For Hospitals in Distress, the Time to Take Action May be Now

Never miss a thing.

Sign up to receive our insights newsletter.

While no hospital has been untouched by the coronavirus pandemic, some may find the recovery more challenging than others. These hospitals may not have the financial resources or proper strategic alignments to prosper post-pandemic and may face transaction scenarios. Especially vulnerable are independent district-owned, not-for-profit, certain for-profit and rural operators.

Panelists on Weaver’s recent webinar, “Distressed Situations: Real Estate Value for Hospital Sale or Lease,” provided insightful commentary on the challenges that hospital operators face and shed light on real estate valuation considerations when entering into a transaction scenario. Here are some key points from the conversation:

- A multitude of factors will continue to impact hospital providers post-pandemic.

- “Healthcare has always been a story of the ‘haves’ and ‘have-nots’…the pandemic may have widened this gap.” – Panelist Kevin Reed, Reed, Claymon, Meeker & Hargett, PLLC

- Oversight committees should not postpone evaluating sale or lease options until situations become dire. Negotiations are complex and deals may take up to two years to complete.

- “There are one hundred things that might happen in a transaction, and only one of those is good.” – Panelist Jonathan Spees, Marine Street Consulting

- Compliance with the Fair Market Value (FMV) standard is especially important for transactions involving nonprofits and governmental districts.

- The role of an attorney or transaction advisor is NOT to bias an independent FMV analysis by guiding towards a specific result. Rather, the attorney or advisor should ensure the valuation firm understands the appropriate information and relevant fact pattern.

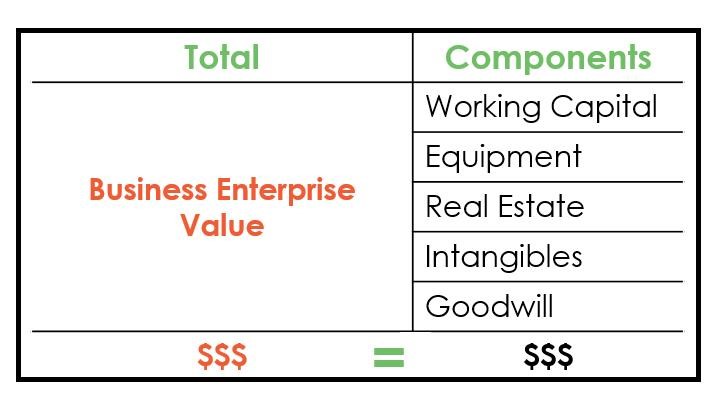

- Valuation approaches for hospital real estate are more nuanced compared to typical multi-use facilities. Particularly when operations are distressed or challenged, a hospital’s real estate value must fit within the context of its total enterprise value.

- One valuation theory suggests the worth of a total business enterprise is the sum of its future cash flows, discounted back to a present value.

- Challenged or distressed operators may have low or negative current cash flows which (all else being equal) translates to a low business enterprise value.

- Because valuation looks towards the future, qualified appraisers must understand which levers typical buyers may pull to achieve better financial performance. Potential for operating performance improvements leads to a higher total enterprise value, and thus higher real estate value.

A successful sale or lease requires the commissioning of a qualified team to advise through the process, including legal representation, transaction advisory and use of a qualified valuation firm. For more information or any other questions, contact a Weaver professional today.

Should you need additional assistance, our panelists can be contacted as follows:

- Kevin Reed, Member – Reed, Claymon, Meeker & Hargett, PLLC

- Jonathan Spees, Principal and Founder – Marine Street Consulting

- Rick Edwards, Managing Director, Real Estate Valuation Services – Weaver

© 2021