Personal Goodwill in Health Care M&A Transactions: Unlocking Tax Benefits

Never miss a thing.

Sign up to receive our insights newsletter.

If you are an owner-operator of a medical or dental practice, the tax structure of your business has implications when you sell. For private equity transactions, the largest percentage of the purchase price often represents the goodwill associated with your business. From a tax standpoint, not all goodwill is created equal.

Most buyers prefer to structure health care transactions through an asset purchase agreement (APA). Under an APA, if your business is taxed as a C corporation, you will face double-taxation on cash proceeds—the corporation will first pay tax on the proceeds received and then you will pay tax when the corporation distributes those proceeds to you. Even if for tax purposes your business is a pass-through entity, such as a partnership or S corporation, you could face short-term capital gains tax (i.e. ordinary income) if your holding period is less than a year.

In these situations, sellers may be able to partially avoid double-taxation or ordinary tax rates to the extent that their “personal goodwill” is a component recognized in the transaction. Personal goodwill is sold directly by the individual (not the entity) and taxed at long-term capital gain rates. While the tax savings can be substantial, buyers and sellers should properly document supporting facts and opinions to be prepared in the event of an Internal Revenue Service (IRS) audit.

Here are key questions to address in considering personal goodwill in health care transactions:

What is personal goodwill?

The IRS defines goodwill as “the value of a trade or business based on expected continued customer patronage due to its name, reputation, or any other factor.”1 Various tax cases since the 1940s have further bifurcated goodwill between such value associated with an individual (i.e. “personal goodwill”) versus such value associated with the enterprise.

Personal goodwill arises from the individual’s special expertise or know-how, skill, customer or vendor relationships, community standing, likeness, reputation, comparative professional success, and intimate involvement in driving economic benefits and value. Personal goodwill exists when an individual is so critical that the loss of that individual would damage total value.

Alternatively, enterprise goodwill arises from business reputation, processes, locations, customer loyalty, competitive position, non-reliance on any single individual or relationship, employee contracts, trained workforce, and management depth which translate to transferable stand-alone success and value. Passive owners of businesses typically have no personal goodwill associated with operations. They are not critical to business operations and such loss would not impact the business.<

Can I recognize personal goodwill in my transaction?

The U.S. Tax Court generally reviews key qualitative elements to determine whether a taxpayer can recognize personal goodwill:

1. Personal goodwill is identified.

Those specific and unique attributes of the selling shareholder (expertise, relationships, personality, reputation, etc.) should be properly documented in advance of the transaction. Merely agreeing to be employed by the buyer after the transaction and being compensated to fulfill typical duties is not enough to support the presence of personal goodwill. Attorneys often help describe and articulate the connection of the selling shareholder’s personal goodwill to the economics of the business.

2. Personal goodwill is available to be sold by the individual seller.

Prior court cases have determined that goodwill associated with a practice or professional service corporation are corporate assets unless proven otherwise. Goodwill is usually considered a corporate asset if the selling shareholder has a pre-existing non-compete with the subject business. In such cases, the tax courts have successfully argued the seller has already transferred their personal goodwill to the business. Thus, the existing non-compete agreement (and seller personal goodwill) is owned by the business, and part of enterprise goodwill. Therefore, a taxpayer seeking to recognize personal goodwill as the selling shareholder should not have an employment contract or non-compete already in place with the target (selling company).

3. Personal goodwill is being transferred to the buyer.

There must be evidence that the selling shareholder actually transfers their personal goodwill to the buyer. If no evidence exists, the IRS can take the position that all goodwill was really enterprise in nature and could be taxable as a dividend distribution. As such, the seller should enter into an employment and non-compete agreement with the buyer. In doing so, the selling shareholder is expected to transfer their personal goodwill (e.g., relationships, know-how, etc.) to the enterprise in the future for the continued economic benefit of the buyer. If a seller retires immediately after the transaction, supporting the transfer of any personal goodwill value becomes problematic.

4. The buyer makes a separate payment to seller specifically for personal goodwill, and the buyer and seller record the purchase of personal goodwill consistently.

Personal goodwill must be purchased directly from the individual, not the business entity. All transaction documents (including the initial Letter of Intent [LOI]) should consistently reference the parties’ intent to buy/sell personal goodwill. Additionally, the buyer and seller should report the same purchase price allocation tables for tax purposes. Documenting post-transaction or having inconsistent documentation between the buyer and seller may cause issues that would allow the IRS to challenge the treatment during an audit. The parties should also consider obtaining an independent valuation that separates the value of personal goodwill from the value of other assets.

