Commercial Mix Erosion Could Signal Valuation Implications

Never miss a thing.

Sign up to receive our insights newsletter.

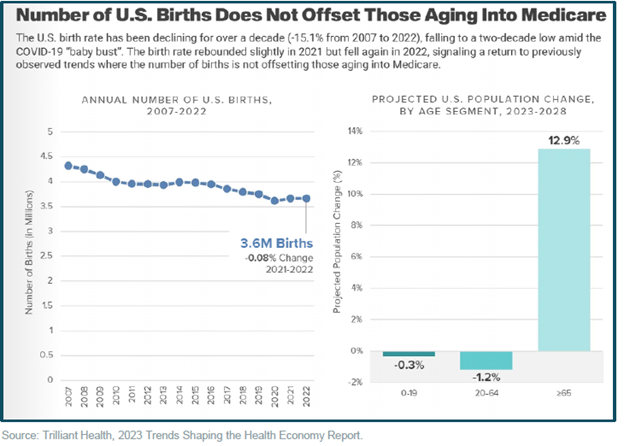

Over the past 15 years, the U.S. birth rate has declined, falling to a multi-decade low in 2021. Meanwhile, the oldest segments of the population are projected to grow rapidly, creating a large and disproportional increase in the Medicare population. These and other demographic trends could yield payor mix erosion as the payor mix in the U.S. slowly shifts from commercial to government payors.

By the Numbers

Data compiled by Trilliant Health shows clearly that the overall US population is aging. The 65+ age cohort (i.e. those eligible for Medicare) continues to expand while the birth rate continues to decline. From a payor mix standpoint, this means a significant shift into Medicare (and Medicare Advantage).

- As shown in the chart above, in 2007, the annual number of U.S. births was around 4.3 million. The birth rate declined steadily in the ensuing years, reaching a low of 3.6 million in 2021, a decrease of 600,000 annual births, before rebounding slightly in 2022.

- Trilliant projects that the over 65 population in the U.S. will increase by 12.9% over the next five years. This will lead to a corresponding increase in the number of Medicare beneficiaries.

- The population under age 19 is expected to decline by 0.3% over the next five years and the age group between 20-64 is expected to decline by 1.2, further skewing the total percentage of the population to the 65+ cohort.

Why it Matters

- The demand for overall health care services will increase, especially for age-related conditions in chronic and complex cases. The volume of patients insured by Medicare (especially Medicare Advantage) with complex conditions will continue to grow.

- The commercially-insured population (ages 20 to 64) has historically driven profitability for most providers.

- Fewer commercial insurance patients and more patients covered by government sponsored insurance means a lower reimbursing and less profitable payor, all else equal.

Health Care Valuation Takeaways

- Health care valuators should take into account long-term demographic trends and incorporate volume (increased Medicare patients) and pricing (decreased commercial patients) into the framework of the valuation analysis.

- Payor mix erosion is a long-term trend, but to protect profits, an operator may combat overall reimbursement declines by servicing patients with higher acuity, adding new services, increasing volume and / or gaining cost efficiencies.

- Theoretically, comparable valuation metrics of publicly traded companies and private arms-length transactions have already incorporated the impact of these demographic changes. The proper use of market-based valuation approaches continues to be very relevant in any opinion of fair market value.

- Health care businesses that fail to innovate, differentiate, and optimize their operations may experience lower business value compared to others.

For more information, contact us. We’re here to help.

©2023

This is one in a series of related health care valuation posts:

- Consider Nursing Staff Mix When Determining Fair Market Value

- Lower Physician Practice Transaction Volume May Impact Valuation

- Increased Demand for Outpatient Surgery Has Valuation Implications: Reading Market Signals

- Retail Clinics Positioned to Become Health Care’s New Front Door

- For-Profit Freestanding IRF Joint Venture Growth: Assessing Opportunities, Risks and Valuation Perspectives