Health Care Valuations in this Time of Uncertainty

Never miss a thing.

Sign up to receive our insights newsletter.

Given the speed and breadth at which the novel coronavirus (COVID-19) has already spread, it’s reasonable to expect an impact on valuations. How drastically different the impact will be depends on various reasons, which we’ll look at through the lenses of the Income and Market Approaches used to value healthcare businesses.

But first, let’s note some macro factors that will come into play as the pandemic develops:

Bad news first:

- People are ill and lives are negatively impacted

- Consumer spending is negatively impacted

- Supply chains are threatened

- Geo-political tensions are magnifying

- Equity markets have plummeted in Q1 2020

- Costs, reimbursement and capacity for the pandemic care are wildly uncertain

News with good intentions:

- Interest rate cuts by the Fed

- 0% payroll taxes

- Delayed tax filings and SEC reporting

- Large employers providing sick leave and benefits to those affected

- U.S. Small Business Administration is funded to assist those affected

- Demand for healthcare services will be high

- No copays for testing

- Underlying economic fundamentals are strong

Income Approach Implications

The Income Approach values a company based on the present value of future cash flows using a market-based, risk-adjusted discount rate. Typically, the value is derived from a discrete forecast such as the next five years plus a terminal period value, and commonly each of these comprises roughly half of the total value.

From a cash flow perspective, certain healthcare providers, such as acute-care hospitals and primary care offices, are positioned to benefit from increased utilization and reduction in certain expenses. However, cash flows of other healthcare providers that are more elective in nature or are generally not diversified, are facing damage driven by lower utilization in the current down economy.

As difficult as it will be for providers to predict cash flows over the next 12 months, it’s very likely results will look very different from a 2020 pre-pandemic forecast. An important exercise for any company right now is to take a close look at budgets, working capital and capital expenditure requirements, especially in the context of cash flows for valuation. The reason is: the better the future cash flows are in concert with the market-based, risk-adjusted discount rate, the more accurate the valuation will be.

If explicit cash flow adjustments are required due to COVID-19, the Income Approach provides plenty of runway to forecast a return to normal steady state growth by the end of the discrete period and into perpetuity.

As for the discount rate, or weighted average cost of capital (WACC), expect some slight changes among time periods pre/post-pandemic based just on the raw market data used in a capital asset pricing model and WACC. For example, the market risk adjusted for the industry will include higher volatility of the equity markets, which will be somewhat offset by a lower risk-free rate after March 3, 2020. The adjustment for specific company risk is where you could see more variations in WACCs as providers could warrant lower or higher risks that come to light due to the pandemic. Examples of specific company risk factors in the context of the coronavirus are:

|

Increase Risk |

Decrease Risk |

|

Unfavorable shifts in service mix and utilization |

Favorable shifts in service mix and utilization |

|

Unfavorable impacts on physician / provider / clinical workforce |

Limited impacts on physician / provider / clinical workforce |

|

Supply chain disruption |

Easing of regulations such as pharmacy and telehealth authority |

|

Unfavorable local economic conditions (e.g. material layoffs in the service area) |

Favorable local economic conditions (e.g. employers provide emergency benefits) |

|

Unfavorable average age of workforce |

Favorable average age of workforce |

|

Unfavorable payor mix for coronavirus care |

Favorable payor mix for coronavirus care |

It is important to note that these risks are specific to this pandemic and do not necessarily reflect past or future ongoing risks. Therefore, adjustments for these risks should be considered carefully based on the facts and circumstances of the subject entity.

At this point in the pandemic, Income Approach healthcare valuations do stand to look different due to impacts on cash flows and specific company risks in the near-term, discrete forecast. Beyond that horizon in the terminal period, we expect valuations to reflect a return to normal.

Market Approach Implications

The Market Approach to valuation applies multiples derived from methods known as the guideline public company and mergers & acquisitions (private companies) to financial results of the subject business. A benefit of the guideline public company method is that it’s real time while the mergers & acquisitions is lagging. Commonly used multiples in healthcare are enterprise value / EBITDA and enterprise value / revenue. We will look at how the pandemic is impacting valuations through both methods.

Guideline public companies:

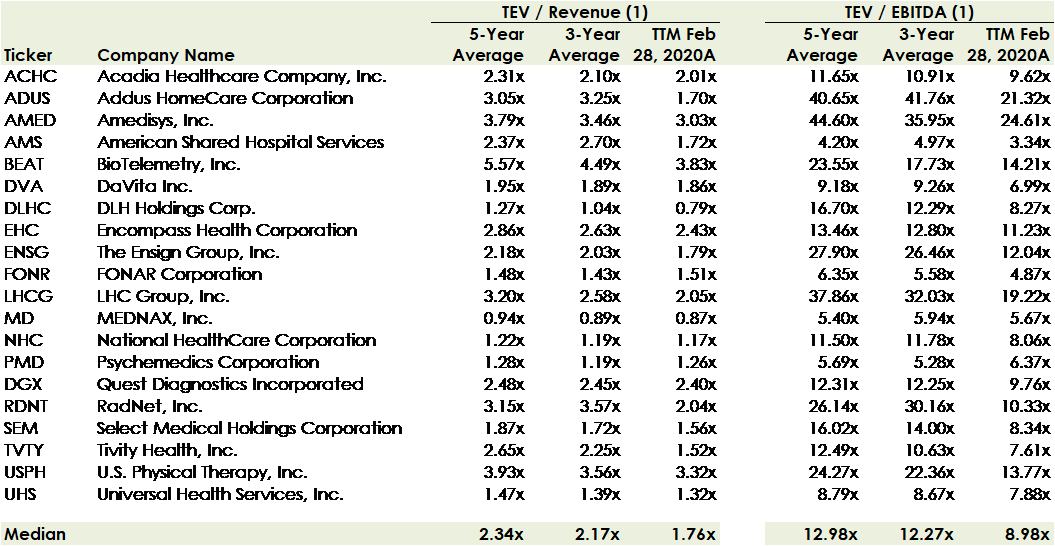

Many analysts attribute the historic Q1 2020 declines in the equity markets directly to COVID-19. Specifically looking at a composite of 20 financially stable public healthcare companies, it is clear that valuations and multiples have decreased materially. Presumably, the current indications include the market’s risk appetite for these types of securities. During a crisis situation, the data will be skewed when compared to normal trends and business cycles. We may not have a clear picture of the impacts due to delayed earnings. Therefore, while the lower point-in-time multiples provide evidence of market sentiment and a reasonableness check to the Income Approach, ideally they would be adjusted based on specific risks of a subject business. Forward multiples can also serve as indicators of a more normal market prior to this coronavirus.

1) Data per S&P Capital IQ as of February 28, 2020. Business enterprise value includes market capitalization of common equity, preferred equity, and debt, less the cash on the balance sheet.

Mergers and acquisitions:

We research private healthcare transaction multiples from sources such as Irving Levin & Associates, DealStats, Pitchbook, and Capital IQ. However, at this point in the pandemic, it would be difficult to identify its impact on multiple trends, simply due to the short time frame and few data points. It has been noted that healthcare transaction volume has been down, aside from the healthcare technology sector which is getting strong interest.

This valuation method is still appropriate during this health crisis, but again it may best serve as a sanity check once specific risks and timing are taken into consideration.

Fair market value consideration:

A key characteristic of Fair Market Value is a willing buyer and willing seller. When valuations are temporarily depressed as they are now, there very well may not be a willing seller. This provides a boundary to prevent over-steering toward lower values based solely on negative market data.

While the unprecedented events around COVID-19 have rocked financial markets and created many questions about how the healthcare industry will be impacted, history shows that pandemics don’t last forever. At this point-in-time, valuations may look different. But we can take comfort in knowing that the approaches and methods, when applied appropriately in practice, will reflect a reasonable level of normalcy – the place we hope to get back to soon.

For more information or questions on how you or your company could be affected, please visit weaver.com

Authored by Adam Portacci, ABV, CVA.