Measuring What Matters: Valuing Risk in Life Sciences Companies

Valuation Services

Never miss a thing.

Sign up to receive our insights newsletter.

In the world of life sciences — biotech, pharma and medical devices — risk isn't just a factor in valuation. It is the key factor. Accurately valuing a life science company centers on properly measuring risk and understanding how that risk evolves as companies hit critical development milestones. As more capital flows into this sector and competition increases, understanding these valuation principles has become increasingly important and timely.

Why This Matters Now

While investor interest persists, the funding environment remains cautious. Capital invested in the sector has declined in recent years, and although signs of a rebound are emerging, many still perceive it as a challenging time to raise funds. Recent reductions in federal support for early-stage research may also limit new company formation, adding more pressure on private capital to support innovation.

The life sciences industry is in a pivotal moment, as investment interest continues and scrutiny remains high. With companies facing long development timelines, high failure rates and increasingly complex regulatory landscapes, both investors and management teams need better tools to assess value today and tomorrow. Without a clear grasp of how risk changes over time and factoring that into financial models, companies could be significantly over or undervalued. Consequently, this can lead to poor investment decisions or missed opportunities for strategic growth.

The Core Challenge

The key pain point in life science valuations is the high and variable nature of risk across a company’s life cycle. Early stage companies face steep odds: success rates from discovery to U.S. Food and Drug Administration (FDA) approval are historically low, often under 10% in many therapeutic areas. Each successful milestone, such as completing phase 1 or phase 2 trials, reduces risk and increases company value.

