Hospital Expense Statistics Illustrate Significant Labor Pressures

Never miss a thing.

Sign up to receive our insights newsletter.

What This Means for Fair Market Value Considerations Moving Forward

In most communities, hospital systems are still dealing with the effects of the pandemic on hospital staff and communities as a whole. According to Kaufman Hall’s August 2022 Flash Report (which reflects July data), hospital operating margins remain significantly lower than pre-pandemic levels due to historically high expenses even as recent monthly trends show some slight moderation.

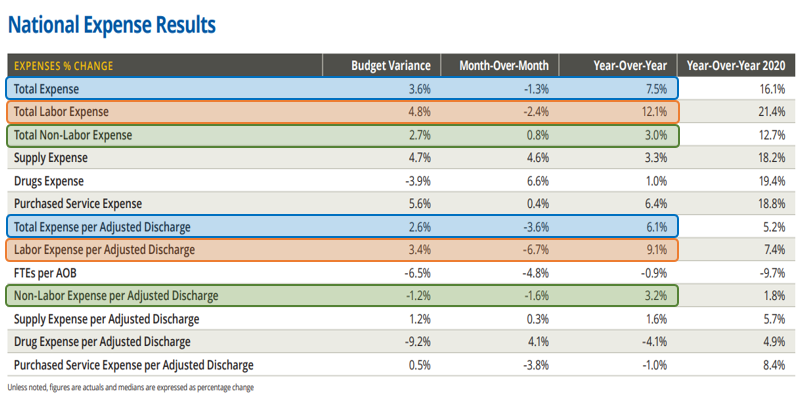

Inflation and labor shortages are contributing to a dramatic increase in total costs. Meanwhile, statistics indicate that hospital management is pulling every lever to control expenses. For example, total expense per adjusted discharge dropped 3.6% in July compared to May, and labor expense per adjusted discharge dropped 6.7% in July compared to May.

Per industry discussions, there has been an intense focus on reducing contract labor and hiring full-time and PRN staff. Hiring new staff often involves greater costs in the short-term with sign-on and referral bonuses becoming the new norm, in addition to overlap pay to contract labor while new staff is trained. The Kaufman Hall data indicates health care providers are finally beginning to see the results of their conversion away from contract labor.

These statistics illustrate hospital management’s ability to effect change and quickly implement cost reduction measures. They also show the difficulty in finding and retaining staff as labor expense growth remains sticky and is the leading negative variance to budget.

By the Numbers

Source: Kaufman Hall, Inc.

Key statistical takeaways from the Kaufmann Hall Flash Report include the following:

- Total labor expenses were up 12.1% year-over-year and 4.8% above budget, while total expenses were up 7.5% year-over-year and 3.6% over budget.

- Conversely, non-labor expenses were up a modest 3.0% year-over-year and 3.2% per adjusted discharge.

- Total expenses per adjusted discharge, a measure of volume adjusted expense management, is up 6.1% year-over-year, significantly below the total labor expense per adjusted discharge increase of 9.1% year-over-year.

Why it Matters

- Total labor expenses are significantly elevated year-over-year and against budget, but other expense categories have grown more modestly. Examples of categories with modest growth include drug and administration costs. Elevated expenses will yield lower operating margins, which will affect hospital systems’ long-term reinvestment into their facilities and communities and make hospital systems more susceptible to future financial stresses.

- Hospital operating margins are deteriorating and have yet to stabilize. Even after abnormally high contract labor expenses subside, labor-pricing levels could permanently adjust to elevated levels, affecting costs and operating margins in the long-term.

- There are levers that hospital management can pull to adjust to the current cost escalation labor trends. However, hospitals face the difficult task of keeping existing employees and filling essential roles while lowering costs. In many markets, there are few candidates to replace departing workers.

- Commercial payor rates for 2023 and beyond may at least reflect some inflationary costs and provide some much-needed relief to stabilize operating margins.

Health Care Valuation Takeaways

- The valuator should use caution when estimating future hospital operating margins. While labor is the largest and most important expense category, there are mitigating factors that can assist in operating margin stability. For example, commercial payor price increases, while delayed to 2023, may assist in operating margin stability.

- There is balance between finding staff savings and maintaining revenue. Lack of essential staff levels will affect the hospital’s ability to accept new patients, accommodate physician surgical schedules and sustain quality. The valuator should determine whether management has been able to maintain revenue generation while cutting costs.

- Even if macro-inflation growth cools, elevated expenses may have reached new permanent shelf levels. More history is needed to determine the long-term persistence and impact of inflation. Some hospitals systems will be more successful than others at stabilizing operating margins.

Dig Deeper

For information about health care provider valuations, contact us. We are here to help.

© 2022

This is one in a series of related health care valuation posts:

- Increased Contract Labor Costs May Lead to Valuation Revisions

- Revenue Growth and EBITDA Multiple Expansion Drove Historical Health Care Investment Returns

- Surgery Outmigration Driving Elevated Valuation Multiples in the ASC Segment

- Expanding Supply of Urgent Care Centers Create FMV Considerations

- Behavioral Telehealth Growth May Mean Opportunities for Inpatient Operators

- The Future of US Health Care Profits

- Hospital Earnings Supported by Fewer Uninsured Patients

- Health Care Services Transaction Volume Declines Below Pre-Pandemic Levels