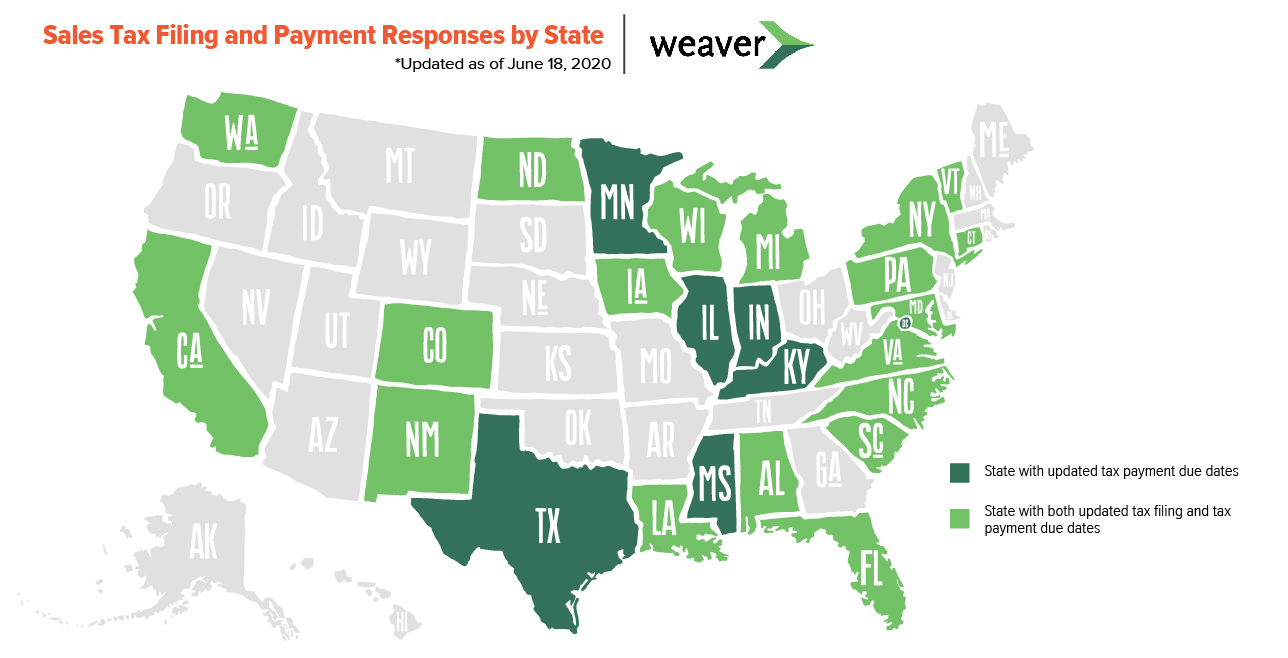

Sales Tax Filing and Payment Responses by State

Article

6 minute read

June 25, 2020

Never miss a thing.

Sign up to receive our insights newsletter.

Below are updates by state in alphabetical order regarding sales tax filing and payment responses to COVID-19. Please bookmark this page for reference as it will be updated as alerts are published.

Download the complete sales tax filing guide for detailed summary of the states’ responses and useful links.

| State | Updated Tax FILING Due Date(s) | Updated Tax PAYMENT Due Date(s) |

|---|---|---|

| Alabama | June 1, 2020 | June 1, 2020 |

| Alaska | N/A | N/A |

| Arizona | N/A | N/A |

| Arkansas | N/A | N/A |

| California | Various Extensions through August 31, 2020 | Various Extensions through August 31, 2020 |

| Colorado | May 20, 2020 | May 20, 2020 |

| Connecticut | February and March filing periods are due May 31, 2020 | February and March filing periods are due May 31, 2020 |

| Delaware | N/A | N/A |

| District of Columbia | N/A | July 20, 2020 |

| Florida | Waiver of P&I for March and April due returns and payments, if qualified | Waiver of P&I for March and April due returns and payments, if qualified |

| Georgia | N/A | N/A |

| Hawaii | N/A | N/A |

| Idaho | N/A | N/A |

| Illinois | No | 5/20/2020 6/22/2020 7/20/2020 8/20/2020 |

| Indiana | N/A | Penalty / Interest Waivers |

| Iowa | 60 day extension upon request | 60 day extension upon request |

| Kansas | N | N/A |

| Kentucky | N/A | 60 day extension |

| Louisiana | June 30, 2020 | June 30, 2020 |

| Maine | N/A | N/A |

| Maryland | February, March, April and May filing periods are due July 15, 2020 | February, March, April and May filing periods are due July 15, 2020 |

| Michigan | May 20, 2020 | May 20, 2020 |

| Minnesota | N/A | May 20, 2020 |

| Mississippi | N/A | Deadlines Extended and Penalty and Interest Delayed |

| Missouri | N/A | N/A |

| Montana | N/A | N/A |

| Nebraska | N/A | N/A |

| Nevada | N/A | N/A |

| New Hampshire | N/A | N/A |

| New Jersey | N/A | N/A |

| New Mexico | Various Enforcement Efforts Modified | Various Enforcement Efforts Modified |

| New York | Penalty and Interest Waived for March 20, 2020 due returns upon request | Penalty and Interest Waived for March 20, 2020 due returns upon request |

| North Carolina | July 15, 2020 | July 15, 2020 |

| North Dakota | Case-by-case, upon request | Case-by-case, upon request |

| Ohio | N/A | N/A |

| Oklahoma | N/A | N/A |

| Oregon | N/A | N/A |

| Pennsylvania | Accelerated Tax Payments not required for April, May and June | Accelerated Tax Payments not required for April, May and June |

| Puerto Rico | One-month extensions | One-month extensions |

| Rhode Island | N/A | N/A |

| South Carolina | Due dates after April 1, 2020 are moved to June 1, 2020 | Due dates after April 1, 2020 are moved to June 1, 2020 |

| South Dakota | N/A | N/A |

| Tennessee | N/A | N/A |

| Texas | N/A | Short term payment plans / P&I waivers upon request |

| Utah | N/A | N/A |

| Vermont | Penalty and Interest Waived for March 25 and April 25 due returns | Penalty and Interest Waived for March 25 and April 25 due returns |

| Virginia | Possible Extension to April 20, 2020 (interest applies) | Possible Extension to April 20, 2020 (interest applies) |

| Washington | Waiver/Extension by request | Waiver/Extension by request |

| West Virginia | N/A | N/A |

| Wisconsin | One-month extension by request | N/A |

| Wyoming | N/A | N/A |

© 2020