The Future of US Health Care Profits

Never miss a thing.

Sign up to receive our insights newsletter.

Key Assumptions and Valuation Impact for Providers

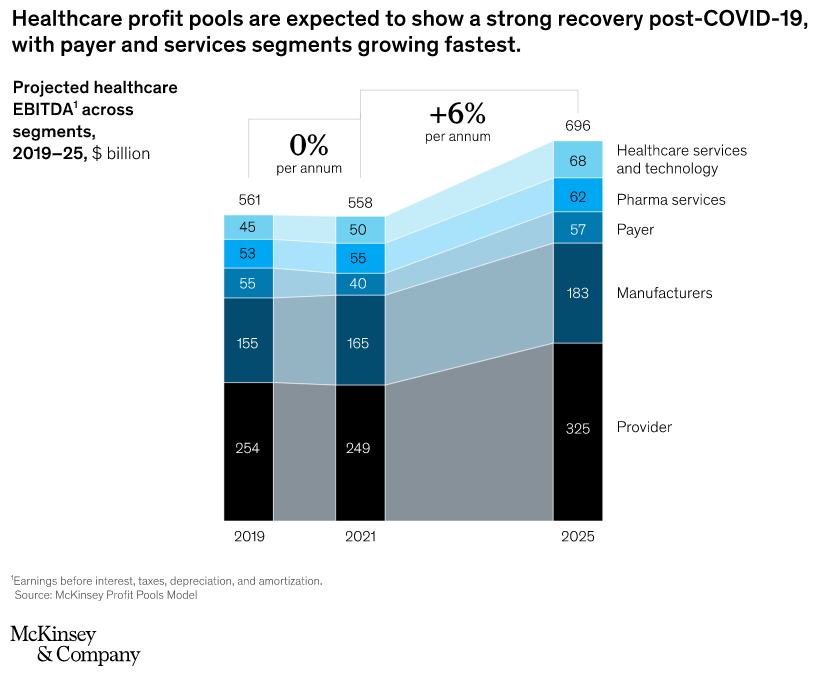

In The future of US healthcare: What’s next for the industry post-COVID-19, published by McKinsey & Company on July 19, 2022, the authors analyze and predict the financial performance for five large segments within the health care industry over the next four years. Providers represented the largest category, with reported EBITDA of $249 billion in 2021.

Interestingly, the article highlighted significant improvement in expectations for provider financial performance. In particular, it forecasts provider EBITDA to grow at an approximate 7.0% compounded annual growth rate over the next four years, from $249 billion in 2021 to $325 billion in 2025. It also predicted consistent shifts in payers and sites of care.

Key Assumptions

Expectations of elevated provider profit pools after the post-2021 recovery are driven by several factors and key assumptions, including:

- Overall patient volumes are expected to increase, spurred by the aging U.S. population. The number of people over 65 is expected to grow three percent annually from 2021 to 2025 compared with about .5% for the U.S. population as a whole.

- Payer categories will shift. Many aging workers will move from commercial plans to Medicare, resulting in lower overall reimbursement; however, this shift will be balanced (in part) by the movement from Medicaid into commercial payers as the economy improves.

- There will be a shift to non-acute sites that have lower costs and two to three times higher profit margins compared to the acute setting. This is expected to drive the industry towards higher overall provider profits on a lower revenue base.

- The accelerated adoption of value-based care will deliver lower costs, better outcomes, and higher profits (margins of more than 15 percent) in primary care and specialty business models.

Yes, But…

Changes to key assumptions in the article could paint a different view.

- The authors did not address the potential for continued significant cost inflation; however, they did acknowledge persistent inflation could dent the outlook. Since the pandemic, personnel and supply cost inflation has continued to have a negative effect on provider profits across the spectrum.

- Changes to payer mix (however slight) have a large impact on profits and are difficult to predict on a yearly basis. If the assumed shift of patients from commercial payers into Medicare is underestimated and / or the assumed shift from Medicaid payers into commercial is overestimated, provider profits would have more severe negative pressures than anticipated.

- While EBITDA margins are higher in the non-acute setting, the absolute dollar amount of revenue and EBITDA are lower, with all else being equal. The article implicitly assumes that strong utilization growth in the non-acute setting will overcome the absolute EBITDA loss in the acute setting. Countervailing forces to increased utilization include continued technological disruption and value-based activities.

- Value-based care has yet to materially affect industry provider profits in a meaningful way. While exceptions apply, providers have not traditionally been successful managing value-based care initiatives over the long run.

Health Care Valuation Takeaways

- Many of the variables outlined in the article (payer mix changes, site-of-care changes, population growth) will continue to be relevant factors that influence the direction of provider EBITDA.

- The estimates contained in the article represent a positive macroeconomic outlook for providers in the aggregate; however, some providers are anticipated to benefit more than others.

- The valuator should closely follow changes to key variables in the macro and microenvironment in order to develop an informed forecast of future profits, thereby leading to a more supportable fair market value opinion.

Dig Deeper

For information about health care provider valuations, contact us. We are here to help.

© 2022

This is one in a series of related health care valuation posts:

- Surgery Outmigration Driving Elevated Valuation Multiples in the ASC Segment

- Increased Contract Labor Costs May Lead to Valuation Revisions

- Revenue Growth and EBITDA Multiple Expansion Drove Historical Health Care Investment Returns

- Expanding Supply of Urgent Care Centers Create FMV Considerations

- Behavioral Telehealth Growth May Mean Opportunities for Inpatient Operators

- Hospital Expense Statistics Illustrate Significant Labor Pressures

- Hospital Earnings Supported by Fewer Uninsured Patients

- Health Care Services Transaction Volume Declines Below Pre-Pandemic Levels