Bracing for Change: Preparing for New Tax and Accounting Requirements in 2025

Never miss a thing.

Sign up to receive our insights newsletter.

In Weaver’s Accounting and SEC Update Q4 2024 webinar, we discussed proposed changes to the 2017 Tax Cuts and Jobs Act (TCJA), corporate tax rates and energy credits, as well as upcoming changes to required income tax disclosures. We provided details about several accounting standards updates (ASUs), including new requirements for enhanced segment reporting under ASC 280 and more detailed expenditure reporting for ASC 740. The discussion wrapped up with tips for completing year-end impairment of financial assets.

Post-Election Tax Updates

2017 Tax Cuts and Jobs Act: Certain provisions of the TCJA are scheduled to be phased out over the next year. The status of and proposed legislation to address key elements are as follows:

- Bonus depreciation: The phase-out schedule remains intact, declining from 60% in 2024 to zero by 2027. Proposed changes would reinstate 100% bonus depreciation.

- Interest expense limitation: Current law limits deductions to 30% of earnings before interest and tax (EBIT). Proposed changes would shift this to EBITDA, which includes an addback for depreciation and amortization, offering a higher limit for interest expense.

- R&D expenditures: Current law retains a 60-month amortization period for expenditures. Proposed changes would allow immediate expensing of eligible expenditures. (This is a big one!)

- Employer-provided meals:100% deductibility of employer-provided meals will be eliminated, and there will be no deduction for employer-provided meals effective January 1, 2026.

Corporate Tax Rates

Under current law, regular corporate tax rates are 21%, with the GILTI tax on foreign income ranging from 10.5% to 13.125%. The alternative minimum tax is applicable to corporations with revenues of $1 billion. Under the incoming administration, manufacturers may see a domestic production credit resulting in an effective corporate tax rate of 15%. To achieve any broad decrease in corporate tax rates, however, Congress would likely need to approve increases in individual tax rates, which is unlikely because it would not be politically popular.

Energy Credits

To raise revenue and offset the cost of new tax credits and other initiatives, current proposals include eliminating tax credits that were created under the Inflation Reduction Act. Affected credits could include:

- Clean hydrogen

- Carbon dioxide

- Electric vehicle credits: up to $7,500 (with AGI limits)

- Energy efficient home improvement credit: 30% of cost up to $1,200

- Residential clean energy credit: 30% of cost

- Home building credit: Section 45L up to $5,000

- Commercial energy credit — Section 179D: up to $1/square foot

Tax Year-End Reminders

For calendar year-end companies, here’s a list of essential tax provision tasks to include on your tax year-end checklist:

- Review/book any provision to return adjustments

- Assess tax attributes: NOLs, credits (R&D, FTC, etc.) and valuation allowances

- Evaluate significant transactions, such as M&A activity, intercompany transactions or restructuring

- Consider such international tax issues as confirming the filing of prior year local country returns and reviewing transfer pricing

- Conduct a deferred tax analysis. Consider any impact of legislative changes and update effective tax rates for any current and future state tax rate changes

- Conduct a tax reserve analysis of FIN 48/uncertain tax positions

- Continue or initiate 2025 tax planning

New Accounting Requirements

Even with so much political uncertainty related to taxes, certain accounting updates remain firm in their implementation timelines. Several of these new accounting requirements reflect efforts by the Financial Accounting Standards Board (FASB) to improve transparency in financial reporting by requiring deeper dives in areas of interest to investors. If you haven’t already begun preparing for these updates, now is a good time to get started.

ASU 2023-07: Improvements to Reportable Segment Disclosures

In issuing ASU 2023-07 in November 2023, the FASB explained that “investors, lenders, creditors, and other allocators of capital (collectively investors) have observed that segment information is critically important to understanding a public entity’s different business activities. That information enables investors to better understand an entity’s overall performance and assists in assessing potential future cash flows.”

