Profitability Drives Recent Hospital Valuations: Recognizing Variability in Transaction Databases

Never miss a thing.

Sign up to receive our insights newsletter.

One key factor continues to play a pivotal role in determining hospital valuations: profitability. This concept, while seemingly straightforward and consistent across various health care sectors, is particularly pronounced in hospital transactions. Recent historical transactions clearly indicate that hospitals with strong profitability command a significant valuation premium.

While buyers can sometimes turn unprofitable hospitals around through improved managed care rates, supply chain improvements and overhead efficiencies, they generally do not pay a premium for hospitals solely based on potential. Instead, a hospital’s standalone profitability and outlook remain the primary drivers of fair market value (FMV). In today’s fluctuating market, understanding how profitability shapes hospital valuations is critical for health care leaders, investors and valuation professionals to make better-informed pricing decisions.

By the Numbers

We have analyzed all hospital transactions with publicly available information between 2019 and 2024. While there are a multitude of factors that impact hospital valuations (e.g., outlook, earnings before interest, taxes, depreciation and amortization (EBITDA), capital expenditures, etc.), we have focused on revenue multiples for purposes of our analysis.

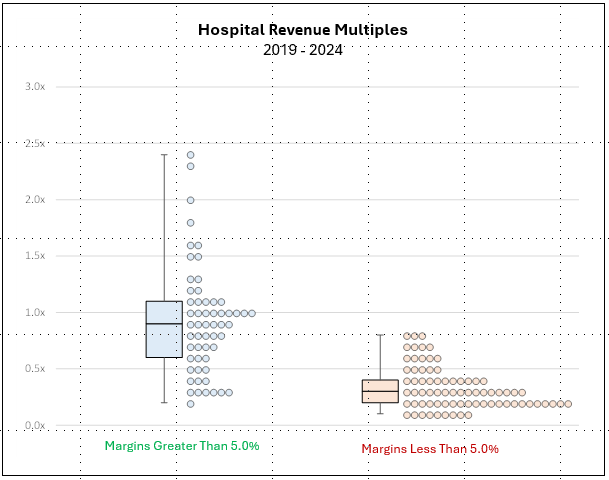

The revenue multiples presented in the below box and whisker and scatterplot chart display the median (horizontal line inside the box), lower and upper quartiles (top and bottom lines in the box), and minimum and maximum extremes of the data (the whisker lines coming out of the box). The corresponding circles represent individual data points.

Source: Author analysis of Scope Research’s database.

The observed revenue multiples are divided between hospitals with EBITDA margins above and below 5% using the most recent financials before each transaction. The data reveals:

- Profitability drives broader ranges: While most data points generally cluster around the median, hospitals with profit margins greater than 5% had revenue multiples range from 0.25 to 2.4 times revenue, with upper and lower quartiles between 0.7 to 1.1 times revenue.

- Lower margins narrow the field: Revenue multiples for hospitals with profit margins below 5% are more narrowly dispersed, ranging from 0.2 to 0.8 times revenue, and are highly clustered between 0.3 to 0.4 times revenue. These valuation levels generally only support tangible asset value, such as real estate, equipment and working capital. Dive deeper about valuation concepts for underperforming hospitals in our article, For Hospitals in Distress, the Time to Take Action May be Now

- The mode tells the story: The most common revenue multiple (the mode) for hospitals with EBITDA margins below 5% is approximately 0.2 times revenue, whereas for those above 5%, it is approximately 1.0 times revenue.

Why It Matters

- Understanding the range and dispersion of transaction multiples is crucial for applying information from transaction databases in valuations. The wider the range (i.e., difference between minimum and maximum values) and higher the dispersion (i.e., variation of data point distribution), the less likely a pure application of industry mean or median revenue multiples is appropriate.

- Notably, there are significant differences in revenue multiple ranges between hospitals with more or less than a 5% EBITDA margin. The mean and median revenue multiple differences are substantial between each grouping, and revenue multiples for less profitable hospitals are relatively tighter.

Health Care Valuation Takeaways

- Health care valuation professionals must thoroughly understand and analyze any transaction database to use the information accurately. Relying solely on the median values of a data set can lead to inaccurate conclusions, especially if the database exhibits varying levels of dispersion and range. For relatively unprofitable hospitals, valuations based on revenue multiples tend to cluster within a narrow range compared to more profitable operations.

- Within any health care segment, the valuator should also examine the broader data set to understand what’s driving variations in multiples. Factors such as hospital size, growth trajectory and profitability can influence value. Appropriate factor adjustments can ensure a more supportable fair market value opinion.

Navigating hospital valuations with clarity is essential for making well-informed decisions in today’s dynamic health care market. For guidance on hospital transactions and valuations, contact us. Our professionals can help you make strategic choices that move your organization forward.

©2025