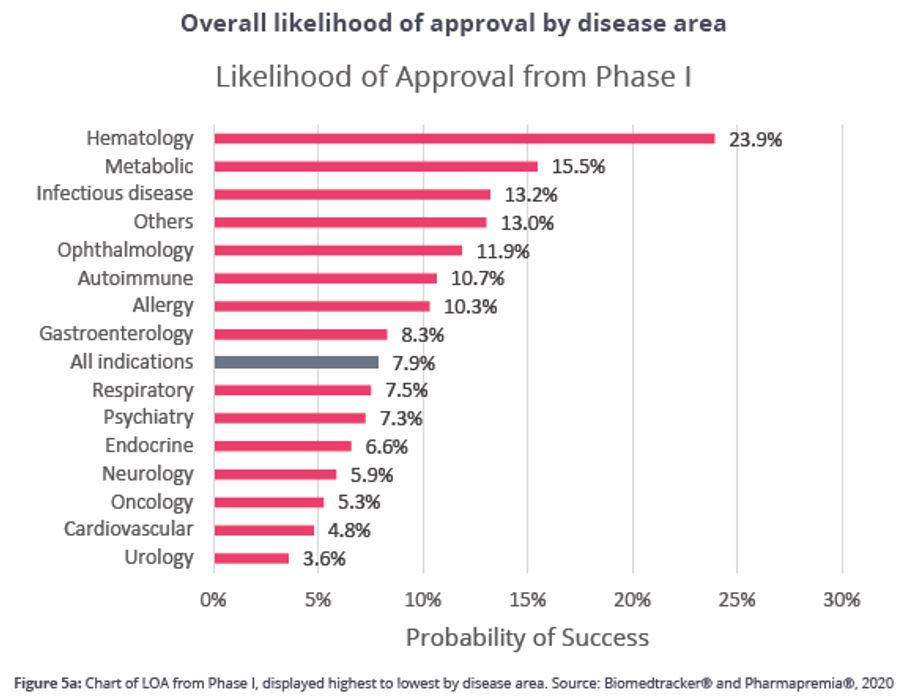

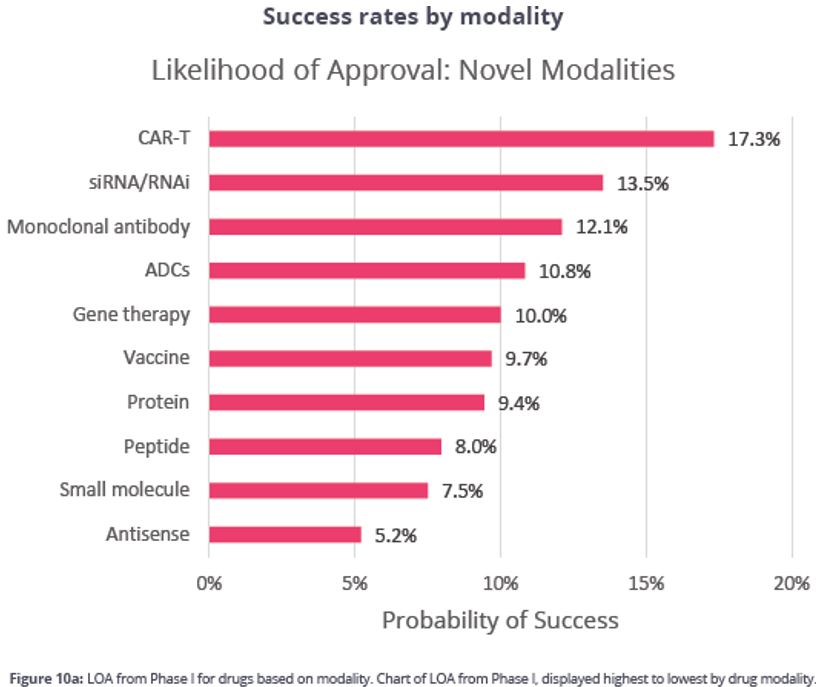

However, estimating these success rates is complex, as they vary widely depending on the therapeutic area and treatment modality. For example, oncology programs tend to have lower probabilities of success compared to infectious disease or hematology programs. Similarly, biologics and gene therapies often follow different development paths and risk profiles than small molecules.

The charts below, from BIO’s Clinical Development Success Rates report, highlight how these differences can significantly influence the probability of advancing through each phase of clinical development.

Effectively modeling the shifting risk profile across a company’s development life cycle is complex. Traditional valuation methods often apply a single, static discount rate, which doesn’t fully reflect how risk decreases over time. This can lead to valuations that either underestimate early stage opportunities or overestimate late stage risks.

NPV vs. rNPV: Two Paths for Measuring Risk

When it comes to modeling value in life sciences, the two most common approaches of net present value (NPV) and risk adjusted net present value (rNPV) share the same foundation but differ in how they handle risk. The below table outlines the differences between the two approaches and why each is used by different stakeholders:

| Purpose | Measures present value of projected cash flows using a blended discount rate that includes the risk of all phases | Measures present value of projected cash flows by adjusting each one with the probability of success at that phase |

| Discount Rate |

|

|

| Risk Treatment | Embedded in the discount rate — higher for early-stage projects, lower for later-stage | Explicitly modeled using stage-specific probabilities of success and compounded across phases |

| Complexity | Simpler to calculate and used when a quick valuation is needed | More complex and requires granular assumptions about each stage’s success likelihood |

| Users | Investors: need a snapshot at a point in time to assess current value and return potential | Management: need to model how risk and value change as milestones are achieved |

| Strengths |

|

|

| Limitations |

|

|

| Best Use | Quick valuation of an entire company or investment decision at a single point in time | Strategic planning, value inflection mapping and assessing the impact of milestone achievements on asset value over time |

Key Takeaways

For life science companies and the investors who back them, using the right valuation framework is critical. rNPV provides a more nuanced, dynamic view of value creation over time, guiding management and stakeholders in making more informed, strategic decisions. As this sector grows more sophisticated and competitive, understanding and applying these risk adjusted techniques are key to unlocking true value.

How Weaver Can Help

Our team can equip life sciences companies with the necessary tools to turn risk into opportunity. Contact us today. We’re here to work with you and tailor valuation frameworks to the unique rhythm of life science, ensuring your financial strategy evolves alongside your pipeline.

©2025