Dallas Fed’s Quarterly Energy Report: Energy Company Outlooks Remain Unchanged

Never miss a thing.

Sign up to receive our insights newsletter.

The Dallas Fed released its Third Quarter Energy Survey on September 23, 2020. The survey, which was conducted September 9 – 17, 2020, is designed to obtain a timely assessment of energy activity among oil and gas firms located or headquartered in the Fed’s Eleventh District, covering the Midwestern region. This quarter, 166 energy companies responded to the survey; about two-thirds represented exploration and production (E&P) firms and one-third represented oilfield services companies.

Special questions this quarter focused on the role of OPEC in determining oil prices, if U.S. oil production has reached its peak, what the primary goals for upstream companies are in the next six months and what price range would trigger companies to restart exploration and development activities.

Overall. While nearly all of the indexes across E&P and oilfield services companies increased, most remained in a negative position, indicating that contraction in the industry continues, albeit at a slower pace. Based on the survey, overall company outlooks have stayed the same from last quarter with little to no improvement.

Oilfield service companies continue to feel the impact of worsening conditions and lessoned development activity in the field. Equipment utilization indexes show slower but continued declines. Due to lower input prices, oilfield service companies are seeing some relief in their operating margins.

Labor. Employment, employee hours worked, and aggregate wages and benefits indexes continue to decline, but not as significantly as last quarter. These declines may indicate the availability of talent at good rates. Some respondents commented about difficulties in recruiting due to the high uncertainty of the industry.

Goals. The survey asked what the primary goal of upstream companies was for the next six months, and responses varied widely. The top four goals, which represent 67% of respondents, include maintaining production, growing production, reducing debt, and finding additional sources of capital. A similar question was asked in 2018 and the top two goals, representing 59%, were to grow production and acquire assets.

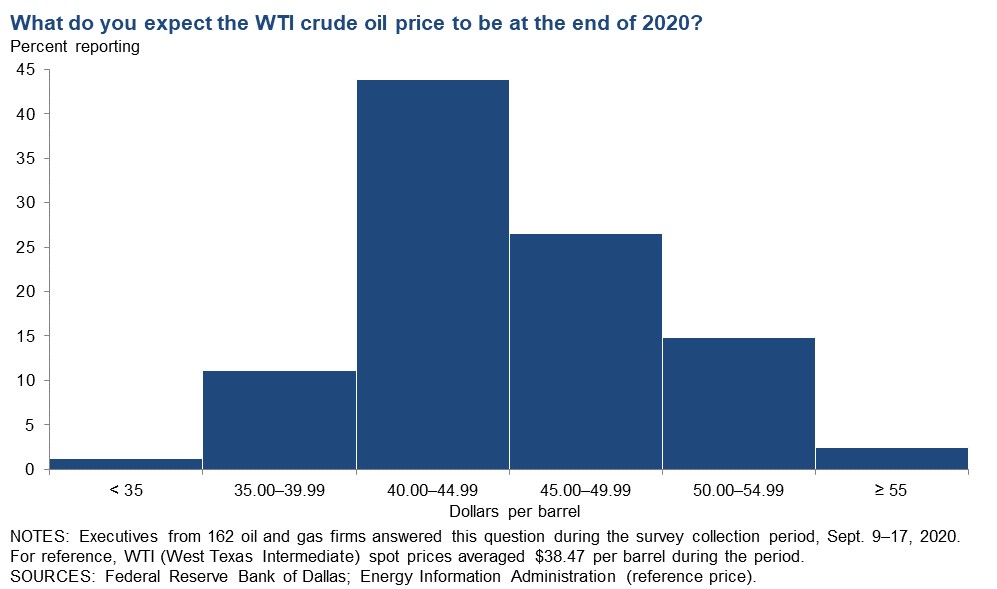

Price Forecasts. As shown in the chart below, 44% of respondents believe WTI Oil price will be within $40 – $45 by the end of the year compared to 35% last quarter. Only 12% of respondents believe prices will be below $40. Almost three-quarters of respondents believe that OPEC will play a big role in determining future oil prices.

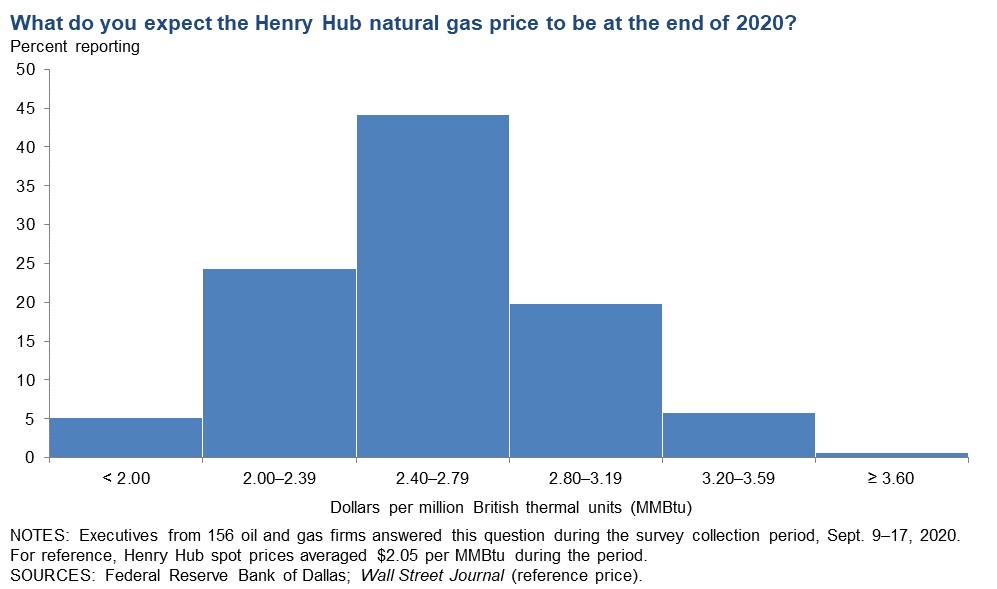

As shown in the chart below, 44% believe Henry Hub Natural Gas price will be within the range of $2.40-$2.79 by the end of the year, compared to the average expectation of $2.15 last quarter.

As shown in the chart below, 44% believe Henry Hub Natural Gas price will be within the range of $2.40-$2.79 by the end of the year, compared to the average expectation of $2.15 last quarter.

When We Will See Increased Activity. If oil prices are within the $40 – $45 range, only 1% of respondents believe U.S oil rig counts will substantially increase and 43% believe it would take a price increase to $51 – $55 in order see the uptick in rig counts. However, if prices are within the $40 – $45 range, 18% of respondents expect companies to complete wells that had previously been drilled but not completed, seeing an increase in completion rig counts.

The Dallas Fed’s next quarterly energy survey will be released December 30, 2020. Watch Weaver.com for information on the new survey in December. For questions or more information, contact us.

©2020