Tariffs, Tax and Trade: Executive Strategies to Bridge the Gap

Related

Never miss a thing.

Sign up to receive our Tax News Brief newsletter.

Executives are familiar with strategic planning for income taxes for their businesses and personal finances. However, the recent volatility driven by the new tariffs has shifted the landscape, and many executives who once left tariff considerations to operations and logistics teams or outsourced them to brokers can no longer overlook the impact of tariffs. Regardless of political shifts, the days of treating tariffs as a secondary concern are over. While a volatile and fluid situation, tariffs are now a critical strategic consideration that will significantly impact the supply chains of global businesses, both large and small.

What Are Tariffs and How Do They Impact Businesses?

A tariff, or duty, is an ad valorem tax imposed by a government on the value of goods being imported or exported within a company’s supply chain. The term "ad valorem" is Latin for "according to value" and means the tax is based on the value of the goods. Tariffs serve various purposes, such as protecting specific industries, regulating trade imbalances or generating government revenue by increasing the cost of goods at the point of import or export.

Tariff Impact on Income Taxes

From a tax perspective, tariffs and income taxes have an inverse relationship when tariff costs are unable to be directly passed on to end customers in the form of pricing increases. The higher the import value, the higher the tariff paid, which in turn typically lowers taxable income derived from those goods, effectively reducing the income tax due. Conversely, a lower import value means a lower tariff is paid but leads to higher taxable income derived from those goods, which increases the income tax due. Such activity makes it essential for executives to consider both tariff and income tax implications when evaluating their supply chain strategies.

Different Valuation Methods

The Internal Revenue Service (IRS) and the Customs and Border Protection (CBP) both play critical roles in the valuation of goods, but they have distinct methods. For related party imports, the IRS requires arm’s length pricing under Internal Revenue Code (IRC) Section 482, which requires that transactions between related entities reflect pricing as between independent parties. Meanwhile, the CBP applies its own customs valuation rules to determine the value of goods for tariff purposes. These differing methods can lead to variations in how tariffs and taxes are assessed and requires careful alignment between the two agencies' methods.

Considerations for Multinational Groups

Executives responsible for global supply chains must now evaluate the potential strategies for tariff optimization while balancing tariff impact with federal income tax, state income tax, and sales and use tax implications. Multinational groups can begin by developing a clear understanding of their global supply chain, gathering data inputs, and understanding the various departments involved to model the realistic impact of tariff changes from an operational, tax, accounting, and tariff perspective. Mapping both the physical movement of goods and the legal flow of title passage are necessary starting points. Importers of record should gather their historical import transaction data from the CBP via the Automated Commercial Environment (ACE) system. This process allows businesses to understand how their goods have been classified and valued historically, which is key in modeling future impacts.

