Managed Care Companies Predicting the “Worst of Two Worlds”

Never miss a thing.

Sign up to receive our insights newsletter.

Incorporating MCO Utilization Estimates into Provider Valuations

Commentary from publicly traded Managed Care Organizations (MCOs) regarding their insurance spend expectations can be an excellent source of macroeconomic data for health care valuation professionals when projecting performance for provider entities. Now halfway through 2021, MCOs are generally factoring continued COVID costs coupled with higher non-COVID utilization into their full year 2021 earnings estimates: the worst of two worlds from the MCO’s perspective.

Why it Matters

- Since providers earn the dollars that MCOs spend, these predictions, (if accurate) are a good macroeconomic source to assist when developing a forecast of provider revenue in the near term by payer and population segment.

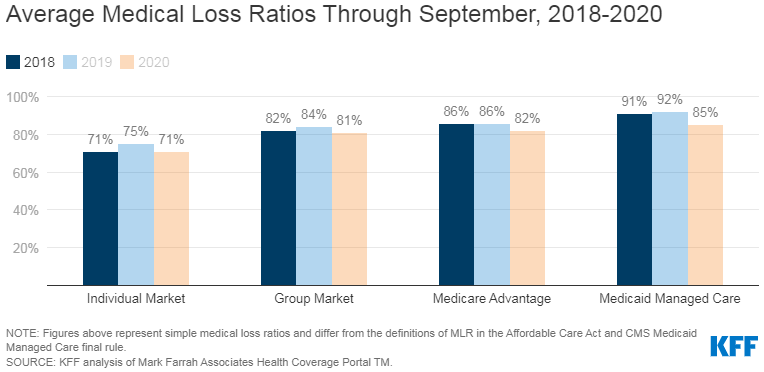

- The medical loss ratio (MLR) reflects the percentage of MCO premiums paid to providers due to insured patient utilization of health care services. This ratio was lower in 2020 compared to prior years due to less overall non-COVID patient utilization from deferred, delayed, or canceled services and patient hesitancy.

- For the second half of 2021, MCO commentary indicates that they anticipate continued payout for patients with COVID. However, unlike the low levels experienced in 2020, MCOs also expect commercial non-COVID utilization to be at or above the 2019 baseline. Comparatively, the Medicare Advantage patient non-COVID utilization is expected to be below the 2019 baseline, and Medicaid patient non-COVID utilization is expected to be below Medicare Advantage.

For Example:

- Overall, MCOs do not expect the strong performance (i.e. low MLR) of 2020 to continue into 2021. Examples of MCO commentary regarding 2nd quarter actual utilization, COVID estimates for the second half of 2021, and non-COVID utilization estimates for the second half of 2021 are summarized below:

|

Managed Care Organization |

Historical Q2 2021 |

Rest of Year |

|

|

Observations |

COVID Estimates |

Non-COVID Estimates |

|

|

Cigna |

*Ongoing *Non-COVID *Medicare |

*Lower |

*Commercial *Mental *Radiology |

|

Anthem |

*Non-COVID *Medicaid *Overall |

*Higher |

*Above *Inpatient *Physicians *Unclear |

|

|

*Higher *Vaccine |

*Slightly |

*Return *Inpatient, *ER |

|

|

*COVID *Commercial *Government |

*No |

*Utilization *Inpatient *Physician |

Note: Baseline = adjusted 2019 utilization

Health Care Valuation Takeaways

- A health care valuation professional should analyze and incorporate economic data from a wide variety of sources. Analyzing MCO expectations for utilization is an excellent source of macroeconomic data. If MCOs are pessimistic about their spend (i.e. higher MLRs), this conversely could be a positive macroeconomic indicator of higher revenue expectations for provider entities.

- MCO commentary seems to indicate that many providers have mitigated patient fears about returning to the health care system, and have succeeded in insulating non-COVID volume. Providers have successfully implemented COVID protocols that have allowed the non-COVID business (especially the commercial segment) to return to pre-pandemic baseline levels in many cases.

- According to MCO commentary, the success of providers bringing back non-COVID core volume is payer class dependent. MCOs report commercial non-COVID volume back to or close to baseline 2019 volumes. Medicare and Medicaid volume remain below baseline, possibly reflecting hesitancy of returning to the health care system by a portion of this population.

Dig Deeper

For Kaiser Family Foundation’s analysis of insurance company performance during the pandemic, click here:

For information about health care valuations for your business, contact Weaver. We’re here to help.

© 2021

This is one in a series of related health care valuation posts:

- Urgent Care Centers Embrace a Once in a Generation Business Opportunity

- Closing the Gap Between Perceived and Actual Demand in Behavioral Health

- The Importance of a Stable Payer Mix to a Premium Valuation

- After the Pandemic, What Are the Long-Term Valuation Implications for Long Term Acute Care Hospitals?

- Hospice Valuations in a High Multiple Comparable Sales Environment

- Guarding the Shelf Life of Fair Market Value Opinions for Management Services Organizations

- Navigating Health Care Valuation EBITDA Multiple Ranges for Fair Market Value

- Navigating Urgent Care Valuations in Unusual Times

- ASC Partnerships Face Succession Challenges