Accounting for Divorce: Getting C.L.E.A.R. on Your Finances

Never miss a thing.

Sign up to receive our insights newsletter.

When a couple decides to divorce, each spouse can find themselves in a position where they need to make decisions about the largest financial transaction of their life at a time when the future looks uncertain. If not addressed thoroughly, questions about the financial elements of a separation can lead to long stalemates that lengthen an already long and demanding process.

While there are many things that can add to the cost of divorce, you can try to influence the length of the negotiation, mediation or litigation processes to keep costs low. There are certainly nonfinancial elements of the process that can extend the timeline, but having a plan to address finances preemptively is critical to ensuring that the division of assets does not cause delays.

The C.L.E.A.R. process is designed to help empower you to organize your data and priorities during what can typically be an overwhelming process. In five steps, you will be able to work through an evaluation of your current situation, an assessment of where you would like to be (given your current resources) and a structure for taking the next steps beyond the divorce negotiation into a new financial future.

Clarity

In the first part of this process, it’s important to identify your priorities related to property division, finances and children, if applicable. While you can rarely expect to get everything you want in a divorce negotiation, it’s important to understand your top priorities and how they align with those of your spouse. List out the top three to four things that you are hoping to achieve as an outcome from these discussions. If you have the insight to know your spouse’s priorities, this could help evaluate how your priorities align. While the children and physical property are not direct financial considerations, they are certainly attached to financial values, needs and desired outcomes. Understanding how financials map onto priorities early on will be instrumental in making sure that you don’t miss anything important.

List

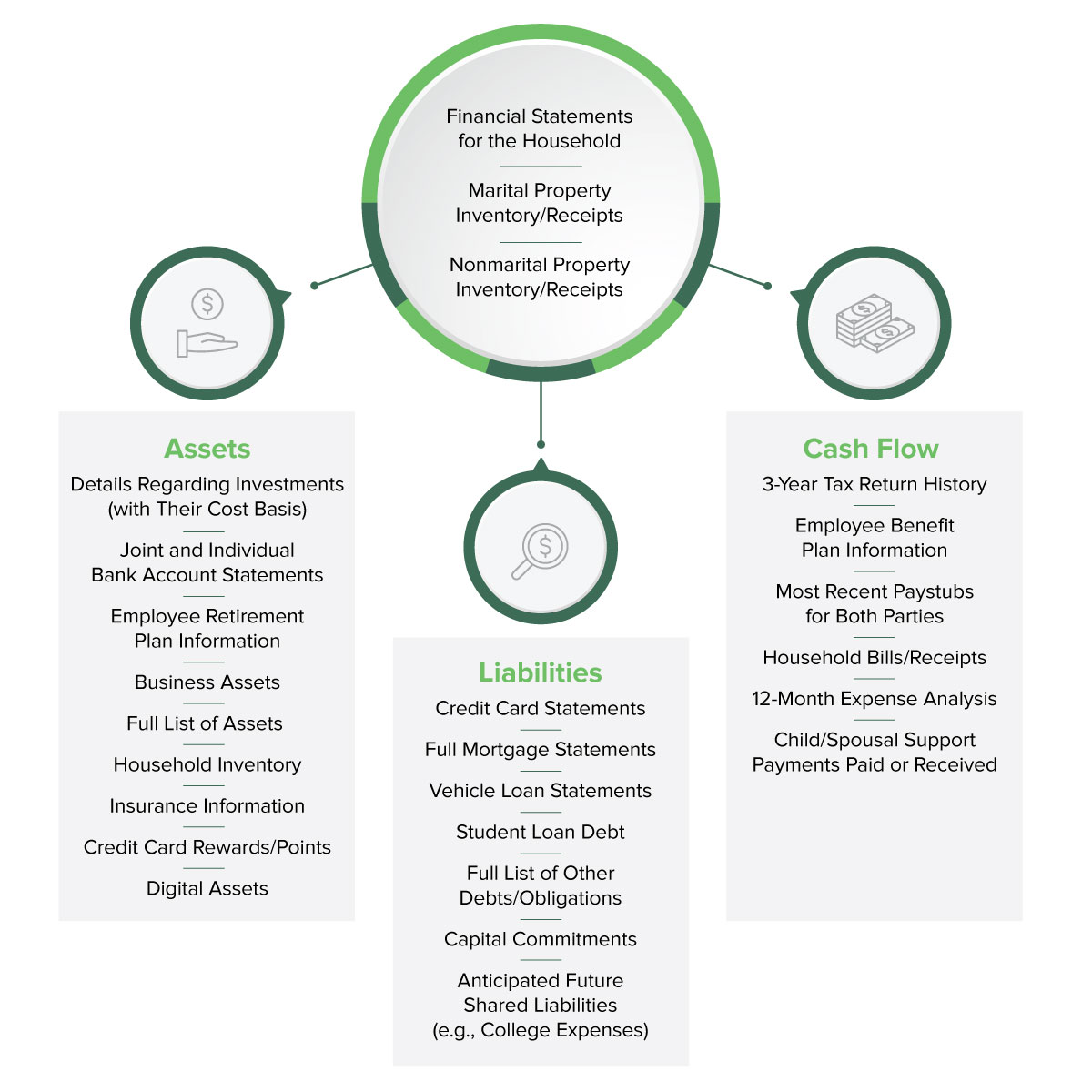

Organization is key. It’s daunting to answer questions about financial goals if you haven’t put together your full financial picture. The earlier you begin gathering relevant financial documents, the easier it will be to get things moving when your team is ready. A comprehensive list of assets and liabilities (both marital and nonmarital) will help your team ensure a fair and comprehensive outcome. Collect and keep all financial documents that will be relevant to the negotiation process in a single place. When you ensure everything is together, you will also know where to put something that surfaces at a later date.

Here is a list of documents to find or prepare, divided into three main categories, that feed into your overall financial statement. Keep in mind that some listed items may not seem financially relevant but could help you consider what contains value (e.g., household inventory or employee benefits). Identifying your assets will be instrumental in helping you determine which specialists to include on your team beyond your attorney or mediator and financial advisor (e.g., a divorce financial analyst, business appraiser, mortgage or real estate specialist, actuary, valuation specialist, insurance specialist, etc.).

Expenses

While expenses are a component of the previous stage of the C.L.E.A.R. process, they merit special attention because daily life after divorce is an immediate concern for both parties. Tying your expenses to the priorities established in the clarity stage of C.L.E.A.R. provides a better understanding of whether your goals are financially sustainable, considering their costs and your anticipated cash flow. Creating a budget or using a budget tracker can also be incredibly insightful. If you feel like a budget is worse than a trip to the dentist, this could be good area for you to expand or lean on your financial team. It’s an essential part of the process, and given the proper care and attention, can lead you to be more confident in determining what you want to get out of the negotiation process and what your future will look like.

Look at your expenses annually since there are several expenses that fluctuate throughout the year. Consider that taxes tend to be paid in surges (income taxes, property taxes, franchise taxes, etc.), and insurance is generally paid at less frequent intervals (annually, semiannually, etc.). Seeing an entire year of your expenses will allow you to not only know where your money has gone but also discover what to anticipate in the first full year of divorce. This insight will be valuable during the last stage in the C.L.E.A.R. process. In addition to understanding the cycle of cash flow throughout the year, remember to identify and separate between fixed and variable expenses to help make decisions about adjustments.

Action Items

If you’ve never been the type of person who creates a to-do list, now is a good time to start. In the first three phases of this process, you identified priorities, mapped assets/liabilities and determined your past and future expenses. In this phase, you need to assess what’s missing. What gaps still exist, and what homework items have you been given to help guide the process? Make this list as you go, and keep it updated to remain organized and timely in your delivery of information.

One example of a typical and important gap is the need to calculate or provide cost basis on taxable assets. Often, the division of assets split 50/50 turns out to cost real money for one party when the tax consequences are not appropriately addressed. If there are complex retirement accounts, it’s likely that you’ll have follow up items associated with the assessment of their value. This action items list will keep you organized and on track to obtain answers to questions that seek a fair outcome and will provide clear goals about what is needed in order to move forward.

Result

As you conclude the negotiation and move closer to the end of the divorce process, the final step in the C.L.E.A.R. process is designed to give you two things:

- The ability to make a fully informed decision about whether the agreement is inclusive of what you need

- The tools to analyze whether it’s worth the time, expense and heartache to renegotiate or go to trial

While your attorney or mediator can certainly offer their assessment, they are trained in the law and won’t necessarily have the financial experience to support intricate details like capital gains, tax issues or pensions. By fully leveraging this structure alongside your legal and financial team, you’ll be in a much stronger position to confidently decide on an agreement that is fair to both parties and meets your needs as you move to the next chapter in your life. Contact us today to discuss questions related to your financial situation.

Authored by Jullie Strippoli.

©2025

This material is for informational purposes and/or illustrative use only. The material presented does not constitute investment advice and is not intended as an endorsement of any specific investment. As is such, the information presented is not client-specific, we make adjustments in individual portfolios based on each client’s financial plan, income needs, risk tolerance and total asset allocation. The views expressed represent the opinion of Weaver Capital Advisors and are subject to change. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Weaver Capital Advisors believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. No warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information herein. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Weaver Capital Advisors view as of the time of these statements. Please check source material for more details. The information discussed is not intended to render tax or legal advice. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Consult your financial professional before making any investment decision. Investing involves risk including the potential loss of principal, and unless otherwise stated, are not guaranteed. Past performance does not guarantee future results. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Advisory Services offered through Sowell Management, a registered investment adviser.