Alternative Fee Arrangements Can Be a Way to Deduct Investment Management Fees

Never miss a thing.

Sign up to receive our insights newsletter.

The Tax Cuts and Jobs Act (TCJA) eliminated a significant tax benefit for investors that are charged investment fund management fees. Prior to the TCJA, investors could deduct investment fees as miscellaneous itemized deductions under IRC Section 67(a). The TCJA suspended Section 67(a) miscellaneous itemized deductions through 2025, meaning that investors are charged a fee for which there is no tax benefit.

Alternative fee arrangements, however, can help investors recover some of the earlier tax benefit. With a change in the character and type of investment fees, investors can avoid the TCJA limitations on miscellaneous itemized deductions and deduct the fees paid to fund managers. Fund managers can do this by trading asset management fees for property management fees or acquisition fees.

Property Management Fees

Expenses attributable to property held for the production of rental and royalty income are deductible in computing adjusted gross income under IRC 62(a)(4), and consequently escape the deduction disallowance under IRC 67(g) and the IRC 67(a) 2 percent floor limit under prior law. Under IRC 63(d), “itemized deductions” do not include any deductions “allowable in arriving at adjusted gross income,” and IRC 62(4) includes IRC 212 expenses attributable to rental and royalty property. Thus, ordinary and necessary expenses paid or incurred in the management, conservation or maintenance of a building devoted to rental purposes continue to be deductible even if that they do not actually produce income in the taxable year and regardless of how or why the property was acquired.

Consider this example: Fund A is a limited partner in PropCo, a lower tier entity. The assets of Fund A are its investment in PropCo, which directly owns income producing, commercial rental real estate buildings. The expenses that Fund A pays to PropCo for the management of its investment are classified as IRC 212 expenses and are not deductible by Fund A limited partners. However, the expenses paid by PropCo for the management of income producing rental real estate are allowable as ordinary and necessary deductions taken into account in determining rental income. The management fees paid by PropCo thus reduce the limited partner’s allocable share of rental income.

Acquisition Fees

IRC Section 263A requires expenses attributable to the acquisition of an asset to be capitalized into the cost basis of the asset. For depreciable assets, the acquisition fees are recoverable over time as depreciation. A real estate fund manager could forego an asset management fee and instead charge an acquisition fee on the purchase of each asset acquired by the fund. While there is a time value of money factor in recovering the acquisition fee as either depreciation or as an offset to a gain on sale, this arrangement provides a greater tax benefit to limited partners than if the fees were non-deductible asset management fees.

Here is another example with the same facts as above: Fund A is a limited partner in lower tier entity PropCo. The assets of Fund A are its investment in PropCo, which directly owns income producing, commercial rental real estate buildings. The expenses that Fund A pays to PropCo for the management of its investment are classified as IRC 212 expenses and are not deductible by Fund B limited partners.

The property acquisition fees that PropCo pays for the acquisition of its income producing rental real estate are capitalized to the cost basis of the property acquired. The acquisition fees increase its depreciation deductions and decrease taxable rental income. Any unrecovered basis in the assets is an offset to sales proceeds when the assets are disposed of, thus reducing taxable gain on sale. The net result is lower taxable income allocated to the limited partners.

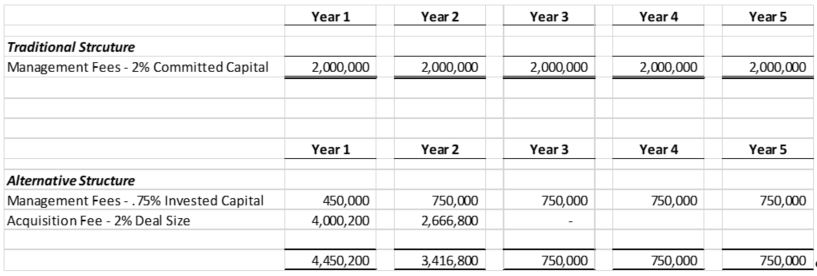

The use of acquisition fees also has a significant impact on cash flow. Consider a traditional fee structure wherein a fund manager is charging 2 percent on committed capital in a $100 million fund. Assuming a full deployment of capital from year one through year five, aggregate fees will be $10 million over five years.

Now consider an alternative structure with two streams of fee income. The fund manager charges a fee of 0.75 percent on invested capital and an acquisition fee of 2 percent per deal. For simplicity, assume 70 percent leverage and three investments in year one and two investments in year two.

Aggregate fees in the traditional structure are $10 million, but they are non-deductible. Aggregate fees in the alternative structure are just north of $10 million, but the $6.66 million of acquisition fees are capitalized and depreciable. The only downside for fund managers in the alternative structure is possibly choppy cash flow, but there is a significantly improved tax result for limited partners.

*Click to enlarge the image below.

With the prospect of additional tax reform is on the horizon in 2021, fund managers should consider not only the impacts of TJCA, but also look to other prospective changes in the Code in considering alternative fee structures.

For more information about alternative fee structures, contact us. We are here to help.

© 2021