Did the Paycheck Protection Program Flexibility Act of 2020 Give Borrowers a Free Pass?

Never miss a thing.

Sign up to receive our insights newsletter.

This blog reflects rulings and guidance from the U.S. Treasury as of June 24, 2020.

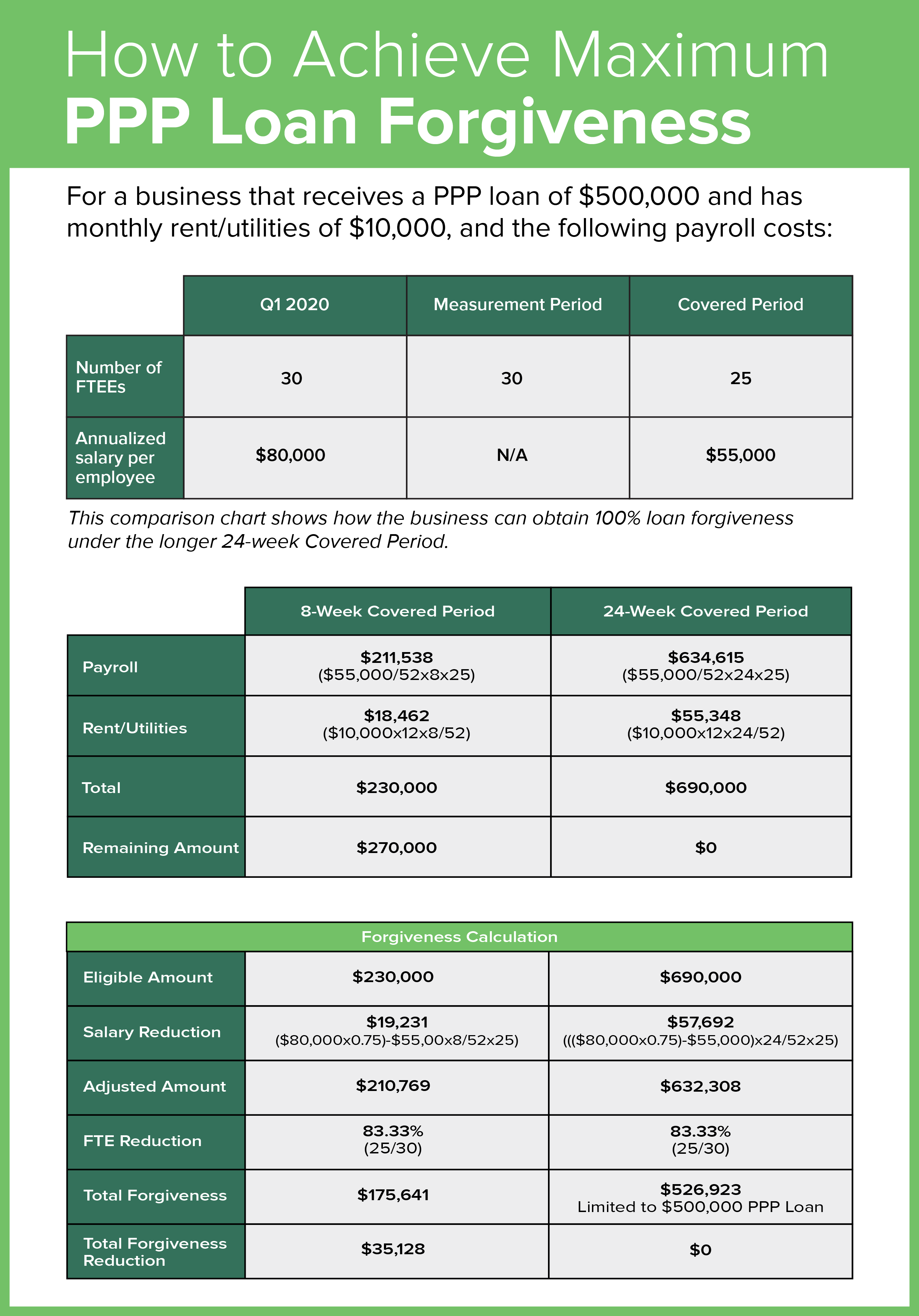

Under the newly revised Paycheck Protection Program (PPP), an extension of loan periods from eight to 24 weeks may have unintended consequences that are likely to give borrowers a free pass. The application appears to allow borrowers to obtain full loan forgiveness by including eligible expenses paid or incurred, even if those expenses are higher than the loan amount.

Is this what Congress intended?

Following the enactment of the original PPP, many borrowers were struggling to rehire workers and spend PPP funds within the 8-week period covered by the loan. In response to this and other concerns, new PPP legislation signed by President Trump on June 5, 2020:

- Extended the Covered Period of PPP loans from 8 to 24 weeks;

- Decreased the requirement for eligible forgiveness from at least 75 percent of payroll to a minimum of 60 percent of payroll; and

- Provided additional exceptions for headcount reductions.

The salary/hourly wage reductions and full-time equivalent employee (FTEE) reductions did not change.

By extending the Covered Period, Congress intended to give borrowers more time to use the loan funds. But in doing so, it may give borrowers the opportunity to achieve full loan forgiveness even though the forgiveness amount should be reduced based on a reduction in the number of FTEEs and/or salary and wages.

To address this concern, Treasury could modify the PPP Loan Forgiveness Application to account for the salary/wage reduction and the FTE reduction by placing a cap on the sum of total eligible payroll and non-payroll costs allowable in the forgiveness calculation equivalent to the loan amount.

For more information about the PPP program and loan forgiveness, contact us. We are here to help.

© 2020