Off-Highway Fuel Use Credits — Qualifying a Chassis as Mobile Machinery

Related

Never miss a thing.

Sign up to receive our Tax News Brief newsletter.

In earlier blogs, we discussed the basic rules for claiming an off-road credit and the Internal Revenue Service’s (IRS’) rejection of the dual-use test. This post specifically examines when a vehicle is not considered a highway vehicle and qualifies as a specifically designed mobile machinery for nontransportation functions. Understanding the qualifiers is especially timely as businesses in key industries seek to maximize tax benefits and ensure compliance with IRS regulations.

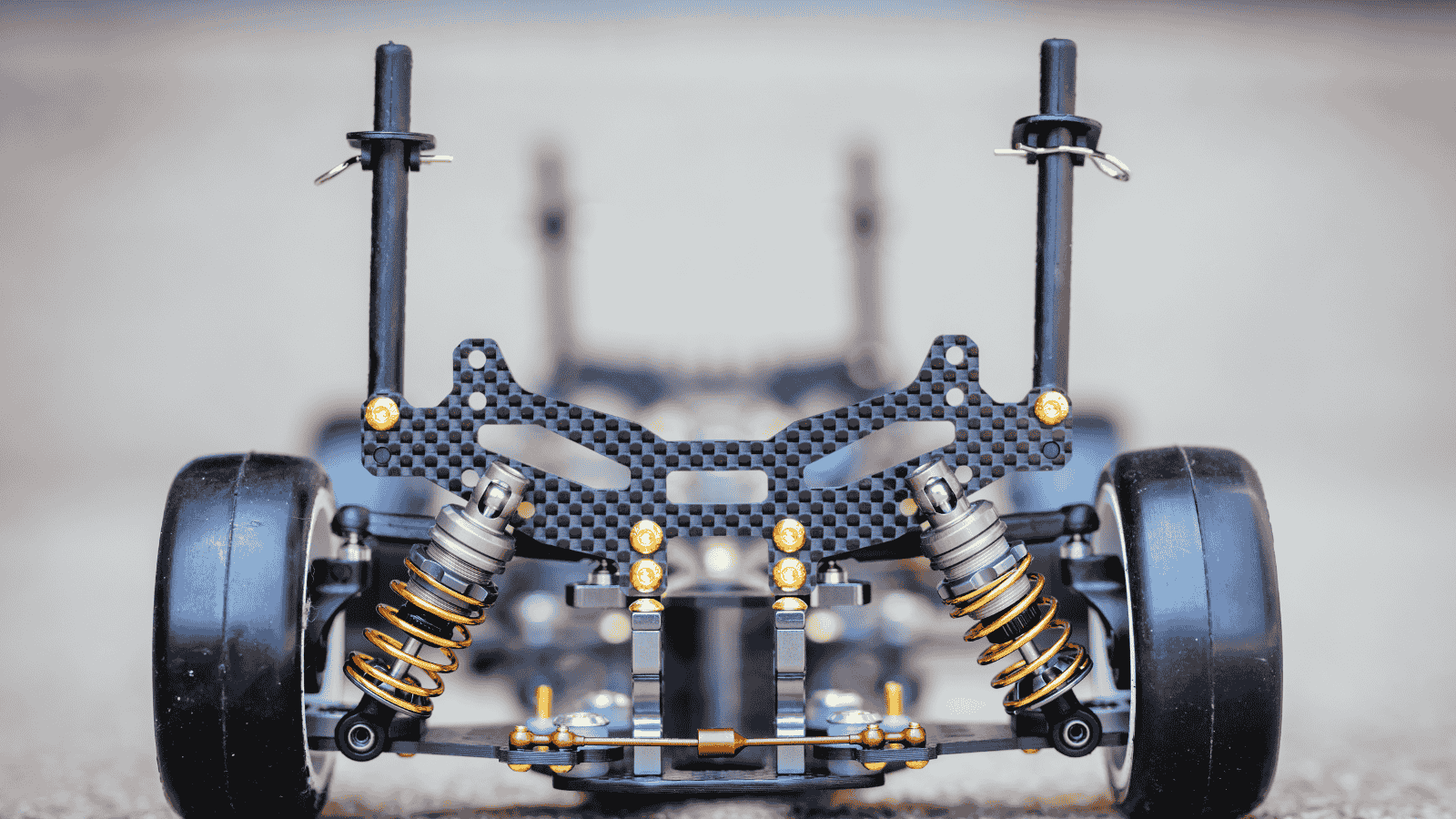

A vehicle qualifies as specifically designed mobile machinery for nontransportation functions if its chassis meets the designed-based and use-based tests. The chassis, which is the base frame of a motor vehicle, is commonly used in various industries including construction, manufacturing, timbering, drilling, farming and mining. A vehicle meets the design-based test if its chassis fulfills the following three criteria:

- The vehicle has permanently mounted machinery or equipment that performs an operation unrelated to transportation on or off the public highways.

- It has been specifically designed to serve as a mobile carriage and mount.

- Due to its special design, the vehicle cannot carry any load other than what it was designed to carry without substantial structural modification as outlined in Internal Revenue Code (IRC) Section 6421(e)(2)(C)(iii).

To meet the use-based test, under 26 USC 6421(e)(2)(C)(iv), the IRS states, “[t]he use-based test is met if the use of the vehicle on public highways was less than 7,500 miles during the taxpayer’s taxable year. This clause shall be applied without regard to use of the vehicle by any organization which is described in section 501(c) and exempt from tax under section 501(a).” In other words, if the vehicle is used for business purposes and driven less than 7,500 miles on public roads, it could qualify for off-highway fuel credits unless it’s being used by a not-for-profit organization. In that case, the mileage doesn’t matter for this test.

Ensuring vehicles meet the design-based and use-based tests can lead to valuable tax savings and maintain compliance with IRS regulations. Contact us. We can help evaluate if a chassis qualifies.

Authored by Kelly Grace and Leanne Sobel

©2025

Off-Highway Fuel Credits and Refunds Series

Our series explores off-highway fuel credits and refunds, covering key topics like navigating IRS rules, how different states handle these credits and tips for substantiating off-road claims. Whether you’re aiming to maximize tax benefits or ensure compliance with regulations, this series will provide the guidance you need.

- Off-Highway Fuel Use Credits — Overlooked or Overpaid?

- Off-Highway Fuel Use Credits — IRS Rejects Dual-Use Single Engines While States Take a Mixed View

- Off-Highway Fuel Use Credits: Qualifying a Vehicle Without a Chassis

- Off-Highway Fuel Use Credits — IRS Offers Stationary Shelter Exception

- Off-Highway Fuel Use Credits — My Vehicle Qualifies … Now What?