Retail Clinics Positioned to Become Health Care’s New Front Door

Never miss a thing.

Sign up to receive our insights newsletter.

The Effects Could Bring Profound Valuation Implications in the Long Term

According to recent statistics, more patients are choosing retail health clinics and urgent care centers for their health care needs. This reallocation of patient preference has significant implications for providers that have been historically dependent on legacy patient access and downstream referral patterns. As consumers prioritize clinics that offer ease of scheduling, cost transparency and overall convenience, retail operations are ramping up to become health care’s new “front door.”

For example, CVS-Aetna plans to expand its retail clinic services (MinuteClinic and HealthHUB), offering everything that patients typically see in a physician’s office. With its recent purchase of Oak Street Health, CVS Pharmacy customers can digitally connect with Oak Street Health providers no matter their patient history with a primary care practice. The Oak Street acquisition will focus on value-based care throughout its 177 locations and 180,000 at-risk lives.

By the Numbers

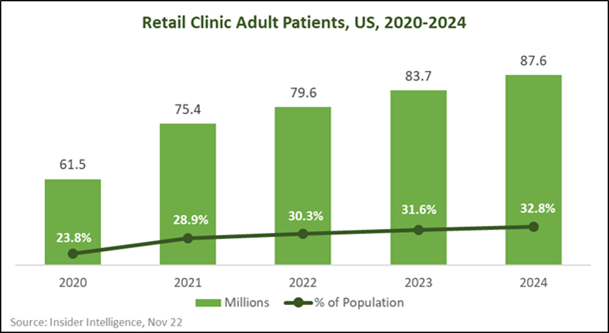

According to Insider Intelligence, retail clinic patient volume has increased significantly as illustrated by the chart below. In addition, projections for retail clinic patient volume are robust, with significant increases expected in the near-term future.

Source: Insider Intelligence, November 2022

Based on current and projected data:

- 61.5 million U.S. adults, or 23% of the population, received in-person care at a retail health clinic in 2020.

- This figure spiked to 79.6 million adults, or 30.3% of the population in 2021. CVS (53.1%) and Walgreens (24.4%) account for more than three-quarters (77.5%) of all retail clinic patients.

- According to Insider Intelligence’s forecasts, retail clinic visits are projected to continue growing, reaching 87.6 million adults, or 32.8% of the population, in 2024.

Why it Matters

- The hospital system ecosystem is designed to capture the patient at the retail level primarily through affiliated primary care practices and urgent care centers. Retail clinics typically offer same-day appointments, and many have online tools that enable patients to check prices, verify insurance eligibility and schedule visits. Often, these features offer a more consumer-friendly experience as compared to hospital-owned primary care practices or other patient entry points.

- Hospital system revenue and profits may be affected in the long-term depending upon how patients are routed from retail clinics, such as the one CVS-Aetna is creating.

- Lower patient volume may also affect hospital-employed physician financial performance, increasing hospital financial losses on the ownership of physician practices. Revenue may also decline from downstream revenue derived from the ancillary services generated from primary care patients.

Health Care Valuation Takeaways

- Retail clinics are striving to be the driving force for change in health care. If they are successful, incumbent primary care providers will need to better understand what matters most to patients and adjust their business accordingly. Otherwise, consumers will simply pick another option.

- Providers that own, employ and depend on primary care providers could eventually experience lower patient volumes, therefore affecting long term downstream and ancillary revenue. Much of this revenue is high reimbursement commercial payer volume, which is more profitable and more impactful to the hospital organization.

- Valuators should have a deep understanding of the durability of patient access for those providers dependent on legacy patient access patterns. The qualitative and quantitative risks of the potential loss of high reimbursement patients to other new and emerging patient ecosystems and changes in consumer patient flow should be assessed.

For more information about these observations and the effect on health care valuations, contact us.

©2023

This is one in a series of related health care valuation posts: