The Valuation Ripple Effect of Proposed Medicaid Cuts

Health Care Valuation Services

Health Care Valuation Services

Never miss a thing.

Sign up to receive our insights newsletter.

Federal Medicaid spending is currently under scrutiny as Congress considers decreasing expenditures by $532 billion to nearly $1 trillion over a 10-year period starting October 1, 2025. Major cuts to Medicaid are necessary to meet the House’s budget resolution requirements. There are several options available for cutting Medicaid, but all would leave states facing difficult choices — raise revenues or cut spending.

Potential cuts to Medicaid spending could result in states dropping coverage for some people, creating wide-reaching effects. This could eliminate coverage of high-cost optional benefits such as prescription drugs or reducing payment rates to health plans and providers.

Assuming Medicaid cuts to providers are imminent, it is crucial for valuators to understand how different segments of the health care sector will be impacted, depending on their funding reliance. For some, Medicaid is an essential portion of funding. On the other hand, providers located in affluent suburbs that focus on commercially insured patients may experience minimal impact from Medicaid cuts. Recognizing the effects of these proposed cuts can help health care leaders and valuators prepare strategic responses as challenges arise.

By the Numbers: Medicaid’s Role in Health Care Spending

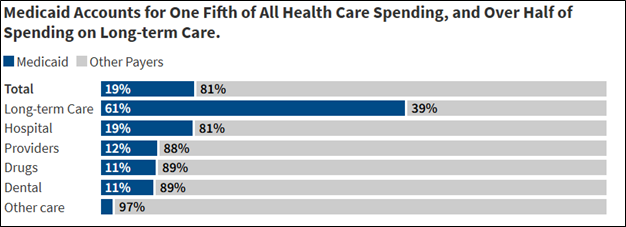

This data sourced from the Kaiser Family Foundation (KFF) illustrates the varying levels of Medicaid dependence across health care sectors.

Source: KFF

According to the data, Medicaid accounts for:

- Nearly one-fifth (19%) of total health care spend

- A large majority (61%) of long-term care spend

- Nearly one-fifth (19%) of hospital spend; however, reliance on Medicaid is significantly higher in safety net and rural hospitals

- A small percentage (3%) of total spend for ambulatory, imaging and other ancillaries

Other Data Points to Consider

- According to KFF, behavioral health services in the U.S. heavily rely on Medicaid, which covers over a quarter of the country’s behavioral health expenditures. Mental health services are rendered in clinics, hospitals and specialized facilities. Medicaid enrollees are more likely to receive mental health treatment compared to privately insured or uninsured individuals, with about 24% of Medicaid adults receiving some form of mental health treatment.

- In 2023, Medicaid covered 1.5 million births, accounting for 41% of all U.S. births and 47% of births in rural areas.

- Long-term care takes place in many settings, especially senior living facilities. Long-term care also includes memory care and programs for the disabled. Medicaid is the primary payor for six in 10 (60%) residents in nursing facilities.

- Conversely, some health care segments are not heavily exposed to Medicaid payments. These include ambulatory surgery centers, imaging centers, physical therapists, inpatient rehab and other providers focused on commercial or Medicare payments. These businesses may be located in wealthy suburbs or are otherwise covered by Medicare (not Medicaid).

- However, Medicaid still plays a role: Approximately 18% of Medicaid enrollees are also part of Medicare. Similarly, about 17% of Medicare beneficiaries are enrolled in Medicaid. Known as dual-eligible beneficiaries, these individuals have low income and significant health needs. Approximately 50% of such dual-eligible beneficiaries are Qualified Medicare Beneficiaries (QMBs). In these instances, Medicaid covers Medicare Part A and Part B premiums, deductibles, coinsurance and copayments. If an individual is dual-eligible but not classified as a QMB, they can still achieve significant benefits through other Medicare Savings Programs (MSPs). Therefore, some of the health segments that have low Medicaid exposure but Medicare exposure, may still be impacted by cuts.

Health Care Valuation Takeaways

- Federal cuts have introduced uncertainty for health care segments that are reliant on Medicaid payments.

- In the valuation of a subject company, the valuator should properly adjust reimbursement projections or the risk profile of companies with Medicaid exposure. It is also important to remember reimbursement risks always exist in health care businesses. Reimbursement rates and payment methodologies are variable in the long run.

- As federal Medicaid cuts create financial pressures, it is reasonable to expect some response by other market participants (e.g., state and local governments, health system consortiums, etc.) to partially mitigate the losses. Cost shifting to commercial insurers and/or patients will likely occur.

Understanding the Medicaid ripple effect is essential as health care providers and valuators assess the financial landscape. For more insight on how Medicaid changes may impact your business, contact Weaver today.

©2025