The following are frequently cited landmark cases involving personal goodwill matters:

| MacDonald v. Commissioner | Personal Goodwill Exists | • There is a difference between personal and corporate goodwill • Personal goodwill results from an owners’ personal characteristics, including ability, customer relationships, personality, reputation, and other individualistic qualities |

| Solomon v. Commissioner | Personal Goodwill Does Not Exist | • There must be demonstration personal goodwill exists such that the ongoing corporate success is dependent upon such personal characteristics • Mention of personal goodwill should exist in the purchase/sale documents |

| Lopez v. Lopez | Personal Goodwill May Exist | • Factors that should be considered in valuing the personal goodwill in the context of a professional practice include: age and health; earning power; reputation, judgment, skill, and knowledge; comparative professional success; nature and duration of practice or contributions |

| Martin Ice Cream Co. v. Commissioner | Personal Goodwill Exists | • In the absence of an employment contract and noncompete agreement, an employee’s personal goodwill cannot be considered a corporate asset • Personal goodwill may be transferred separate from corporate assets |

| Norwalk v. Commissioner | Personal Goodwill Exists | • No salable goodwill exists where the business of a corporation is dependent upon its key employees, unless they enter into a covenant not to compete with the corporation or other agreement whereby their personal relationships with clients are transferred to the corporation |

| Kennedy v. Commissioner | Personal Goodwill Does Not Exist | • Upfront payments for future services rendered to buyer is not personal goodwill • Purchase price allocations should be grounded in economic realities rather than merely minimizing tax liabilities |

| Muskat v. United States | Personal Goodwill Does Not Exist | • Personal goodwill is different than merely compensation for a non-compete • The taxpayer must have “strong proof” to alter initial tax allocations; discussions and transaction documents should reference personal goodwill to prove intent |

| Howard v. United States | Personal Goodwill Does Not Exist | • The taxpayer is still bound by the terms of a pre-existing employment agreement and covenant not to compete despite the fact that as sole owner, officer, and director of the corporation he or she could modify these agreements (1) |

| H&M, Inc. v. Commissioner | Personal Goodwill May Exist | • In contrast to Muskat, personal goodwill may exist even if not discussed in the transaction documents • The IRS must have expert evidence to re-allocate purchase price consideration |

(1) On April 23, 2024, the Federal Trade Commission (FTC) issued its final rule generally prohibiting non-compete agreements with certain exceptions. The final rule does not apply to a non-compete in connection with a “bona fide sale of a business entity, of the person’s ownership interest in a business entity, or of all or substantially all of a business entity’s operating assets.” While legal challenges to the FTC’s authority to issue such final rule have been filed, a non-compete associated with the sale of an individual’s personal goodwill would still be binding as the final rule was written. Assuming the FTC final rule goes into effect as written, the IRS has yet to address whether owners who previously transferred their personal goodwill to an enterprise via a non-compete could now allocate proceeds from the sale of such business to their personal goodwill.

How do you quantify the value of personal goodwill?

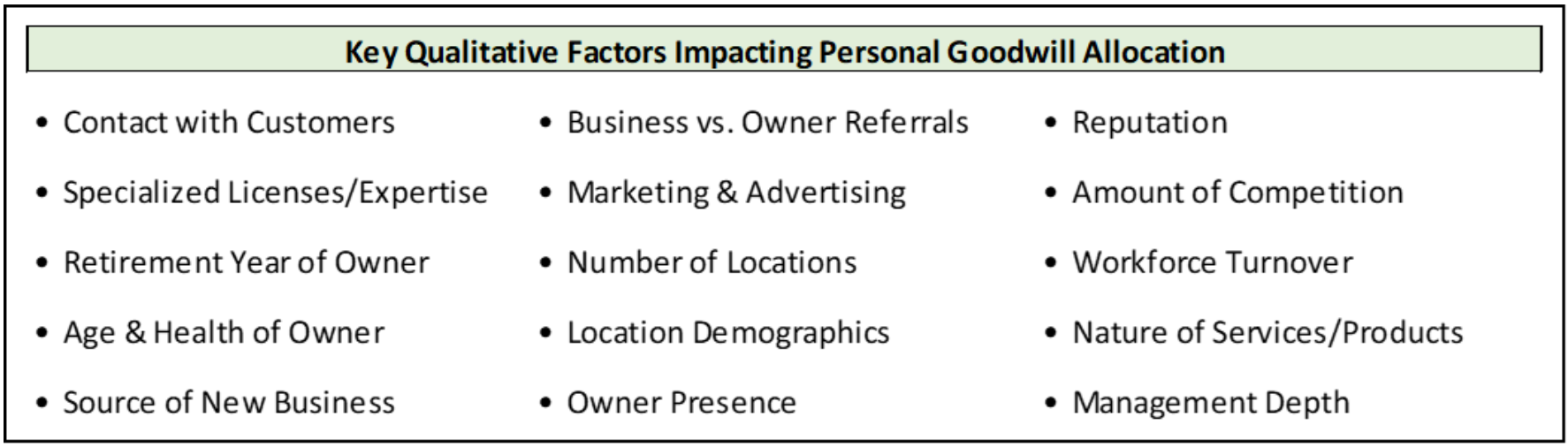

The quantification of personal goodwill is a fact-specific exercise that blends qualitative and quantitative considerations. Two common methodologies valuators use to determine personal goodwill are:

1. With and Without Analysis

Compares the value of the enterprise with and without the seller’s personal goodwill based on various assumptions that impact financial performance (revenue, earnings, etc.). The resulting differential between the two scenarios is a reasonable measure of the fair market value of personal goodwill.

2. Modified Multi-Attribute Utility Model (MUM)

This is a weighted scorecard approach that focuses on specific attributes to establish a distinction between personal goodwill and enterprise goodwill. Areas of consideration include:

Note: The existence of multiple sellers each with their own personal goodwill adds considerations and complexity to the valuation analysis.

Can you provide an example?

Assume a dentist (seller) owns and operates a single location practice taxed as a C corporation. The seller receives a buyout offer for $2,000,000, and the buyer insists on acquiring the assets of the practice through an APA. The seller speaks with his accountant and transaction attorney and hopes to avoid double taxation through the recognition of personal goodwill. The seller is advised that his situation would qualify for the recognition of personal goodwill for several reasons:

- Seller does not have a pre-existing non-compete or employment agreement in place with the selling company;

- Seller intends to sign an employment and noncompete agreement associated with the buyer after the practice sale; and

- Buyer recognizes seller’s personal goodwill. To justify the offer price, buyer wishes seller to continue working at the practice while slowly transferring his personal goodwill to a newly recruited dentist.

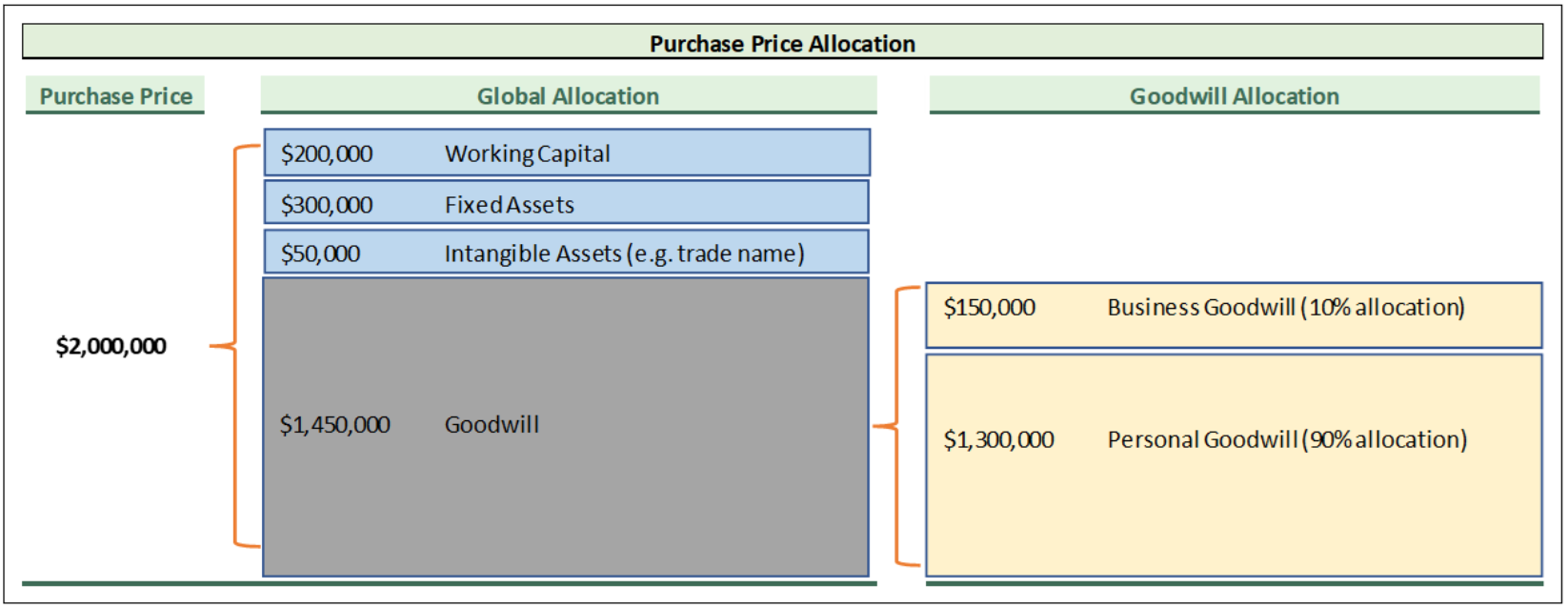

The seller engages a valuation firm to perform a purchase price allocation. The valuator first performs a global allocation of the $2,000,000 among working capital, fixed assets, intangible assets, and goodwill. Next, the valuator employs a modified MUM (see above methodology) to document and distinguish the fact-pattern favoring personal versus enterprise goodwill. Based on the weighted scorecard approach, the valuator determines that most (90%) of the allocable goodwill is personal. Below is the result from the valuator.