ASU 2023-07 is effective for annual reporting periods for years ending after December 15, 2024, and interim periods thereafter. As background, the Accounting and SEC Update, Q4 2024 webinar includes an overview of the existing segment framework under ASC 280, Segment Disclosures.

Disclosure Requirements

ASU 2023-07 clarifies that existing requirements of ASC 280 as well as disclosure requirements in ASU 2023-07 apply to all public business entities, including those with only a single reportable segment.

The new requirements include disclosures of:

- Significant segment expenses

- The title and position of the Chief Operating Decision Maker (CODM), who is the individual(s) responsible for evaluating operating results, assessing performance, and allocating resources

- The way the CODM uses the reported measures

The requirements also allow multiple measures of segment profit or losses to be presented.

“Significant segment expenses” are those that are significant to the segment, regularly provided to or easily computed from information regularly provided to the CODM.

Included in the reported measure of segment profits or losses. “significant” is not defined, but qualitative and quantitative factors are considered significant if their omission would change an investor’s understanding of the segment results to a degree that would change the investor's decisions. What qualifies as a significant segment expense may vary for different segments.

Disclosure of “Other” Segment Items

For each reportable segment, a company must disclose the aggregate amount and description of other segment items not separately reported. Put simply, other segment items represent the variance needed to reconcile reported segment revenues to reported segment profit or loss.

Other Disclosure Considerations: Non-GAAP

Since the required segment measure of profit and losses must be disclosed, typical non-GAAP requirements may not apply. For example, if the CODM uses segment EBITDA as the only primary metric (i.e., the required metric), then it is not considered "non-GAAP." If a CODM uses multiple measures, the one that is most consistent with the amounts included in the financial statements must be presented. However, companies should be aware that presentation of total EBITDA outside of the required segment reconciliation would still be considered non-GAA.

In December 2023, SEC commentary presented at an AICPA/CIMA conference clarified that if multiple measures of segment profit or loss are used and disclosed, the additional measures disclosed would be considered non-GAAP, if not calculated in accordance with GAAP. This is because multiple measures are allowed, but they are not required to be disclosed. The SEC also commented that for companies with a single reporting segment, the required profit and loss metric is still expected to be net income/loss.

Segment reporting can be very complex, subjective and require detailed analysis. It should be clearly documented and supported.

ASU 2023-09: Improvements to Income Tax Disclosures

Another change aimed at improving transparency for investors and others requires more detailed expenditure reporting for ASC 740. Currently, items that meet or exceed a 5% threshold of taxes paid net of refunds received are reported as a single amount. ASU 2023-09, which will be effective for public entities with calendar year ends in 2025 and all other entities in 2026, requires that these items be broken down and reported in one of eight expenditure categories.

Even though public companies will not need to conform to the new system until next year, it’s a good idea to start planning for implementation of the update now.

The FASB sought to minimize the burden on entities with the use of existing data for tax provision calculations or detailed tax payment records, ensuring compliance without introducing significant operational hurdles. However, the new system will require judgment in determining which costs to apply to each category. Implementing the new system may also involve adjustments in technology or other systems.

