Supply Chain Inflation Expectations Add to Provider Challenges

Health Care Valuation Services

Health Care Valuation Services

Never miss a thing.

Sign up to receive our insights newsletter.

Supply cost inflation is expected to continue into 2026, according to the summer 2025 Vizient Spend Management Outlook survey. Vizient, a national health care performance improvement company, serves more than half of the acute care hospitals in the U.S., and their insights offer a credible snapshot of nationwide trends.

For many providers, sustained inflation means tighter margins and increased pressure on capital planning. With limited ability to absorb or offset rising costs, health systems must pay close attention to spending trends now to avoid long-term financial strain.

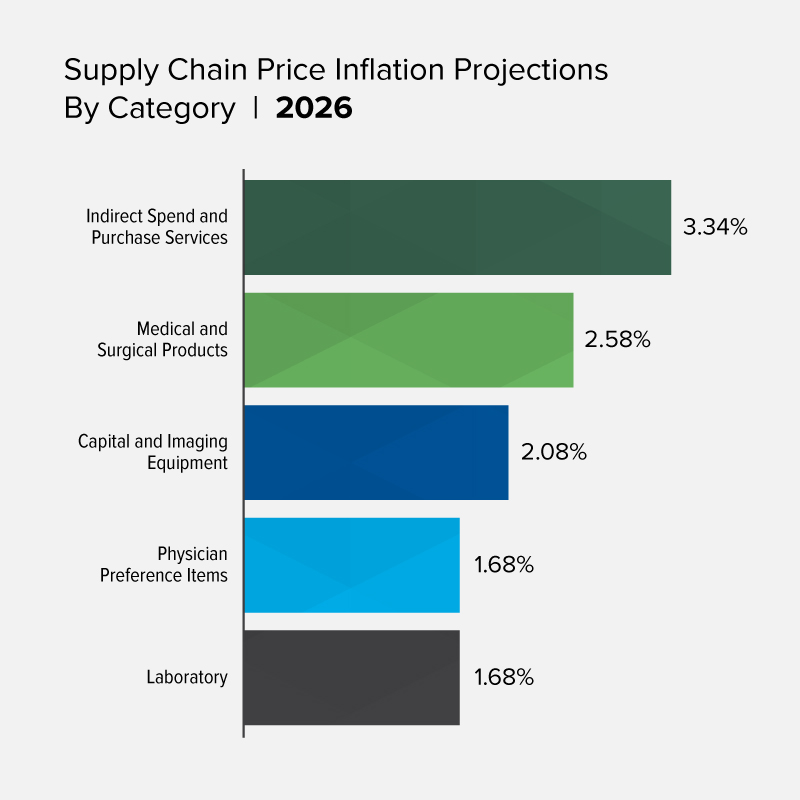

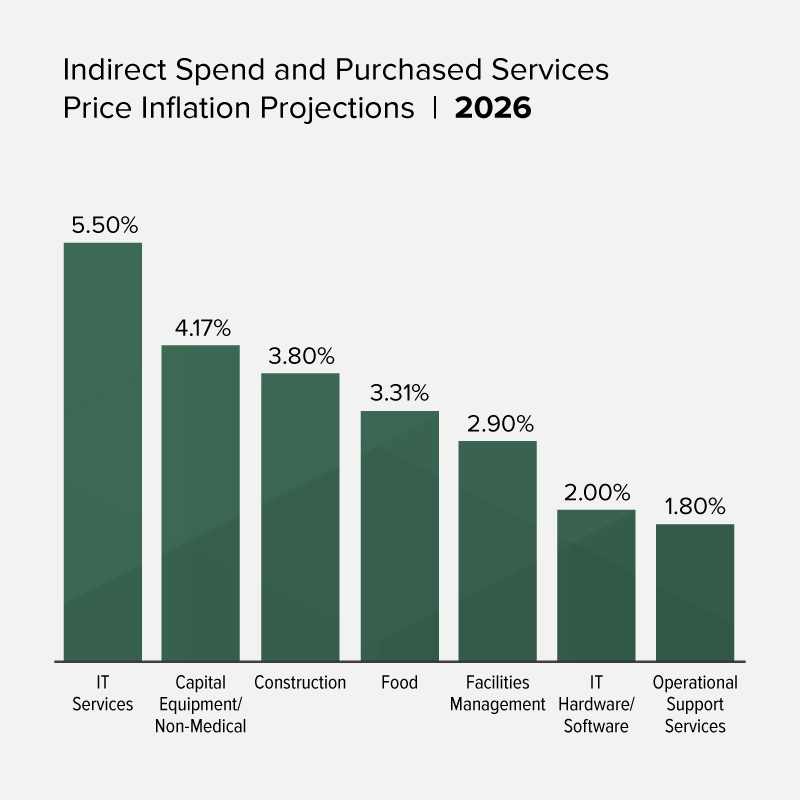

By the Numbers

Navigating supply cost inflation in health care valuations

The recent survey reveals above average inflationary pressures in areas like information technology (IT), while categories such as laboratory supplies and physician preference items are seeing relatively less impact. Ultimately, how providers experience and respond to rising supply costs will depend on their operational priorities and future capital investment plans.

Key insights from the report include:

- Indirect spend and purchased services: These categories are projected to see the highest inflation in 2026, with an average increase of 3.34%. Notably, IT services are expected to rise by 5.5%. Other high inflation purchased services include capital equipment/nonmedical, construction, food and facilities management.

- Medical and surgical products: Inflation in this category is forecasted at 2.58%, driven by rising costs in raw materials, freight and tariffs. However, the impact is partially offset by stable pricing in domestically sourced medical supplies.

- Capital and imaging equipment: Costs are expected to increase by 2.08%, influenced by factors such as manufacturing inputs, labor, freight, tariffs and the introduction of new imaging technologies.

- Physician preference items and laboratory supplies: These categories show the lowest inflation expectations for 2026, suggesting relative price stability compared to other areas of the supply chain.

Source: Summer 2025 Vizient Spend Management Outlook

Why It Matters

Health care providers are operating in a complex environment. In addition to concerns about direct expenses, such as salaries, employee benefits and occupancy cost, providers are required to adjust to cost pressures in the supply chain that are macroeconomic in nature and frequently beyond their control.

Inflation pressures are uneven and difficult to predict. High tech and high demand areas continue to push operating costs higher and demand greater access to capital, while stable contracts and mature categories hold prices down.

The level of exposure to cost pressures depends on specialty focus, geography and access to capital. Exposure can differ drastically even between different providers in the same health care segment.

Health Care Valuation Takeaways

Providers have limited ability to immediately pass through supply costs to the patient due to fixed reimbursement rates from government and commercial payors. Without a proper understanding of supply inflationary trends relative to reimbursement growth, a valuation professional risks overvaluing an entity using the discounted cash flow methodology.

Valuation professionals must stress test forecasts from company management, incorporating anticipated increases in supply chain operating and capital costs, and properly adjusting risk premiums to reflect these exposures. The Vizient analysis can assist valuation professionals in preparing a supportable valuation analysis.

Planning Ahead in an Inflationary Environment

Persistent inflation continues to challenge health care organizations, often creating difficult decisions about resource allocation and long-term planning. Understanding how these cost trends affect your operations and valuations is critical to sustaining financial stability. Contact us. We can help your organization plan confidently for the future through clear, supportable valuations and actionable insights.

©2025