ACA Marketplace Enrollment: FY 2026 Growth Impact on Valuations

Health Care Valuation Services

Never miss a thing.

Sign up to receive our insights newsletter.

Payor Mix Shift Risks for Health Care Valuation

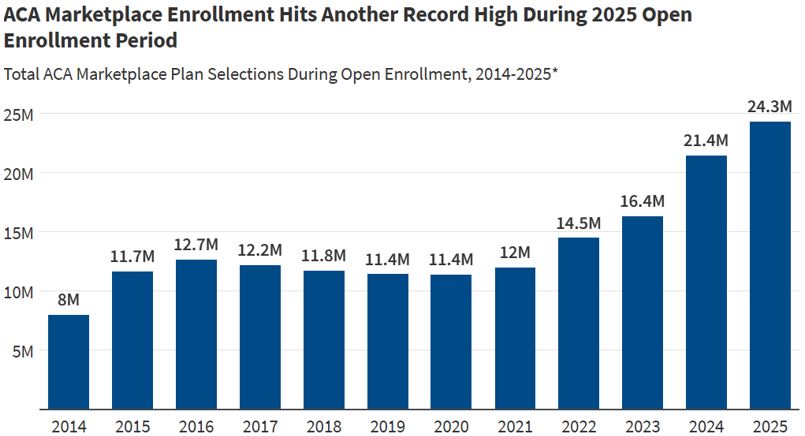

During the 2025 open enrollment period, a record 24.2 million consumers selected health coverage through the Affordable Care Act (ACA) marketplaces. This included 3.9 million new enrollees — more than double the enrollment compared to the 2021 record. The ongoing surge was largely due to enhanced premium tax credits under the Inflation Reduction Act (IRA) of 2022, which made coverage more affordable. In fact, in 2025, four out of five consumers found plans costing $10 or less per month.

Such expanding commercial enrollment levels have created a tailwind for providers. In addition to receiving higher reimbursement for services, providers have also benefited from higher demand due to increased patient access unlocked through the ACA marketplace.

By the Numbers

Source: KFF Analysis of Open Enrollment Reports

Based on the above chart from the Kaiser Family Foundation (KFF), the data shows:

- Since 2014, the first year of the exchanges, enrollment has tripled, from eight million in 2014 to 24.3 million in 2025.

- Enrollment growth accelerated since 2022, adding approximately 10 million enrollees in the last three years.

- In 2025 alone, enrollment jumped by approximately three million, or 15%, compared to the prior year.

Why It Matters — Increased Provider Profitability

- Growth in ACA enrollment increases the insured population, which typically boosts demand for health care services and improves revenue for providers.

- ACA health plans pay better than government payors. For example, for the first quarter 2025, HCA Healthcare Inc. reported that ACA patients made up 8% of volume, but these patients contributed 10% of revenue, indicating above-average reimbursement rates compared to an average blend inclusive of governmental payors.

Yes, But Potential Risks Are Ahead

- Prior ACA enrollment tailwinds could turn into headwinds for providers: The enhanced premium tax credits are scheduled to expire in 2026 without congressional action. Additionally, funding cuts to federal navigator programs and other legislative changes also inject uncertainty into outreach and enrollment continuity. Estimates suggest up to four million people could become uninsured, with subsidized marketplace enrollment declining by over seven million.

- Reductions to ACA enrollment could also impact insurance premiums: Losing younger and healthier (i.e., less expensive) enrollees from the marketplace can destabilize insurance risk pools, leading to higher costs or premiums for remaining enrollees. Higher costs or premiums may further discourage enrollment.

Health Care Valuation Takeaways

- For providers, historical ACA enrollment tailwinds may turn into headwinds starting next year without congressional action.

- Valuators should closely monitor legislative developments and payor mix changes to evaluate impacts on subject company revenue, profits and outlook.

- Despite possible disruption to the ACA marketplace, valuation should never be performed in a vacuum. The way management responds to external factors is just as crucial as the factors themselves in shaping outcomes.

As health care dynamics continue to evolve, valuation professionals should stay ahead by understanding how regulatory and payor mix shifts may shape future financial performance. To explore how these changes could impact your organization, contact us. We’re here to help.

©2025