Increased Contract Labor Costs May Lead to Valuation Revisions

Health Care Valuation Services

Health Care Valuation Services

Never miss a thing.

Sign up to receive our insights newsletter.

Assessing the Durability and Longevity of Contract Labor Cost Increases

The pandemic has placed enormous strain on the nation’s health care workforce. Labor costs account for more than half of the typical hospital’s total expenses. Even a slight increase in labor costs can have a significant impact on a hospital’s total expenses and EBITDA margins.

The combination of employee burnout, fewer available staff, and increased patient acuity has forced hospitals to turn to contract staffing firms to help address staffing shortages. Health care providers have long worked with contract staffing firms to bridge temporary gaps in staffing. The pandemic-driven-staffing-shortage has created an expanded reliance on contract staff, especially contract or travel registered nurses. According to a survey by AMN Healthcare, one of the nation’s largest health care staffing agencies, 95% of health care facilities reported hiring nursing staff from contract labor firms during the pandemic.

By the Numbers

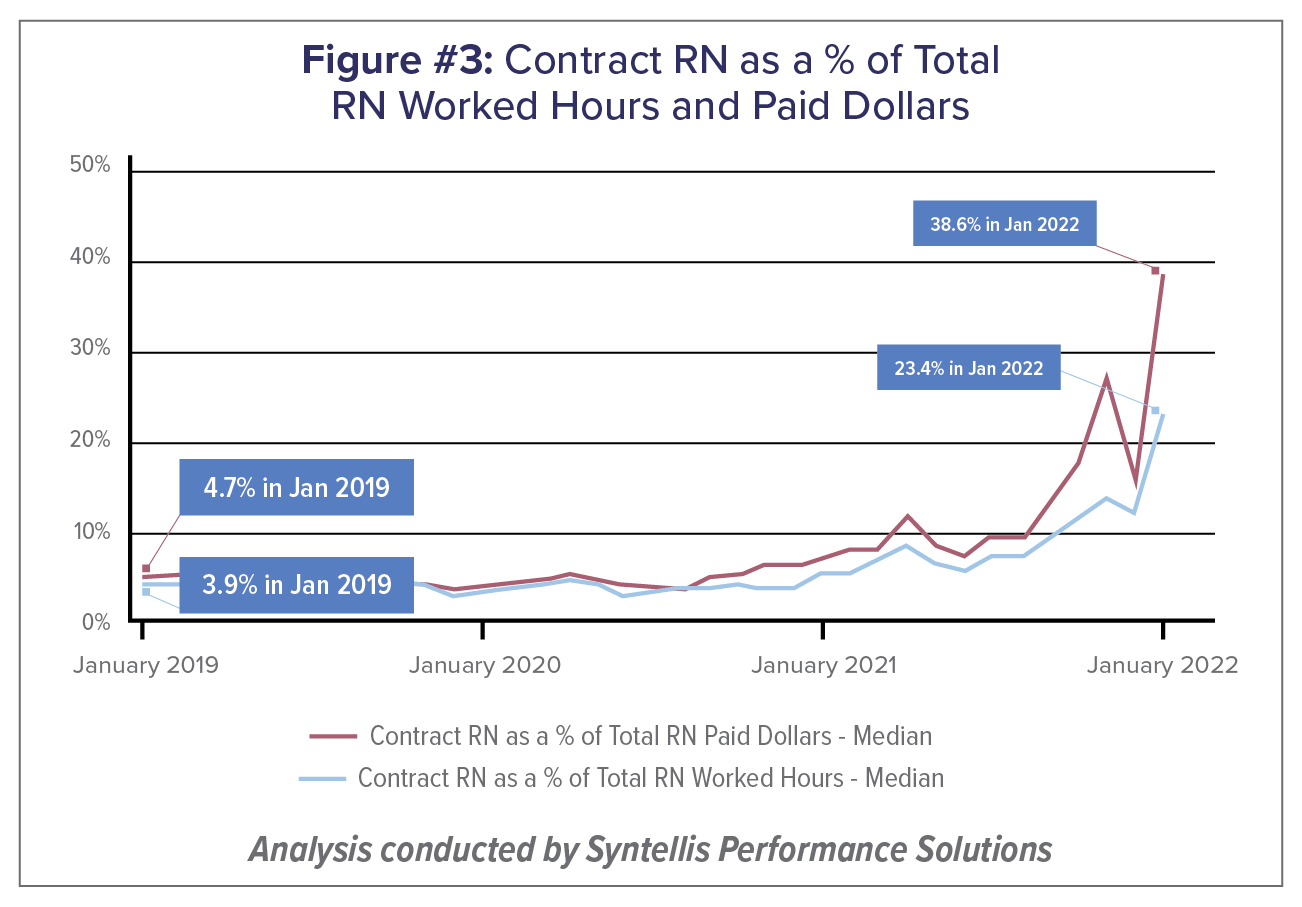

As illustrated in the chart below, Contract RN as a percentage of Total RN worked hours and paid dollars has increased significantly since 2019, prior to the pandemic.

Source: American Hospital Association

- Hours worked by contract or travel nurses as a percentage of total hours worked by nurses in hospitals has grown from 3.9% in January 2019 to 23.4% in January 2022.

- Illustrating the significant increase in contract labor RN rates, paid dollars increased at a much higher rate, from 4.7% in January 2019 to 38.6% in January 2022. The rise of the hourly rate has had a greater impact on cost than the amount of hours incurred.

Why It Matters

Health care providers may have difficulty returning to the contract labor percentages prior to the pandemic in the short time frame initially anticipated. The degree and speed of normalization of contract to permanent percentages will determine the rate and change of the structure of these businesses. Salary wages and benefits are likely to remain elevated for a long period.

- Public company hospital operators expect further improvement for the remainder of the year as they align the workforce appropriately by reducing the utilization of contract labor and the associated hourly rates. Numerous initiatives are underway around retention, recruitment, capacity management, new care models, and lower turnover.

- Hospitals are also adjusting base wages to be responsive to the market. Base wage adjustments will lower turnover and contract labor, but at a cost.

- Over time, hospitals hope to utilize payer contracts negotiations to get some relief from the wage inflation pressures.

- Disruption in the labor market and the pressure it places on labor cost inflation will likely moderate slower than the industry originally anticipated.

Health Care Valuation Takeaways

- Valuation during this post-pandemic time is very uncertain. The valuator needs to determine whether the contract labor is transitory or if the related base wage reflects more permanent wage inflation. Will the contract labor market revert to previous levels?

- Initiatives are under way to invest in recruiting and retention strategies and case management. Providers are hiring lower cost personnel to focus on non-surgical or non-clinical duties. Will these structural changes be effective?

- If the valuator believes that at least part of the contract labor increase will be enduring, then recent and future valuation multiples need to be reevaluated to account for lower structural profit margins for the industry.

Dig Deeper

For information about health care provider valuations, contact us. We are here to help.

© 2022

This is one in a series of related health care valuation posts:

- Surgery Outmigration Driving Elevated Valuation Multiples in the ASC Segment

- Revenue Growth and EBITDA Multiple Expansion Drove Historical Health Care Investment Returns

- Expanding Supply of Urgent Care Centers Create FMV Considerations

- Behavioral Telehealth Growth May Mean Opportunities for Inpatient Operators

- The Future of US Health Care Profits

- Hospital Expense Statistics Illustrate Significant Labor Pressures

- Hospital Earnings Supported by Fewer Uninsured Patients

- Health Care Services Transaction Volume Declines Below Pre-Pandemic Levels