Where Imaging Demand Is Accelerating and How It’s Reshaping Valuations

Health Care Valuation Services

Health Care Valuation Services

Never miss a thing.

Sign up to receive our insights newsletter.

Outpatient imaging volumes are expected to rise steadily over the next decade, but not all modalities will grow at the same pace. Routine studies such as X-ray, ultrasound and nuclear medicine are projected to increase in line with population trends. In contrast, advanced modalities, central to diagnosing cancer, cardiovascular disease and neurological conditions are positioned for significantly faster expansion. These shifts carry important implications for valuation and capital planning.

By the Numbers

Sg2, a Vizient company, highlights a clear shift toward higher-acuity, higher-reimbursement imaging. This is an important factor influencing valuation and capital allocation for imaging centers and radiology platforms.

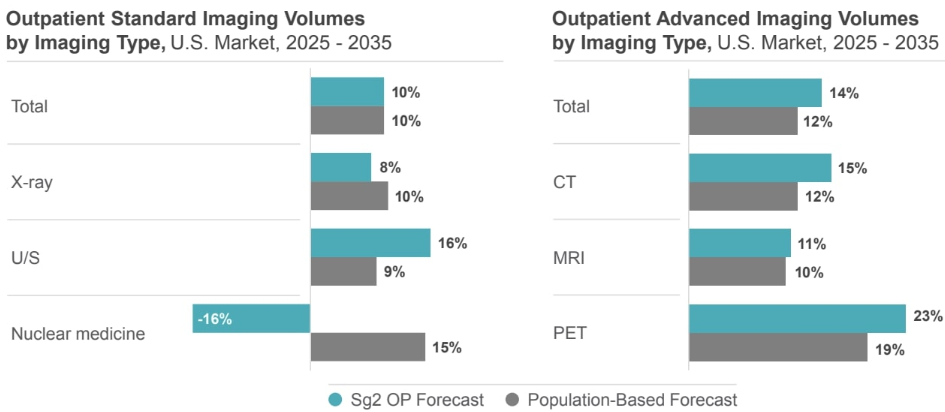

Sg2’s estimates frame outpatient imaging volume growth over the next 10 years, with a population-based baseline forecast included for comparison.

Source: Impact of Change®, 2025; Proprietary Sg2 All-Payer Claims Data Set, 2023; 2023 CMS Limited Data Sets (Carrier, Denominator, Home Health Agency, Hospice, Outpatient, Skilled Nursing Facility); Claritas Pop-Facts®, 2025; Sg2 Analysis, 2025.

- Standard imaging scans from 2025 to 2035 are expected to grow 10%, generally mirroring population growth. Among standard modalities, ultrasound is projected to increase most rapidly (+16%) compared to x-ray (+8%), while nuclear medicine is expected to decline (-16%).

- Advanced imaging volumes are projected to significantly outpace population growth, with PET leading at +28%, followed by CT (+18%) and MRI (+11%), all exceeding baseline estimates.

Why it Matters

- Diagnostic imaging is undergoing rapid transformation, driven by technological innovation, clinical advancements and evolving care needs. Demand is rising as advanced imaging becomes essential for earlier detection, precision diagnosis and treatment planning, particularly for oncology, neurology and cardiology.

- PET is no longer a niche modality; it has become a growth engine. PET plays an expanding role in diagnosing and monitoring cancer and Alzheimer’s disease and often complements MRI in memory-care workups.

- Growth, however, is uneven. Standard imaging faces margin compression risk: slower growth means that operating expenses and capital requirements may outpace revenue over time, eroding profitability.

RadNet, Inc. Statistics and Quotes

RadNet, Inc., the nation’s largest publicly traded outpatient imaging company, operates more than 400 outpatient imaging centers in multiple states. RadNet’s performance illustrates how advanced imaging is reshaping volume mix nationally.

- In Q3 2025, same-center advanced imaging increased 9.9%.

- On a same center basis (excluding acquisitions), scan volume increased 8.5% for MRI, 8.7% for CT and 16.3% for PET/CT.

- Advanced imaging comprised 28.2% of all scans in Q3 2025 compared to 25.7% in Q4 2024, representing a notable shift in modality mix.

According to recent comments by RadNet President and CEO Dr. Howard Berger, the shift toward advanced imaging “is both a reflection of overall industry trends and the capital investment we have made in advanced imaging equipment.”

Health Care Valuation Takeaways

- Valuation multiples will likely widen between commodity imaging centers and those with strong advanced imaging capabilities. Higher-acuity modalities support stronger growth and profitability expectations.

- Equipment replacement strategy matters. Advanced imaging requires thoughtful capital planning, access to financing, regulatory compliance and safety approvals. Platforms with scalable capital strategies and reliable capital access typically achieve higher valuations.

- Market share is shifting. As hospital systems transition outpatient imaging from owned sites to joint ventures or independent networks with strong CT/MRI access, those providers are positioned to capture volume from competitors with limited advanced-imaging capacity.

For more information about how uneven growth affects business valuation, contact us.

©2026