following a transition period, LAFs will require a reasonable assurance report beginning in fiscal year 2033.

Market Challenges and Opportunities That Impact Risk Assessments

The risk assessment should expand further than what your organization currently faces. By evaluating six market challenges and opportunities, the organization can take a proactive approach to identifying emerging risks and actions to mitigate.

- Improving the Customer Experience

- Leveraging Emerging Technology and Business Practices

- Preparing Your Future Workforce

- Legacy System Modernization

- Operating Budget Pressures

- Data Governance and Management

These market challenges and opportunities are interrelated. While you may have strategic plans in place, taking a proactive approach to the risk assessment may reveal gaps or weaknesses that should be explored to address potential risks.

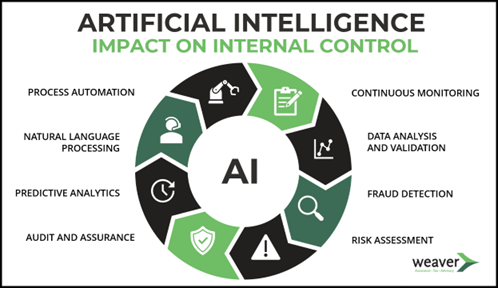

An excellent example of a risk evaluation is when a company introduces AI and machine learning to gain efficiencies or expand their operations. As expected, the introduction of new processes can often introduce new risks. Current staff may not have the skillsets required to match the new technology and financial resources may need to be reallocated to address that gap. Current policies may also not govern the way employees are able to use and leverage AI. Each of these areas must be addressed when updating a comprehensive risk management plan.

Using AI in the Workplace

Artificial intelligence (AI) continues to gain ground in the workplace and its impact on Internal Control over Financial Reporting (ICFR) is far reaching. From eliminating manual tasks to fraud detection to improving audit efficiency, the scope of possibilities is endless. Identifying patterns and anomalies is its strong suit but using natural language processing (NLP) extends its usefulness far beyond data and spreadsheets.

The plethora of benefits that AI offers may be enough to overcome any hesitance organizations have in adopting new technologies and implementing AI in a company’s operations. These potential benefits include:

- enhanced accuracy

- greater capacity for in-depth analysis to inform decision making

- strengthened control mechanisms and improved compliance

- reduction of manual tasks and other operational cost reductions

- generation of audit trails and logs

The challenges though, cannot be ignored. Model bias, data quality issues, lack of interpretability and potential cybersecurity threats each must be understood, evaluated, and addressed. Performing data cleansing, monitoring integration points, and enforcing strong data governance practices are activities that can offset and remediate the challenges of integrating AI into your business operations.

Implementing a full suite of AI and machine learning utilities can introduce companies to continuous ICFR monitoring in many business practice areas.

- Financial Transaction Monitoring

- Operational Process Monitoring

- Compliance Monitoring

- Data Quality Monitoring

- Controls Testing

A fortunate part of advancing an organization’s venture into AI is how various tasks, controls, and methods can be planned and phased in over time. These can help with both user adoption and cost control.

Next Steps

Weaver’s accounting and technology advisors offer companies several ways to learn more about architecting their paths forward during Weaver’s Quarterly Accounting and SEC Update webinars, within their podcast series, and in their Executive Resource Center. To discuss your unique circumstances, we encourage you to contact us directly to schedule a consultation.

©2024