First Sale for Export: A Beneficial Strategy

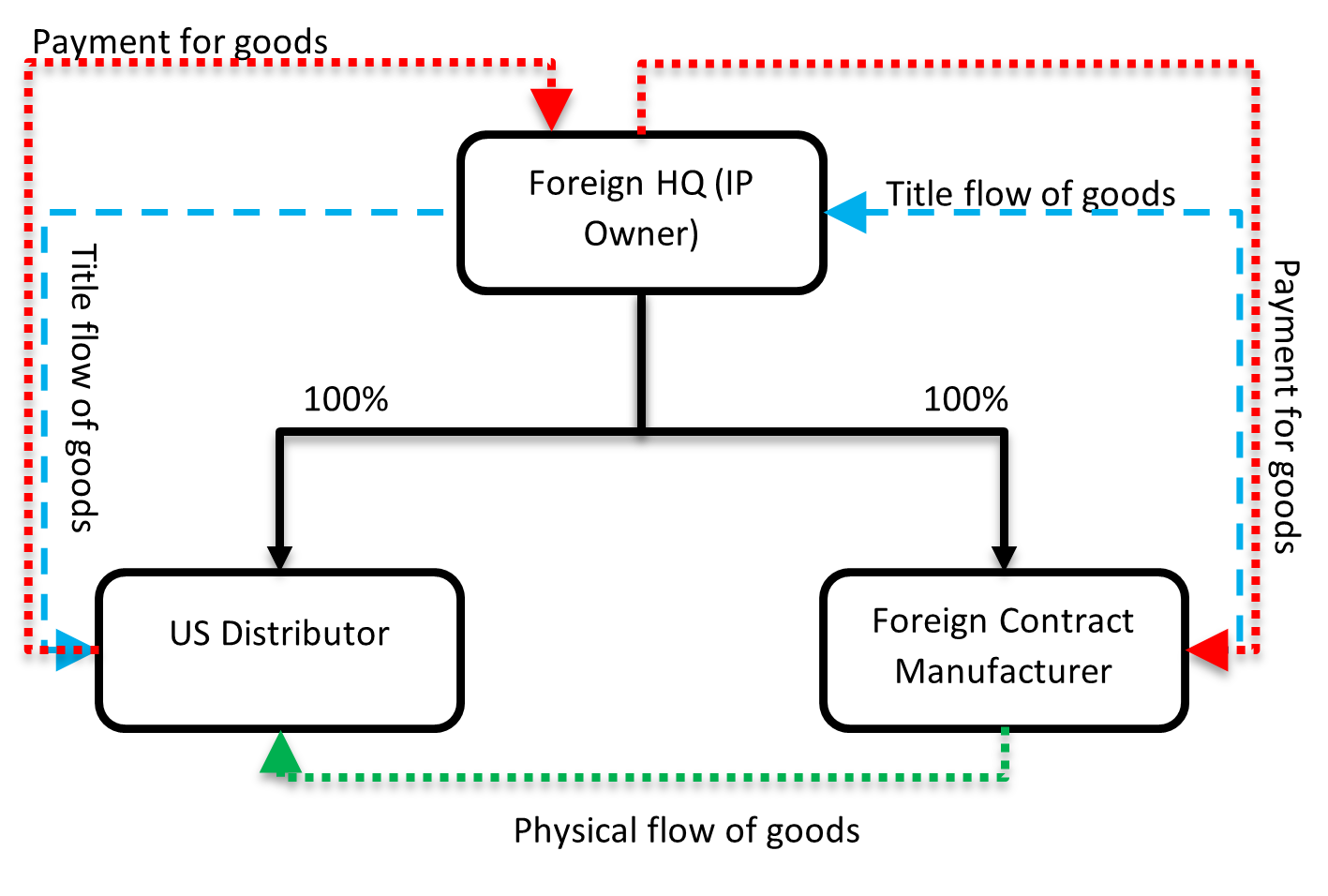

For foreign headquartered multinational groups using limited risk manufacturing operations (e.g., related-party tolling or contract manufacturing) outside the U.S., the first sale of export (FSFE) can provide a valuable planning opportunity. FSFE offers the potential for a more optimal tariff impact, especially for foreign principals or headquarters (HQ) that own the intangible property (IP) tied to a specific manufacturing or distribution supply chain. The diagram below illustrates how the flow of transactions in an FSFE might be structured.

The example calculations below demonstrate how potential savings could materialize where transactions qualify for FSFE. It’s important to note that the U.S. distributor’s results, from an IRC 482 transfer pricing perspective, would need to be evaluated in parallel. The magnitude of the final tariff levels may present significant challenges across the supply chain as multinational groups adapt their IRC 482 transfer pricing policies to account for tariff impact.

| US distributor's Revenue (sales to end customer) | $100.00 | $100.00 | $100.00 |

| US distributor's COGS (importer of record purchase price) | $70.00 | $70.00 | $70.00 |

| 10% US Tariff on import of goods | $7.00 | $4.00 | |

| US distributor's Gross Profit | $30.00 | $23.00 | $26.00 |

| US distributor's Operating Expenses | $20.00 | $20.00 | $20.00 |

| US distributor's Income (EBIT) | $10.00 | $3.00 | $6.00 |

| US federal income tax (21%) | $2.10 | $0.63 | $1.26 |

| Foreign manufacturing principal Sales (of product) | $70.00 | $70.00 | $70.00 |

| Foreign manufacturing principal COGS (from contract manufacturer) | $40.00 | $40.00 | $40.00 |

| Foreign manufacturing principal Gross Profit (as IP Owner/Licensee) | $30.00 | $30.00 | $30.00 |

| Foreign contract manufacturer Sales | $40.00 | $40.00 | $40.00 |

| Foreign contract manufacturer COGS | $36.00 | $36.00 | $36.00 |

| Foreign contract manufacturer Income | $4.00 | $4.00 | $4.00 |

| Total Corporate Income Tax + Tariff Impact | $2.10 | $7.63 | $5.26 |

| Hypothetical Tax + Tariff Cost Savings*,** *** | 31.1% |

*Assumption: Tariff costs are unable to be passed on to customers through price increases.

