IRS Form 6765 Changes Could Create Additional Reporting Headaches for Taxpayers

Never miss a thing.

Sign up to receive our Tax News Brief newsletter.

The Internal Revenue Service (IRS) has released changes to certain sections of Form 6765, Credit for Increasing Research Activities, IR-2024-171. The new form will be implemented in taxpayer’s 2024 income tax returns (e.g., for a fiscal year ending on March 31, the change will apply to fiscal year April 1, 2024, to March 31, 2025, reported on the 2024 income tax return). These changes do not change the calculation method of the credit, but increase the disclosures required to file for a Research Tax Credit.

It is essential for taxpayers to familiarize themselves with these upcoming changes and to understand the implications for their tax reporting process. The IRS revised Sections A and B and introduced Sections E and G.

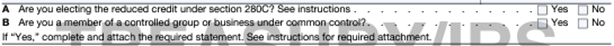

Revised Sections A and B: Claiming the Reduced Credit and Identification of Controlled Group

IRS has moved two questions related to the “reduced credit” election and controlled group members to the top of Form 6765.

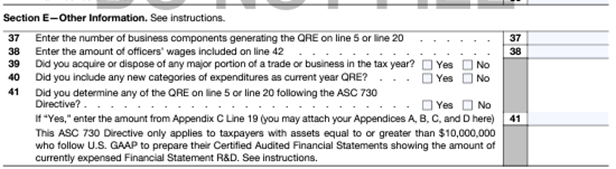

New Section E – Reporting Miscellaneous Information

IRS has added Section E that requests the following additional information:

- The number of business components generating the credit

- The amount of officers’ wages

- Whether the taxpayer acquired or disposed of any major portion of a trade or business

- Whether the taxpayer identified any new categories of expenditures

- Whether the taxpayer determined any of the Qualified Research Expenses (“QREs”) on line 5 or line 20 in accordance with the ASC 730 Directive; and identification of amount calculated using this methodology

- Additionally, ASC 730 directive applies ONLY to taxpayers with assets equal to or greater than $10,000,000 who follow US GAAP to prepare Certified Audited Financial Statements shown in the amount of currently expensed Financial Statements

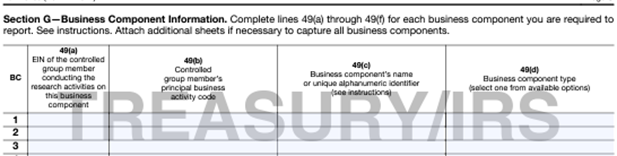

New Section G – Reporting Quantitative and Qualitative Information

In response to comments received regarding the initial draft Form 6765 released in September 2023, the revised form now includes Section G, which was previously Section F, pertaining to Business Component Information.

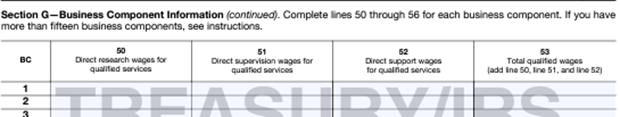

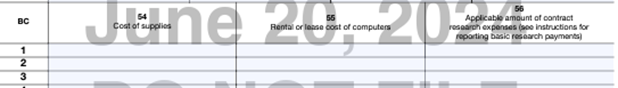

Section G requests quantitative and qualitative information for each business component. Questions on Lines 49 through 56 must be completed for each business component being claimed. However, the IRS did reduce the number of business components that are required to be reported to 80% of the QREs claimed and up to a maximum of 50 Business Components, with special instructions for taxpayers using the ASC 730 directive who can report ASC 730 QREs as a single line item on Section G.

The information being sought is very similar to the information the IRS requests for amended Research Tax Credit claims for refunds. For example, taxpayers will be required to identify each business component by company, identify the business component type and specifically identify whether the business component relates to software development. If so, to specify whether it is internal use, dual function or non-internal use software and describe the information sought to be discovered. Finally, Section G will require all claimed QREs to be separately identified by wages, supplies, rental/lease cost of computers and contract research expenses by business component. The wages detail will include a breakdown of qualified wages claimed as direct research, direct supervision and direct support.

Section G would not affect the requirement to maintain books and records and to provide Section G information in similar format upon requests. It would also not apply to amended returns for the research credit claims prior to the filing date.

Section G is optional for all taxpayers in tax year 2024. However, it is mandatory for tax year 2025 unless taxpayers are a qualified small business defined under IRC section 41(h)(1), that elect a reduced payroll-tax offset or taxpayers with QREs below $1.5 million, determined at the controlled group level and gross receipts of $50 million or less under section 448(c)(3) on an originally filed return.

These additional disclosures provide information to the IRS that previously would only have been shared in the case of an IRS examination of the credit claim or an amended filing. This IRS trend towards heightened disclosure obligations mirrors changes implemented for refund claim amendments for the Research Tax Credit. The IRS has recently updated refund disclosure requirements, the details of which can be found in the Weaver article entitled “IRS Simplifies Research Credit Refund Claim Requirements.”

How Weaver Can Help

Weaver’s dedicated Specialty Tax Service professionals can assist taxpayers in navigating the nuances of these changes while at the same time ensuring the credit claim is maximized, documented and presented in the most favorable position possible. Our team can also help implement an efficient methodology and approach to claiming the research credit in the future, as well as assisting in any examination by either the federal (i.e., IRS) or state taxing authorities. Don’t go it alone, contact your Tax Advisers at Weaver. We are here to help!

©2024