All About Quality of Earnings Reports and How to Read Them

View all content.

Sign in or create a free account to view all Executive Resource Center content.

Log In Create AccountSuccessful M&A transactions are notoriously hard to execute, in large part because buyers and sellers generally do not come to the table with equal information. Many acquisitions fail due to buyer bias, incomplete or erroneous information, or a poorly executed diligence plan. Even strong financials that are complaint with GAAP can be manipulated and hide material inaccuracies or inconsistencies.

That is why a routine but important step in the M&A financial due diligence process is securing a Quality of Earnings (QofE) report. Prepared independently in connection with an anticipated merger, acquisition, or divestiture, a well-executed QofE answers specific questions about the sustainability of earnings and insights into the underlying economic performance of the business. Ultimately, it helps level any financial information differences between the buyer and seller.

A buy-side QofE helps minimize the seller’s informational advantage over the buyer regarding financial performance, accounting policy, and operations. Similarly, a sell-side QofE provides transparency and provides a seller more time and information to understand complex deal structures and helps to identify the best successor or go-forward partner.

A QofE report is often required by lenders or other stakeholders involved in the M&A transaction. Obtaining a Quality of Earnings analysis is comparable to obtaining a home inspection prior to closing on a house. After submitting an offer and going under contract, most buyers will seek a home inspection to ensure there are no water leaks, roof damage, foundational issues, electric system problems, etc. Similarly, buyers of a business will want to gain confidence in the financial information, understand key reporting metrics, and recognize any risks associated with the change of control prior to closing.

Most financial due diligence engagements will also assist the buyer or seller with other complex deal issues, such as estimating the normalized level of working capital needed to operate the business, net debt considerations, go-forward considerations, and other financial matters relating to the transaction.

How Is a QofE Different From an Audit?

An audit primarily focuses on evaluating a company’s financial reporting and compliance with accounting principles, using the balance sheet as the main source of the point-in-time review. An audit is not designed to assess the sustainability of earnings or the reliability of earnings on a go-forward basis.

A QofE gives a broader financial and operational view of the business, typically focusing on EBITDA and highlighting key financial metrics and trends in the business. A quality of earnings will delve into gross margin and performance metrics, sales and customer analyses, and other relevant data to provide insights into the underlying economic performance of the business and net working capital trends. While audits are focused on annual results, a QofE will emphasize monthly performance as buyers (and lenders) are particularly interested in the trailing twelve-month results. Further, a QofE is often used as the foundation to illustrate and project go-forward earnings post-transaction. A QofE may also contain pro-forma considerations of interest to a buyer.

Buy-side Due Diligence

Banks generally will require a QofE to secure financing. Buy-side due diligence helps provide confidence and clarity in the transaction and allows the buyer to better understand complex accounting assumptions, policies, and issues related to the business. The QofE report summarizes voluminous sets of complex data into a concise and digestible format and provides context for the buyer to better project forward-looking performance models or forecasts.

Buy-side due diligence can identify potential opportunities, such as eliminating excess costs, identifying unprofitable customers and business segments. It also can identify risks in a transaction, such as a change in accounting policy distorting financial results, customer concentrations, one-time revenues, inventory valuation methods, reversal of accruals resulting in income, customer collectability issues, and inappropriate capitalization on the balance sheet, among other issues.

Certain findings, including adjustments that reduce EBITDA, may reveal trends that do not warrant the current purchase price or valuation applied to the business. Ultimately, allowing the buyer to ensure purchase price is in line with expectations and, if not, provide the opportunity to renegotiate the deal on better terms.

Sell-side Due Diligence

Transactions are taxing on the seller and their accounting personnel. A sell-side QofE reduces deal fatigue and grants the seller more control over the transaction process. Overall, sell-side due diligence prepares and gives the seller more control over a quicker and more efficient transaction process. A sell-side QofE allows the seller to organize relevant financial information, gives the seller the ability to answer complex financial questions, and obtain support for the QofE in advance. It also allows the seller to identify any potential issues a buyer (and the buy-side QofE team) may uncover and proactively address them, eliminating any surprises that could disrupt a sale process.

A sell-side QofE allows the seller to better understand value drivers and help maximize transaction value. A buyer typically will not share adjustments that are favorable to the seller. It will also help reduce the number of buyer assumptions during the bid process, and allow for more precise and informed offers.

The Elements of a Quality of Earnings Report

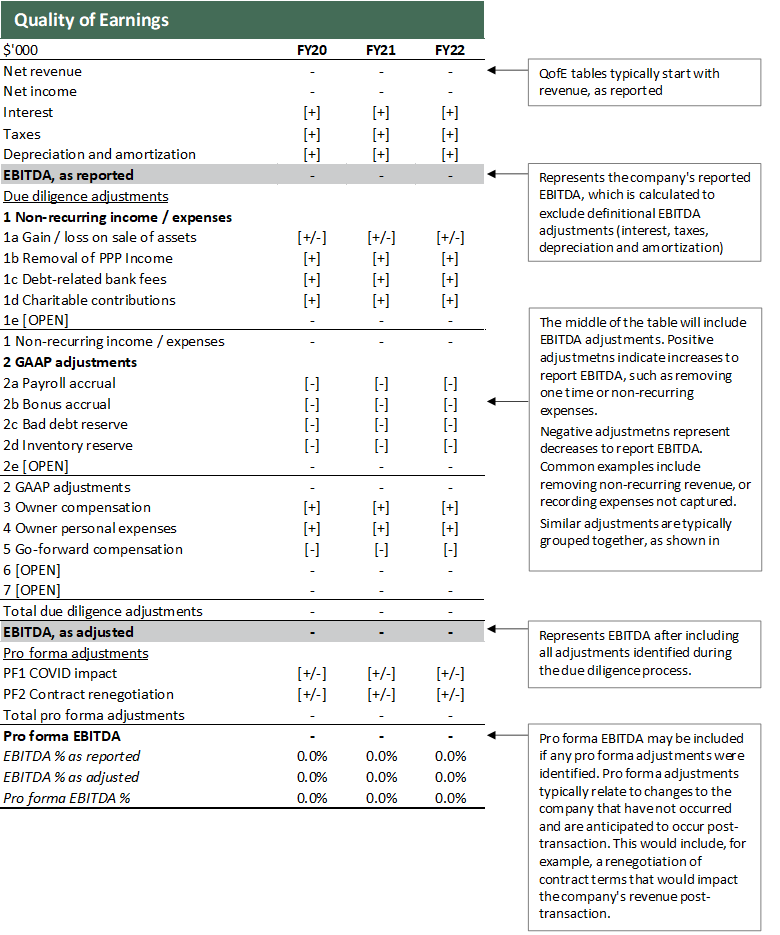

Every QofE report is different, but they include the same general categories, with information specific to the business and transaction. If you’re not in the business, you might not be familiar with the elements of a QofE report or how to read it.

Here are the key pieces you will find in almost every QofE report:

*Click to enlarge the image below.

For more information about these requirements, contact us. We are here to help.

©2023