The buyer and seller agree upon the above allocations and represent such values in all transaction documents and tax filings.

Tax Savings

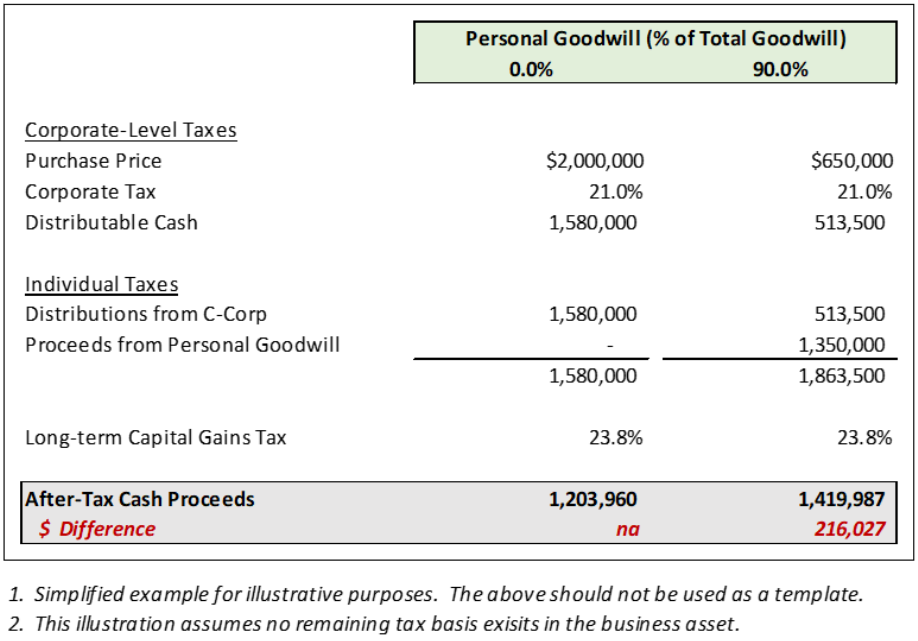

The recognition of personal goodwill allows for the selling shareholder to avoid double-taxation in the event of a sale. In the chart below, the previous example would result in a tax savings of approximately $216,000.

With no allocation to personal goodwill, such proceeds would be considered a “gain on the sale of assets” and taxed at the corporate level. Remaining proceeds would be taxed again at the individual level after the corporation makes a distribution to the selling shareholder. In this example, we assumed the seller has held the corporation for over a year, the assets of the company have no basis, and will be taxed on distributions at long-term capital gains rates.

This example also assumes that the selling shareholder can recognize 90% of the total goodwill as personal in nature. Thus, the corporate taxes only apply to $650,000 (the total amount allocable to business assets). Proceeds for personal goodwill of $1,350,000 would only be taxed as long-term capital gains.

Should I consider obtaining a third-party valuation?

Yes. While a formal valuation is not specifically required in the tax code, the IRS is more skeptical of taxpayer-prepared analyses than those prepared by an independent, reputable firm. A taxpayer has the burden of proving facts in a tax dispute with the federal government, and the IRS commonly points to lack of documentation or records in its findings. In the event of an IRS audit, the taxpayer will be better able to support and defend its position with a well-documented report that determines the allocation using accepted methodologies and approaches. In Kennedy,2 the tax court held that the value of the purchase price allocated to personal goodwill was “a tax-motivated afterthought that occurred late in negotiations” and lacked justification. The IRS noted that Kennedy provided the court no appraisal of the personal goodwill asset supposedly owned.

The decision to allocate 75 percent of the total payments to [personal] goodwill appears not to be grounded in any business reality. It did not reflect the value of goodwill in relation to the other valuable aspects of the transaction.

If personal goodwill is an element to any transaction, it is advisable for the taxpayer to seek legal review in conjunction with a third-party valuation and to maintain records.

Conclusion

Understanding the distinction between enterprise and personal goodwill is crucial for sellers. Properly identifying and quantifying personal goodwill can have tax advantages, as gains on personal goodwill assets are taxed at capital gains rates rather than ordinary income tax rates. So, when navigating M&A waters, consider the power of personal goodwill—it just might save you a bundle!

Copyright 2024, American Health Law Association, Washington, DC. Reprint permission granted.