SEC Adopts Climate Disclosure Rules for Public Companies

Never miss a thing.

Sign up to receive our insights newsletter.

The Securities and Exchange Commission (SEC) on March 6, 2024, announced its adoption of final rules that require public companies to report certain climate-related information in their registration statements and annual reports. The final rules were adopted nearly two years after the SEC introduced their initial proposed guidance on March 21, 2022.

The long-awaited final rules will require information about a registrant’s climate-related risks that have materially impacted, or are reasonably likely to have a material impact on, its business strategy, results of operations, or financial condition.

Certain qualitative disclosures related to severe weather events and other natural conditions will be required in a registrant’s audited financial statements. The final rules require a registrant to disclose, among other things: material climate-related risks; activities to mitigate or adapt to such risks; information about the registrant’s board of directors’ oversight of climate-related risks and management’s role in managing material climate-related risks; and information on any climate-related targets or goals that are material to the registrant’s business, results of operations, or financial condition.

The SEC’s final release significantly scaled back disclosure requirements regarding greenhouse gas (GHG) emissions compared to the original proposals. Most notably, the requirement for public companies to report emissions from across a company’s supply chain, referred to as Scope 3 emissions, was dropped from the final rule; however, it is still included in California’s Climate Corporate Data Accountability Act (CCDAA) and the EU’s Corporate Sustainability Reporting Directive (CSRD). Certain larger public companies will be required to report material Scope 1 and/or Scope 2 emissions data related to its direct operations and purchased energy, accompanied by an attestation report on a phased in basis. The definition of materiality is consistent with SEC financial reporting standards which considers the relevance of the information to the investor.

Specifically, according to the SEC’s press release, the final rules will require a registrant to disclose:

Climate-Related Risks

- Climate-related risks that have had or are reasonably likely to have a material impact on the registrant’s business strategy, results of operations, or financial condition

- The actual and potential material impacts of any identified climate-related risks on the registrant’s strategy, business model, and outlook

- If, as part of its strategy, a registrant has undertaken activities to mitigate or adapt to a material climate-related risk, a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that directly result from such mitigation or adaptation activities

- Specified disclosures regarding a registrant’s activities, if any, to mitigate or adapt to a material climate-related risk including the use, if any, of transition plans, scenario analysis, or internal carbon prices

- Any oversight by the board of directors of climate-related risks and any role by management in assessing and managing the registrant’s material climate-related risks

- Any processes the registrant has for identifying, assessing, and managing material climate-related risks and, if the registrant is managing those risks, whether and how any such processes are integrated into the registrant’s overall risk management system or processes

- Information about a registrant’s climate-related targets or goals, if any, that have materially affected or are reasonably likely to materially affect the registrant’s business, results of operations, or financial condition. Disclosures would include material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or actions taken to make progress toward meeting such target or goal

- The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (RECs) if used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements

Greenhouse Gas Emissions

- For large accelerated filers (LAFs) and accelerated filers (AFs) that are not otherwise exempted, information about material Scope 1 emissions and/or Scope 2 emissions

- Companies that are required to disclose Scope 1 and/or Scope 2 emissions will be required to have independent audits, initially with limited assurance and, following a transition period, reasonable assurance

Severe Weather Events

- The capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds, disclosed in the notes to the financial statements

- If the estimates and assumptions a registrant uses to produce the financial statements were materially impacted by risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans, a qualitative description of how the development of such estimates and assumptions was impacted, disclosed in a note to the financial statements

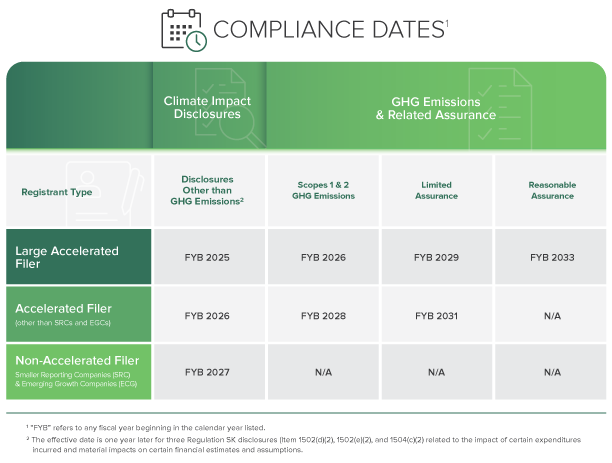

Compliance Dates

The final rules will be phased in for all registrants with the compliance date dependent upon the filing status of the registrant as a LAF, AF, smaller reporting company (SRC), or emerging growth company (EGC), the content of the disclosure and provides several accommodations, including:

- Additional phase-in periods for disclosures pertaining to material expenditures, GHG emissions, the assurance requirement, and the electronic tagging requirement if the registrant is a LAF (see compliance date table);

- A safe harbor from private liability for climate-related disclosures (excluding historical facts) pertaining to transition plans, scenario analysis, the use of an internal carbon price, and targets and goals;

- An exemption from the GHG emissions disclosure requirement for SRCs and EGCs; and

- An accommodation that allows Scope 1 and/or Scope 2 emissions disclosure, if required, to be filed on a delayed basis

The following chart was developed based on a table in the SEC Fact Sheet about the final rules.

The final rules will become effective 60 days following publication of the adopting release in the Federal Register. Legal challenges to the new SEC climate rule were anticipated. The first, by a coalition of 10 states, was announced the same day as the rules were adopted.

Weaver’ Public Company and ESG Strategy and Consulting groups provide audit, tax and advisory services to public companies of all sizes from smaller reporting companies to large accelerated filers, and across a broad spectrum of industries. For assistance in preparing for these new rules or other information, contact us.

©2024