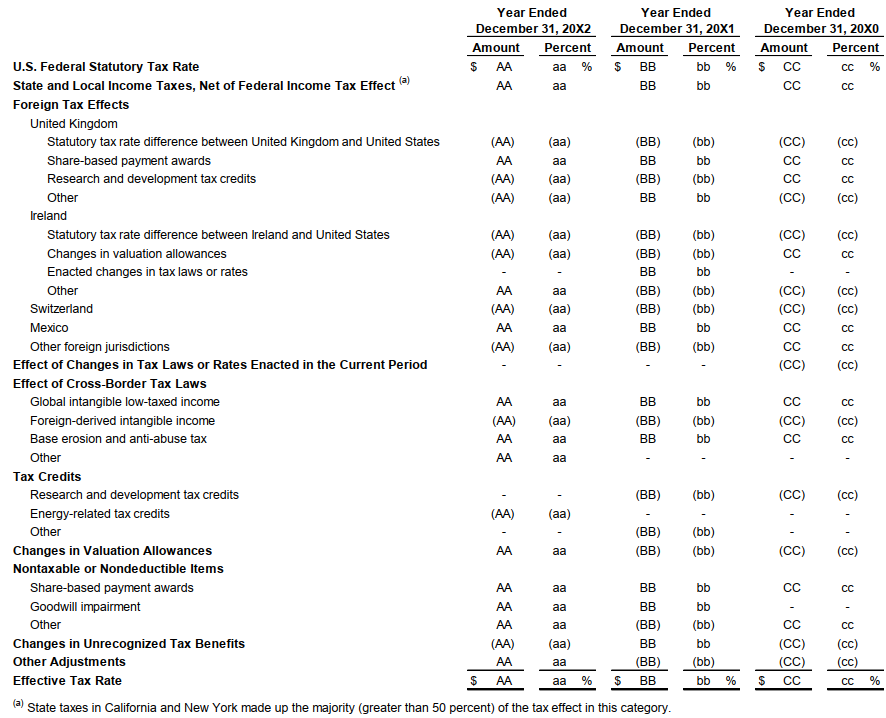

Rate Reconciliation

Requires a tabular reconciliation by percentage and amount, with qualitative explanations for significant reconciling items. Entities must explain the nature, effect and underlying cause of these items. For reconciling items exceeding 5% of pre-tax income multiplied by the statutory tax rate, separate disclosure is required. Specific categories of material items will be:

- State and local income tax, net of federal/national income tax benefit

- Foreign tax effects

- Effect of changes in tax laws or rates enacted in the current period

- Effect of cross-border tax laws

- Tax credits

- Changes in valuation allowances

- Nontaxable or nondeductible items

- Changes in unrecognized tax benefits

For example….

This is a hypothetical illustration of a financial report by a public business entity domiciled in the United States and doing business in Ireland, Mexico, Switzerland, and United Kingdom. The entity presents comparative financial statements. The quantitative threshold is met for the U.K. and Ireland. Both jurisdictions have an effect greater than or equal to $15,750: 5% x ($1.5 million pre-tax income x 21% applicable statutory rate).

Other Upcoming ASUs

Don’t overlook these ASUs scheduled for implementation in the coming year:

- ASU 2023-07: Expanded Segment information effective for interim periods

- ASU 2023-05: Eliminate diversity in practice regarding measurement of assets contributed and liabilities assumed in forming a joint venture. A new basis of accounting at fair value should be used upon formation.

- ASU 2023-08: Definition of crypto assets are clarified and requires measurement of such assets at fair value at each reporting date with changes recognized in net income each reporting period.

- ASU 2023-09: Improvements to income tax disclosures including enhanced rate reconciliations and other matters.

- ASU 2020-11 and related ASUs: For SRCs, ASUs related to long-duration contract issued by insurance companies.

Impairment of Non-Financial Assets

Here are some helpful reminders related to the impairment of non-financial assets. The focus is on impairment of assets that are held and used. Assets held for sale or presented as discontinued operations are evaluated under a different framework.

| Accounting for Goodwill (ASC 350-20) |

Accounting for Intangibles (ASC 350-30) | ||

|---|---|---|---|

| Definite Lived | Indefinite Lived | ||

| Unit of Account | Goodwill is tested for impairment at the reporting unit level | Asset group: A group of assets and liabilities with identifiable cash flows that are largely independent | Generally, consists of single asset, but may be a group of assets in limited instances |

| Timing | Goodwill is tested for impairment annually, or between annual tests if an impairment indicator exists (i.e., a triggering event) Optional qualitative analysis |

Whenever events or circumstances indicate that the carrying amount of the asset (or asset group) may not be recoverable | Tested for impairment at least annually and more frequently if triggering event Optional qualitative analysis If it is more likely than not that the asset is impaired, the entity would be required to perform a quantitative test |

| Measurement and Recognition | If the carrying amount of a reporting unit exceeds its fair value, an impairment loss is recognized in that amount (one-step test replaced historic two-step model with ASU 2017-04 | Step 1: Recoverability – undiscounted cash flows Step 2: An impairment loss is recognized if the carrying amount of the asset or the asset group exceeds its fair value |

If the carrying amount of the asset (or group) exceeds its fair value, an impairment loss representing the excess is recorded |

Impairment Considerations

Goodwill and indefinite lived intangible assets are tested for impairment annually, or between annual tests if an impairment indicator exists (i.e., a triggering event). Definite lived intangible assets are tested for impairment whenever events or circumstances indicate that the carrying amount of the asset group may not be recoverable. When evaluating for impairment, sequencing matters and is based on the nature of the assets as follows:

- Other assets in the reporting unit (i.e. AR, Inventory)

- Indefinite-lived intangible assets

- Long-lived assets

- Goodwill

It is important to clearly identify reporting units and how assets are grouped in assessing for impairment. An asset group represents the lowest level for which identifiable cash flows are largely independent.

Long-lived Assets: Indicators of Impairment

Long-lived assets that are held and used may be impaired if one or more of the following triggering events have occurred:

- Decrease in market price of comparable assets

- Change in extent or manner in which it is used

- Change in legal factors, regulatory or business climate

- Accumulation of costs in excess of original expectations from an acquisition or construction

- Deteriorating financial conditions (e.g., operating cash losses, etc.)

- Expectation that, more likely than not, it will be sold or otherwise disposed of significantly before its previously estimated useful life.

Intangible Assets: Qualitative Assessment

For goodwill and indefinite lived intangible assets, a qualitative assessment is optional. If performed, it is determined based on whether it is more likely than not (that is, a likelihood of more than 50%) that the fair value of a reporting unit is less than it's carrying amount, including goodwill. ASC 350-20-35-3C and ASC 350-20-30-18B, respectively, provide events and circumstances for consideration.

Goodwill Impairment: Quantitative Assessment

Here are details to consider in conducting a quantitative assessment:

| Carrying Value | Fair Value | Consider Income Tax (ASC 740) Matters | Internal Controls Are Critical, and Often Challenging, to Document for Estimates | |||

|---|---|---|---|---|---|---|

| • Allocating to reporting units – consider corporate assets and intercompany

• May require subjectivity at times, but consistency is key |

• Based on market participant concept • Market Capitalization reconciliation • Discounted cash flow models are most common |

• Deferred tax assets / liabilities allocated to reporting units • Evaluate impacts of taxable vs. non-taxable goodwill |

• Identify and document rationale and considerations for key inputs (e.g., projections, cost of capital, peer groups, etc.) • Review of specialist work, including completeness and accuracy of information provided |

Goodwill Disclosures

There are many disclosures required in the notes to the financial statements as well as MD&A related to goodwill. Broadly, disclosures in MD&A are expected to be more detailed than those in the notes to the financial statements. For example, within the critical accounting estimates section, a company would disclose the method(s) used to measure fair value as well as the key assumptions used. Sensitivities may also be included. If multiple methods were used, weighting between the two should also be included.

Within the footnotes to the financial statements, a roll forward of changes in goodwill year over year is required. The roll forward should include activity such as additions due to recent acquisitions or purchase accounting adjustments, impairment and foreign currency effects, among others. Other disclosures include the existence of reporting units with negative carrying value and potential future impairment.

Next Steps

Weaver’s accounting and tax advisors offer companies several ways to sharpen their focus on upcoming accounting and tax regulations during Weaver’s Quarterly Accounting and SEC Update webinars, within their podcast series, and in their Executive Resource Center. To discuss your unique circumstances, we encourage you to contact us directly to schedule a consultation.

Authored by Phil Ilgenstein, Sean Muller and Steffanie Crump

©2025