**Assumption: Facts and circumstances of transactions qualify for FSFE.

*** Represents US tax only. Would need to also consider the non-US tax implications/costs.

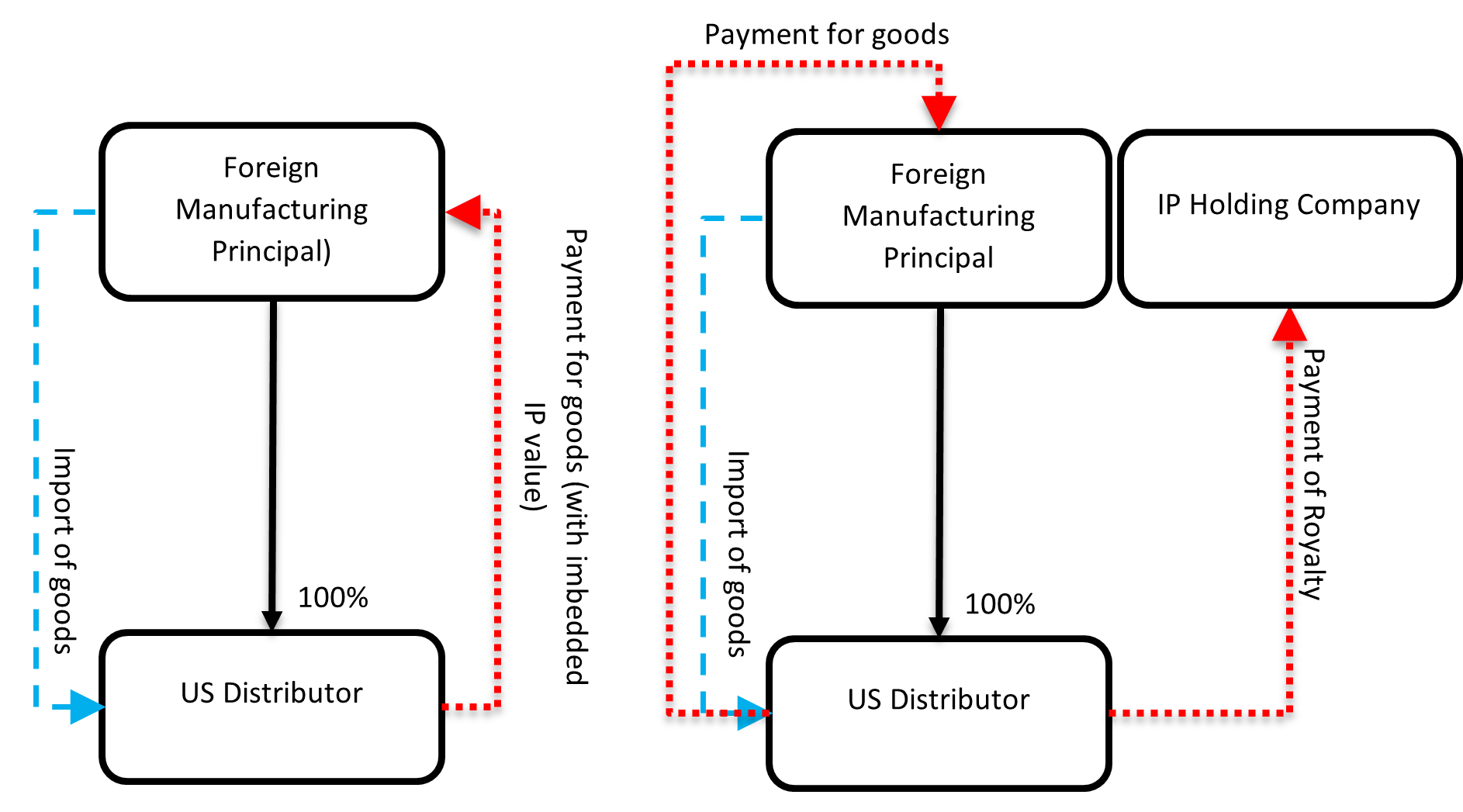

IP Unbundling or Restructuring: Additional Optimization Opportunities

Another potential planning opportunity for foreign manufacturing principal entities with IP ownership is the unbundling of IP value from the import value and charging a separate royalty. This can help optimize the tariff impact on imports into the U.S. market.

The CBP applies specific rules, rulings and case law when determining whether a royalty charged separate of the imported goods dutiable value is acceptable. There may also be withholding taxes on royalty payments that need to be factored into this scenario’s overall cost vs. benefit analysis.

