Urgent Care Centers Embrace a Once in a Generation Business Opportunity

Article

4 minute read

May 4, 2021

Never miss a thing.

Sign up to receive our insights newsletter.

Urgent care centers have been a key player in testing the U.S. population for COVID-19. With the efficiency and customer service acumen embedded in their business model, urgent care centers have stepped up to the challenge of processing high COVID-19 testing volume in an accessible and efficient setting.

Why It Matters

- Most urgent care centers score high on patient satisfaction surveys. However, a large percentage of the population had not visited a local urgent care center prior to the pandemic.

- First time patients have flocked to urgent care centers for quick and efficient COVID-19 testing. A large percentage of these new patients will convert to regular recurring patients of the urgent care center for future health conditions and diagnoses.

- Urgent care centers have proven not only resilient in the crisis, but have also gained market share and awareness in the general population for high quality on demand healthcare.

By the Numbers

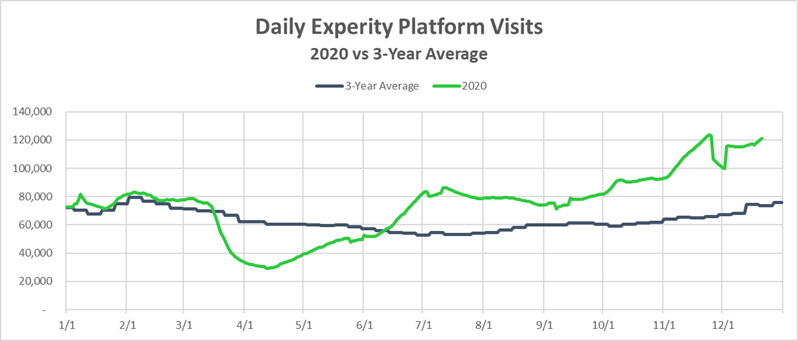

- Based on patient volume statistics from Experity Inc., the industry leading software and services company focused on urgent care software solutions, urgent care volume in 2020 was up significantly from the average of the last 3 years (2017-2019).

- After an initial decline in volume at the beginning of the pandemic, most urgent care centers (85% according to data from Experity, Inc.) introduced COVID-19 testing in or around May or June 2020.

- From June to September 2020, total visit volume was approximately 30% above the average volume of the last 3 years.

- From October to December 2020, volume spiked and averaged around 40% higher than the average of the last 3 years.

- Also according to Experity Inc., nearly half (48%) of all visits to urgent care centers in 2020 were new patients to the center.

Source: Experity, Inc.

Health Care Valuation Takeaways

- The urgent care industry has introduced itself to a large cohort of new patients, with the expectation that a large percentage of those patients will turn into repeat patients.

- High COVID-19 testing volume is likely not permanent and is likely to diminish to a lower baseline over time. However, COVID-19 tests may be required for many years, even at a diminished level.

- While formulating financial projections will be challenging due to the uncertainty of predicting at what level future patient volumes will settle, there is reason to believe that, on average, urgent care patient volume will remain at levels that are higher than pre-pandemic levels.

- Given these assumptions, there is evidence, all other factors equal, to support a sustainably higher valuation for the average urgent care center, assuming historical market valuation metrics (i.e. EBITDA multiples) also hold.

Go Deeper

For more detailed, up-to-date data and insights, visit Experity Health. For information about valuations for urgent care centers, contact us. We are here to help.

© 2021

This is one in a series of related health care valuation posts:

- Closing the Gap Between Perceived and Actual Demand in Behavioral Health

- The Importance of a Stable Payer Mix to a Premium Valuation

- After the Pandemic, What Are the Long-Term Valuation Implications for Long Term Acute Care Hospitals?

- Hospice Valuations in a High Multiple Comparable Sales Environment

- Guarding the Shelf Life of Fair Market Value Opinions for Management Services Organizations

- Managed Care Companies Predicting the “Worst of Two Worlds”

- Navigating Health Care Valuation EBITDA Multiple Ranges for Fair Market Value

- Navigating Urgent Care Valuations in Unusual Times

- ASC Partnerships Face Succession Challenges