Urgent Care Clinic Volumes Revert to Pre-Pandemic Levels

Health Care Valuation Services

Health Care Valuation Services

Never miss a thing.

Sign up to receive our insights newsletter.

Total urgent care patient volume has returned to pre-pandemic levels from elevated levels at the height of the COVID-19 pandemic. According to data from Experity Inc. (the leading provider of urgent care software solutions), urgent care visit volumes per center since early 2022 have aligned closely with figures from 2019. However, the landscape has changed since 2019, creating new challenges for the urgent care industry.

By the Numbers

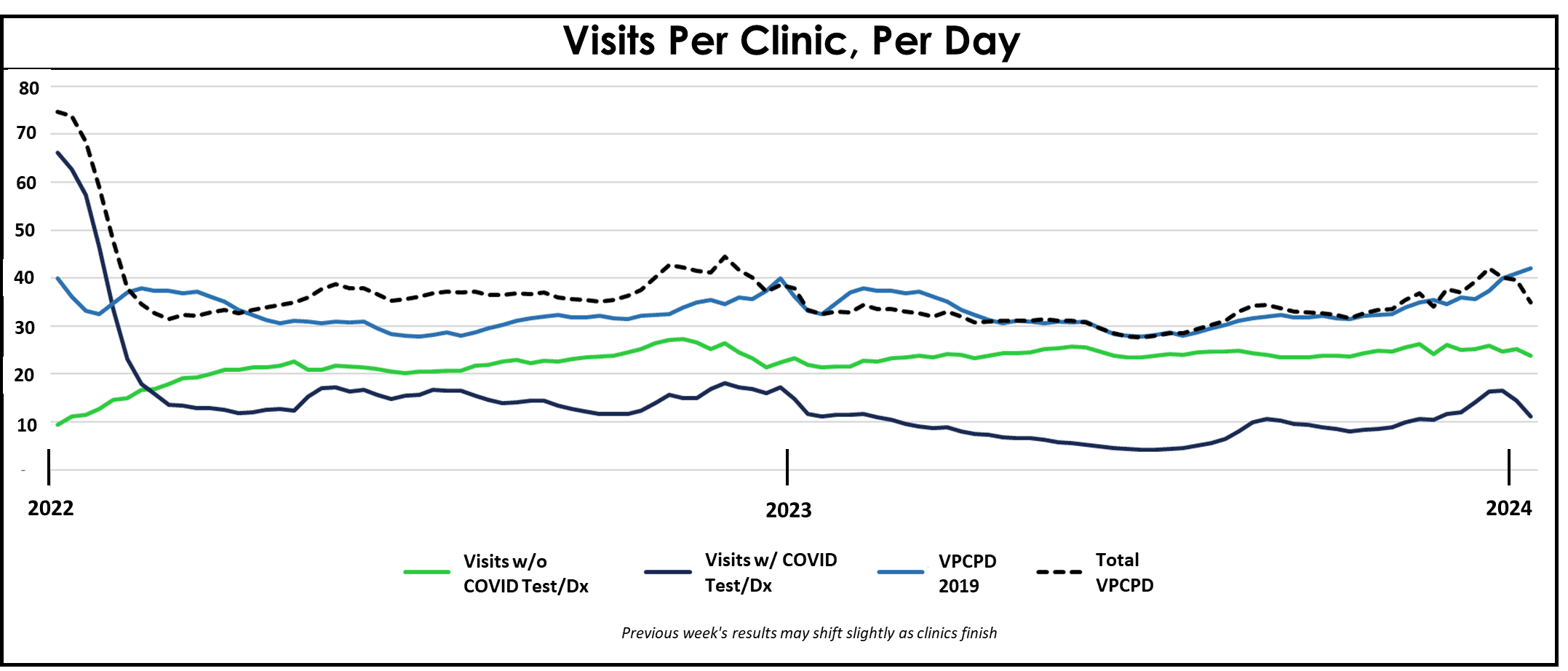

The Experity data displayed in the chart below trends total visits per center over time. This data includes visits with and without COVID tests or diagnosis, as well as total visits per clinic, per day for 2019.

Source: Experity, Inc. data range: January 2022 to January 2024

According to the data charted above:

- Volume per center decreased from pandemic levels in February 2022, as the immediate elevated need for COVID-19 testing and treatment waned.

- Since that time, volume per center has stabilized, adjusted for seasonal volume.

- Since January 2023, total volume has closely mirrored total volume for 2019.

Yes, But…

- There are more urgent care centers today. The Urgent Care Association estimates about 14,382 as of July 2023, a 25 percent increase from 11,481 in 2019. The increase in centers dilutes patient volume per center.

- Visits per clinic per day excluding COVID-related diagnostic and testing services fall below figures from 2019, suggesting demand for certain core services (e.g., care for other illnesses, injury care, sports physicals, etc.) has been out-stripped by the increase in supply of clinics.

- Visits with COVID testing or diagnosis have remained steady since the spring of 2022, indicating that COVID-related services may remain common in urgent care centers for the foreseeable future.

- Expenses are significantly higher per center, as inflation has occurred in provider compensation and other costs. This increase in operating costs puts pressure on profit margins.

Health Care Valuation Takeaways

- Volume per center has not increased since pre-pandemic (2019).

- Given the current landscape, it is difficult for the valuator to justify growth in the valuation projection period until the industry restructures (e.g., fewer centers, lower cost, etc.). Many marginally performing urgent care centers should close. This will reallocate patient volume to the stronger centers and stabilize the costly competition for staff.

- Simultaneously, expenses per center are up significantly (e.g., labor, supplies, rent, etc.).

- Profit margins (on average per center) are down. This is a direct result of high operational costs and the dilution of patient volumes across more centers.

Weaver’s valuation team remains vigilant to the trends and opportunities that shape the health care space. Contact us today for information on how we can help.

Authored by Connor Campbell

©2024