Additionally, unbundling can be considered for services value embedded in an import price for goods, but a detailed analysis must be conducted to ensure compliance with CBP standards. IRC 482 transfer pricing rules should also be considered, though unbundling doesn’t automatically alter the distributor’s ultimate taxable income in the U.S.

The following diagram illustrates an example of unbundling transaction:

The example calculations below show how the potential savings could materialize where IP unbundling is appropriate. It’s important to note that the U.S. distributor’s results, from an IRC 482 transfer pricing perspective, would need to be evaluated in parallel. The magnitude of the final tariff levels may present significant challenges across the supply chain system as multinational groups adapt their IRC 482 transfer pricing policies to account for tariff impact.

| US distributor's Revenue (sales to end customer) | $100.00 | $100.00 | $100.00 |

| US distributor's COGS (importer of record purchase price) | $70.00 | $70.00 | $44.00 |

| 10% US Tariff on import of goods | $7.00 | $4.40 | |

| US distributor's Gross Profit | $30.00 | $23.00 | $51.60 |

| US distributor's Operating Expenses | $20.00 | $20.00 | $20.00 |

| Royalty Expense for IP | $26.00 | ||

| US distributor's Income (EBIT) | $10.00 | $3.00 | $5.60 |

| US federal income tax (21%) | $2.10 | $0.63 | $1.18 |

| Foreign manufacturing principal Sales (of product) | $70.00 | $70.00 | $44.00 |

| Foreign manufacturing principal COGS | $40.00 | $40.00 | $40.00 |

| IP Holding Co. / Foreign manufacturing principal Royalty Income | $26.00 | ||

| Foreign manufacturing principal Gross Profit | $30.00 | $30.00 | $30.00 |

| Total Corporate Income Tax + Tariff Impact | $2.10 | $7.63 | $5.58 |

| Hypothetical Tax + Tariff Cost Savings*,** | 26.9% |

*Assumption: Tariff costs are unable to be passed on to customers through price increase.

**The value of unbundled IP / royalty is the key driver in magnitude of potential cost savings.

***Represents US tax only. Would need to also consider the non-US tax implications/costs.

Establishing a New US Entity

Foreign manufacturing businesses that have historically imported goods into the United States utilizing a foreign entity as the importer of record may be able to benefit by establishing a U.S. corporation to act as the importer of record and U.S. distributor. The benefit is derived where the arm’s length cost of the distribution activities could subsequently be carved out of the dutiable value of the imported goods, potentially lowering the tariff impact. Tax treaty analysis would be necessary to ensure taxation on any dividends from the U.S. company to the foreign owner would not exceed the benefit of tariff optimization.

Supply Chain Considerations to Achieve Duty Free Imports

Under the United States-Mexico-Canada Agreement (USMCA) certain goods are eligible to be duty-free. These goods must meet certain requirements, including rules of origin in order to qualify for tariff relief. USMCA provides an opportunity for executives to reevaluate their supply chain to identify adjustments that could be made in order to obtain duty-free status. This could include everything from adjusting a company’s internal supply chain to merely identifying other contract manufacturers/suppliers that meet the requirement.

Restructuring IP Ownership for Tax and Tariff Optimization

Restructuring from a full-risk IP owner or licensee to a limited-risk manufacturing operation is another potential avenue for foreign manufacturing businesses to optimize tariff impact. In addition to economic substance and operational considerations, restructuring requires careful modeling and evaluation of the current income tax implications related to moving IP or de-risking a principal entity. This ensures that the tax costs of restructuring are weighed against the long-term savings of the IP ownership structure.

Next Steps for Executives

Executives interested in potential tariff optimization should take the following next steps:

- Understand the mapping of global supply chains and global value chains

- Identify the importer of record within the company’s supply chain(s)

- Review customer contracts to identify relevant entity in the supply chain that legally bears the economic impact of tariff costs

- Assess their current U.S. tariff classifications and valuations using ACE data

- Analyze the income tax and other tax implications of their current global supply chains and global value chains

- Identify the cross-functional leaders and external advisors needed to model and assess the feasibility of alternatives

- Evaluate organizational stakeholders and operational steps required to implement alternatives to their global supply chains and global value chains in light of tariff optimization opportunities

In today’s dynamic business landscape, tariffs must be central to strategic planning for leaders managing global supply chains. Weaver is here to help. We can help you assess the impact of evolving trade rules and uncover opportunities to reduce costs, enhance compliance and drive operational efficiency. Contact us today to ensure your business remains competitive in a rapidly shifting global trade market.

©2025