Private Equity

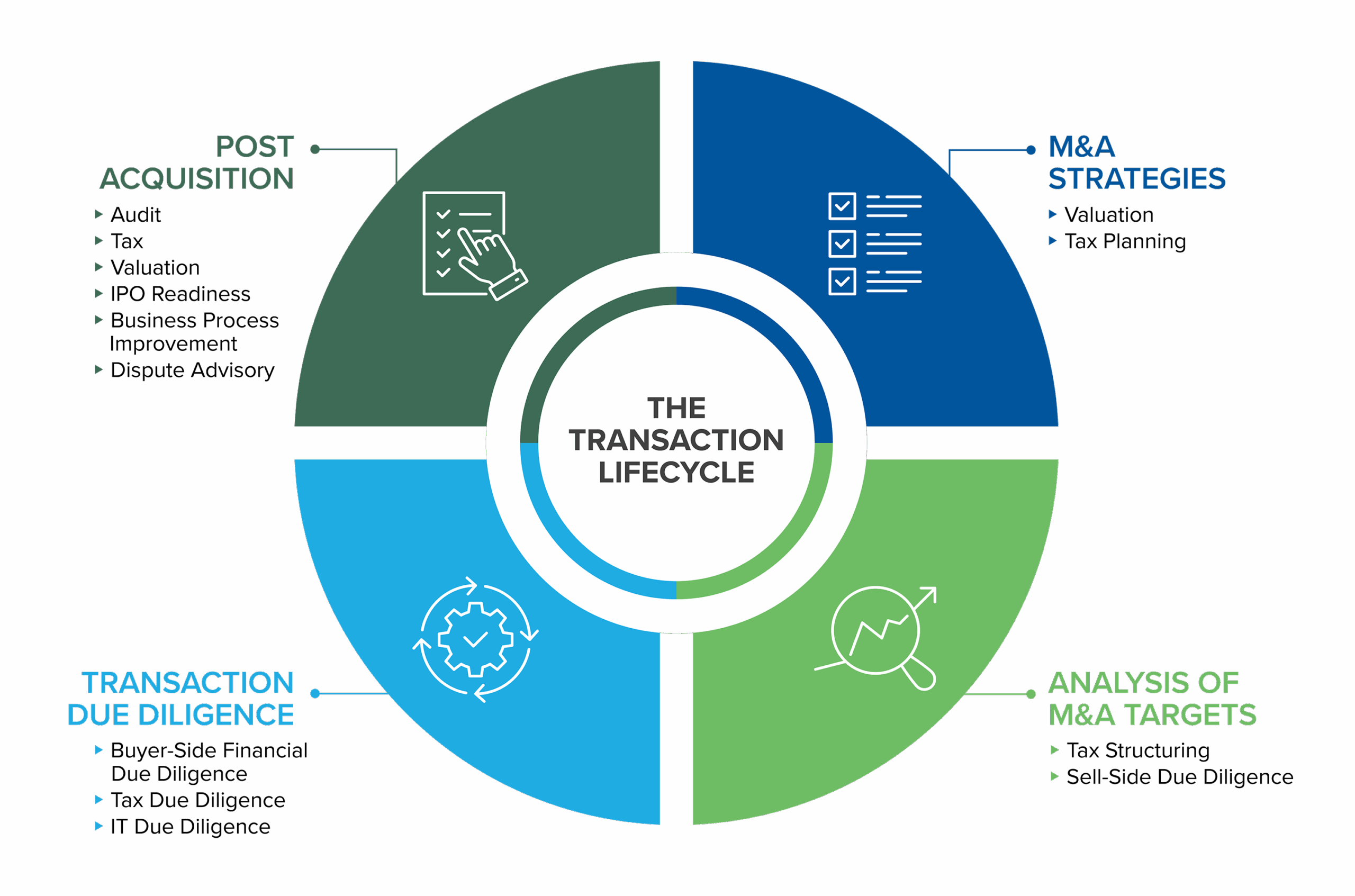

Weaver’s Private Equity practice group combines national-firm knowledge with a passion for client service to support your fund’s financial goals and strengthen your framework for sustainable growth. Our seamless multidisciplinary approach is designed to execute on the blocking and tackling at both the fund and portfolio company levels, freeing up your bandwidth to focus on maximizing returns.

Let's Get StartedTrending

Insights & Resources

What Weaver's Private Equity Services Can Do for You

At Weaver, we understand the complexities of selecting the right private equity service provider. Our team of knowledgeable professionals is dedicated to delivering customized solutions that align with your unique needs and goals. We combine industry experience, strategic insights and a client-focused approach to provide you with the highest level of service — committed to helping you succeed and thrive in today’s dynamic marketplace.

Connect with usStreamlined Processes to Support Growth.

Weaver began working with the Fund supporting financial reporting and compliance, and through the rapid growth period, the Fund turned to Weaver for the centralization and standardization of its investment strategies which included private equity, venture capital, private credit and impact investment. Weaver supported the development of the company’s governance models, policies and procedures, control structure, platform development and investment advisory compliance maturity assessment. With a shared commitment to excellence, Weaver’s team became integral in support of the management strategy of its $12.7 billion in capital.