Understanding Challenges and Value Drivers in Behavioral Health

Health Care Valuation Services

Health Care Valuation Services

Never miss a thing.

Sign up to receive our insights newsletter.

Acadia Healthcare: Navigating Macro Headwinds and Valuation Lessons

Behavioral health leaders face tightening reimbursement models, rising operating costs and uncertainty around government funding. While demand for services remains strong, sustaining profitability and growth has become increasingly difficult. This current market reality requires facilities to take a closer look at their growth and capital strategy to protect long-term value.

On its third quarter 2025 conference call, Acadia Healthcare Inc., one of the nation’s leading providers of behavioral health services, announced reduced EBITDA guidance, reflecting mounting pressures on its business. Management emphasized a renewed focus on strengthening free cash flow potential as a strategic response to these challenges.

The updates shared during the call offer important signals for providers, investors and valuation professionals assessing risk, resilience and opportunity in today’s behavioral health landscape.

Key Headwinds

Acadia’s headwinds mirror the challenges impacting the behavioral health industry, including:

- Volume softness: Lower patient admissions reducing revenue

- Length-of-stay pressures: Payers, especially Medicaid managed care, pushing for shorter treatment durations

- Increased denials: Higher rejection rates from insurers

- Bad debt growth: Rising unpaid balances

- Weak rate updates: Annual payer rate adjustments below expectations

These factors have weighed heavily on performance, contributing to a 56% year-to-date stock price decline as of November 12, 2025.

Bed Expansion Trends and Signals

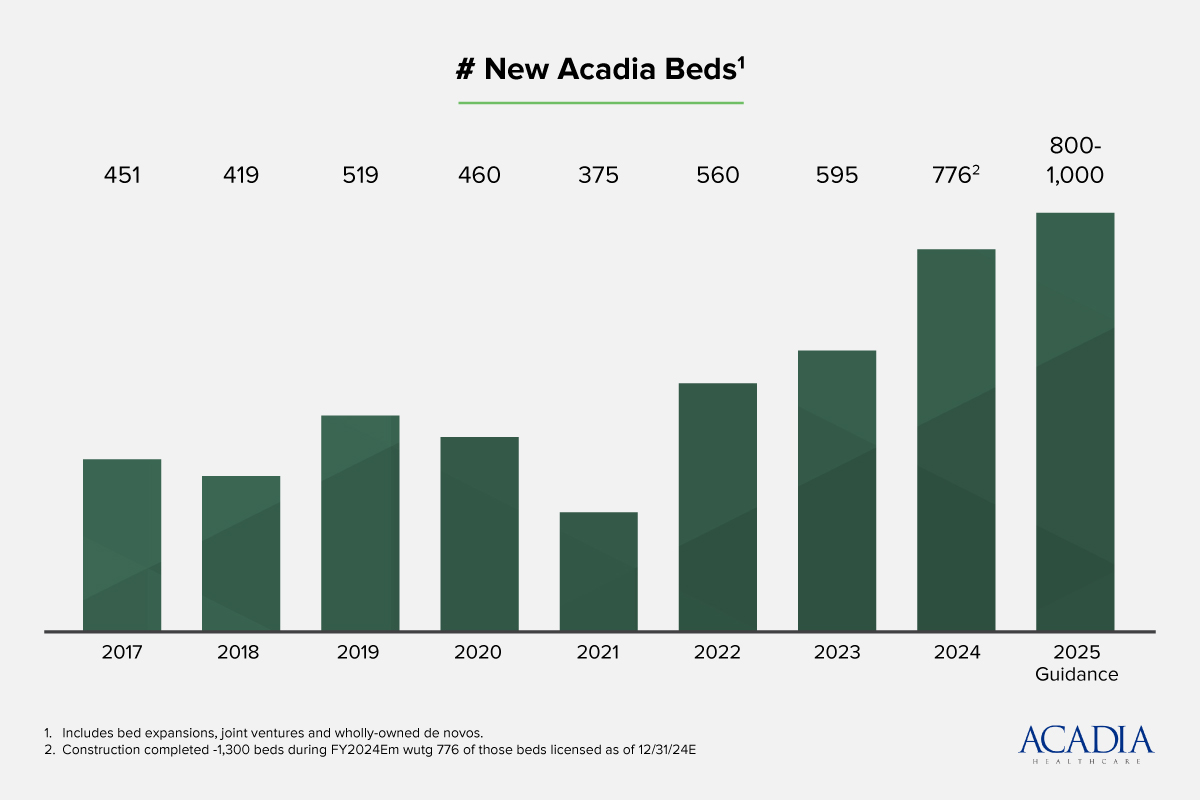

Acadia’s historical bed expansion aligned closely with steady demand and reimbursement trends. More recently, the company has shifted toward accelerated scaling, introducing greater risk alongside potential opportunity. The timeline below shows how this strategy has evolved.

Source: Raymond James Institutional Investors Conference – March 2025

- Acadia has consistently added approximately 500 beds per year across expansions, joint ventures and wholly-owned de novo facilities.

- This steady pace reflected a disciplined growth strategy aligned with market demand and reimbursement stability.

- In 2024, Acadia accelerated growth with an additional 250 beds, exceeding the historical average.

- For the 2025 guidance, management projected another 250-bed increase, indicating a more aggressive expansion posture.

- Combined, this represents a significant step-up in capacity compared to prior years.

November 2025 Update: A Strategic Reset on Growth and Capital

Acadia’s earlier expansion plan for 2024-2025 reflected a shift from steady, predictable growth toward accelerated capacity increases. This demonstrated management’s confidence in the demand for behavioral health services and health systems partnerships, but it also raised questions about capital allocation in an uncertain environment.

As headwinds intensified and the risk of Medicaid cuts became more evident, Acadia pivoted its growth strategy, placing greater emphasis on capital discipline and portfolio optimization rather than aggressive expansion. The revised plan includes:

- 2026: Planned addition of 500-600 beds, a 40-50% reduction from 2025 levels

- 2027: Further slowdown to 150-250 beds, a 50% decline from 2026 and the lowest annual increase since 2017

- Capex reduction: 2026 capital expenditures expected to be $300 million below prior guidance

- Development pause: Several projects placed on hold to conserve resources

- Facility closures: Five facilities slated for closure as part of portfolio optimization

Health Care Valuation Takeaways

For investors and operators alike, shifting growth strategies and reimbursement uncertainty are reshaping how value is assessed across the behavioral health landscape. Acadia’s strategic shifts reveal important takeaways for anyone assessing value in behavioral health services.

- Adaptability matters: Valuation experts must assess management’s ability to pivot in response to reimbursement pressures and other negative macroeconomic forces.

- Cash flow over EBITDA: Free cash flow (operating profit less capital expenditures) is a more reliable measure of value in healthcare services. EBITDA does not drive future value. Rather, free cash flow is the ultimate measure of value.

- Scenario analysis: Valuation experts must understand downside cases that incorporate reimbursement pressure while upside cases should reflect operational improvements and strategic responses.

- Time Horizon: Reimbursement pressures in the behavioral health industry are likely temporary. Conversely, strong and increasing demand for behavioral health services will persist well into the future.

Weaver Puts Insights into Action

Behavioral health organizations, investors and operators can apply these insights to inform growth, capital allocation and valuation decisions. For guidance tailored to your organization’s unique situation, contact us. Our team can help you address these challenges and seize opportunities in today’s market.

©2026